A live event this evening with Luke Lango … a quant approach to trading the market … Luke’s core trading market approach on steroids … a sector of the market that’s printing money today

Let’s talk about how to trade this market with greater peace of mind… reduced risk of self-sabotage… and increased profit potential.

It might not be as difficult as you’d imagine.

Tonight at 7 PM ET, our technology expert Luke Lango is holding a special live event that centers on two things:

- A quantitatively driven way to trade today’s stock market.

- A specific sector that’s generating loads of triple-digit winners – right now.

When you put these two things together, you get the benefits we just highlighted, which I find especially attractive…

- Greater peace of mind: My own skill (or lack thereof) as a stock analyst won’t be the determining factor in whether I make money because computers/algorithms are doing the heavy lifting for me.

- Reduced risk of self-sabotage: With trade decisions uninfluenced by my own emotions, there’s less risk that my fear and greed result in self-defeating market choices.

- Increased profit potential: The combination of quant-sourced trades and a specific sector of the market that’s soaring right now offers a greater likelihood of significant wealth creation compared with the outcome if the entire process was left in my own hands.

But let’s take this out of “theoretical” land and look at the details so you can make up your own mind.

Putting AI to work in your trading portfolio

For most regular investors, computerized trading is a relatively new phenomenon.

Not so for the world’s most successful hedge fund managers. They’ve been using computers and algorithms to out-trade everyday investor for decades.

But this computerized advantage has come at a cost – literally.

From the teams of data and behavioral scientists, the armies of computer coders, the rooms full of mainframe computers, it’s all very expensive (and we’re barely scratching the surface of what a cutting-edge investment quant shop will spend on its infrastructure).

Of course, deep-pocketed hedge fund managers have been happy to pay that expense to enjoy the wide competitive moat it’s provided them.

But this moat is now narrowing at a faster pace than ever before – and that means investors like you and me can get in on the game.

Given Artificial Intelligence and the explosion of new algorithmic firepower at the fingertips of everyday investors, last fall, our technology expert Luke Lango and his team of CalTech engineers launched their own quant-based trading service.

Here’s Luke, describing the process and mindset that went into it:

Over the past year, my team of data scientists and myself have developed, tested, and fine-tuned a quantitative trading system to help crush the market.

We realized that the era of human-driven investing is drawing to a close. The era of machine-driven investing has arrived.

And if 2022 taught us anything, it is that investors who fail to leverage the power of quantitative finance to uncover the best stocks, will get crushed by those who do…

We want to be the investors doing the crushing, not the ones getting crushed.

So, we built a quantitative trading model to help us do just that. With it, we leverage the power of machines and big data to always beat the markets.

The result was Breakout Trader.

Like most successful market approaches, Luke’s system was simple in theory, but challenging in application

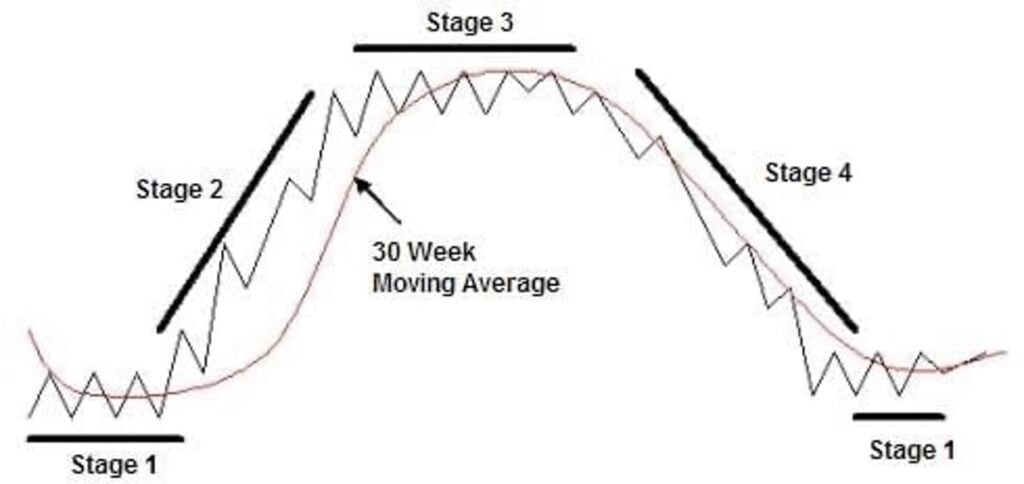

It involves something called “stage analysis.”

In short, every stock at any given point in time is either going up, down, or sideways.

To that end, every stock is always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.

The key to scoring big returns consistently is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out.

So, that’s what Luke and his team set out to do when they engineered Breakout Trader.

More than half a year since that debut, here’s Luke with the results of this market approach:

Frankly, over the past few months, that system has been kicking butt and taking names.

In fact, last month alone, we used the system to book partial profits of roughly 85%, 40%, and 100% on three different stocks.

The month before that, we booked profits of roughly 70%, 25%, 30%, 40%, and 35%.

And the month before that, we used the system to score profits of ~40% on two different stocks.

But tonight’s event isn’t about Breakout Trader. Luke says it’s more like Breakout Trader on steroids…

What happens when you combine a quant-driven market approach with an explosive market sector

Let’s go straight to Luke for more context about the next evolution of his quant-based trading approach:

I’m a big believer that complacency is the enemy of progress. The moment you get comfortable is the moment you stop progressing.

It is also the moment someone else passes you.

The same is true when developing quantitative trading strategies. The moment we stop developing bigger and better quant strategies is the moment AI passes us by and renders us obsolete.

I’m not going to let the machines win that easily.

So, while our Breakout Trader system has been racking up big winner after big winner here in 2023, I’ve been busy working on a high-octane adaptation of this quant trading system.

This high-octane adaptation puts one corner of the market in Luke’s crosshairs today.

We profiled it in yesterday’s Digest. Luke’s research concludes that it’s responsible for five of the top 10 best-performing stocks here in 2023. And over the past year, this sector has accounted for six of the top 10 best-performing stocks.

But as Luke noted yesterday, this part of the market is risky. That’s why most investors stay away. It’s also why Luke explicitly writes:

This corner of the market is only for the most serious traders.

High-risk, high-reward…

But if you’re curious, Luke also points out that “there are literally hundreds of stocks in this specific hidden bull market that could soar 1,000% in less than a year.”

Tonight, you’ll get the details on both the trading system and the market sector behind this “hidden bull market.”

What the back tests of the system reveal

A moment ago, we looked at some actual returns from Breakout Trader over the past handful of months. How do they compare with this latest adaption of the Stage Analysis market approach?

When Luke tweaked his trading system and applied it to the sector we’ve been discussing, the returns snowballed. His back tests showed gains of 655%, 822% and even 1,208%.

Here’s Luke’s take:

As I like to tell my team, this new quant trading system is our highly successful Breakout Trader on steroids.

Bigger. Better. Faster.

If you’re interested, you should reserve your seat to my presentation tonight at 7 PM, where I’ll unveil this system and even give you a free stock pick that it just flagged as a “Strong Buy” with huge short-term upside potential.

Curious but still unsure?

Great – feel free to join us tonight simply to learn more about trading today’s market, computerized/quant investing in general, and the benefits of a Stage Analysis approach. Just reserve your seat here, and we’ll see you tonight at 7 PM ET.

Have a good evening,

Jeff Remsburg