Warren Buffett’s Berkshire Hathaway (NYSE:BRK-A, NYSE:BRK-B) recently cut a substantial amount of its holdings of Activision Blizzard (NASDAQ:ATVI) stock just days before the Federal Trade Commission failed in its bid to block Microsoft’s (NASDAQ:MSFT) nearly $70 billion acquisition of the video game publisher.

According to a recent 13G filing published Monday, Berkshire Hathaway possesses a 1.9% stake in Activision, via its 14,658,121 shares of the company. This is a roughly 70% cut from the 6.3% stake Buffett’s conglomerate owned at the end of March, and an even bigger reversal from the 6.7% stake the company had at the end of 2022.

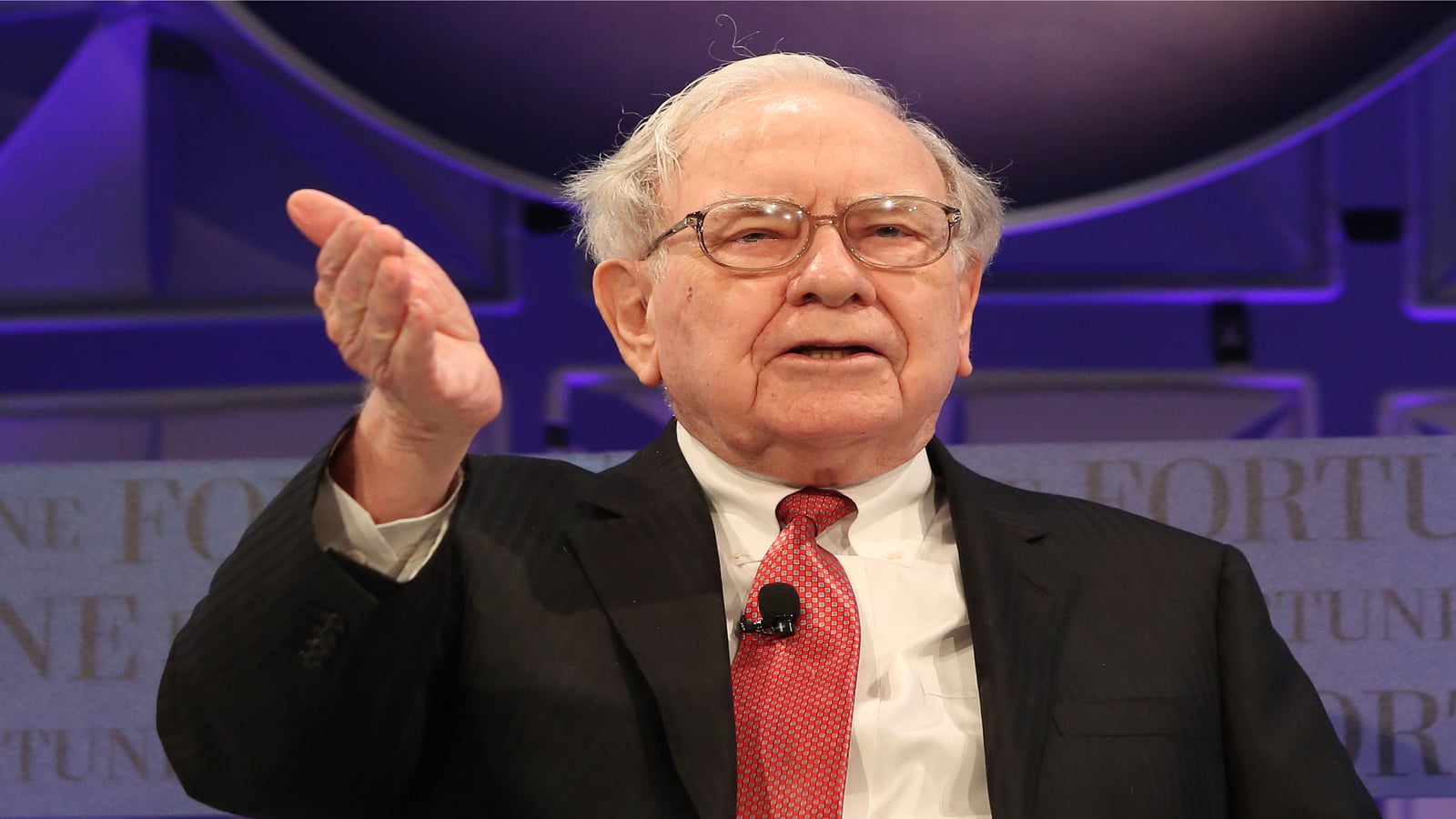

The Oracle of Omaha has had a stake in Activision since October 2021, with an average share cost of about $77. This is means Berkshire profited on Activision stock, as shares closed at $84.30 on June 30, the date of his transaction.

Buffett has previously stated he believes the Microsoft-Activision deal is likely to go through, despite plenty of regulatory backlash.

In that regard, Microsoft still has some hoops to jump through before it can bust out the cigars.

ATVI Stock Surges on Federal Court Ruling

Berkshire’s sale comes as a surprise to investors, especially given the result of last week’s U.S. Appeals Court decision. Indeed, the U.S. Appeals Court for the 9th Circuit denied the FTC’s motion to temporarily halt Microsoft’s acquisition of the video game giant. The decision came as a big win for fans of both Microsoft and Activision, with ATVI stock enjoying a nearly 10% jump following the ruling.

“We appreciate the Ninth Circuit’s swift response denying the FTC’s motion to further delay the deal. This brings us another step closer to the finish line in this marathon of global regulatory reviews,” said Brad Smith, Microsoft’s president and vice chair.

Despite the grin-inducing nature of last week’s court decision, neither Activision or Microsoft are quite out of the woods yet. Last Monday, the U.K. Competitions and Markets Authority pushed back the review of Microsoft’s Activision takeover to Aug. 29 after Microsoft appealed U.K. regulators’ deal block.

On the date of publication, Shrey Dua did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.