The current stock market rally may be the most hated of all time. And that may actually be a very bullish thing that keeps this party going for a lot longer.

The stock market soared in the first half of 2023. And in fact, tech stocks had their best first-half showing in about 40 years. And the second half of the year is off to a hot start, too, with socks rallying even higher here in July.

Many of our portfolios are up more than 60% this year alone!

Yet, despite the record gains on Wall Street, a lot of investors remain skeptical. Sure, most folks have ditched the “this is just a bear market rally” mantra. But now the popular thing is to say that “this rally is on its last legs” and that “a crash is imminent.”

The bears simply aren’t capitulating.

But they should – because the bear thesis now has zero historical backing.

In fact, if history is any indicator, there is a 100% chance that this stock market rally is just getting started.

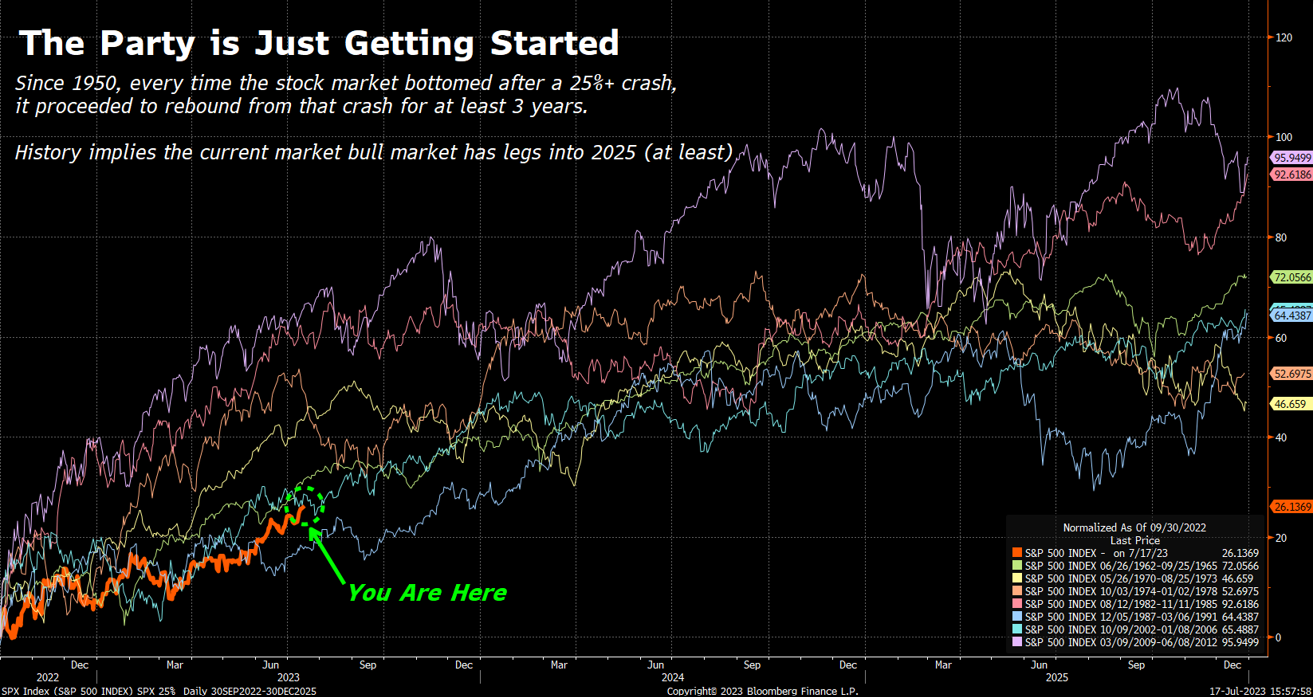

In last year’s nasty bear market, stocks dropped more than 25%. Since 1950, stocks have suffered through eight similarly nasty drops of 25% or worse. Each time, once stocks bottomed and started rebounding, they rebounded for years.

Specifically, they rebounded for at least three years. And over those three years, the market averaged a ~60% return!

In the current bull market, we’re up 26% over nine months, compared to an average of 60% over three years.

Folks, don’t let the bears scare you: This stock market rally is just getting started.

And history says it will last until at least 2025. That’s why you need to keep on buying stocks. And specifically, keep on buying AI stocks.

The Final Word on Bull Market Gains

And what better AI stock to buy than the company that started this whole AI Boom – OpenAI, the creator of ChatGPT.

In case you missed it, OpenAI has done a lot since ChatGPT’s launch in November 2022. Just last week, it announced huge partnerships to power AI programs at both Intuit (INTU) and Moody’s (MCO).

I truly believe OpenAI could be one of the world’s largest companies in the near future – if not the largest.

However, the company is still just a startup. It isn’t publicly traded yet.

But I found an investment “loophole” that allows you to take a stake in OpenAI now – before its highly anticipated IPO.

This is your chance to invest in the next big thing. Like investing in Apple (AAPL) in the 1980s or Amazon (AMZN) in the 1990s, this is an opportunity you can’t afford to miss.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.