History is repeating with corporate name changes … the market gains that accompany a name change … but which AI stocks are the real deal? … a roundtable discussion on Thursday

In January 1999, MIS International hadn’t made a dime of profits, and its stock traded below $0.50 per share.

But MIS management was aware of a powerful sentiment shift rippling throughout the business and stock market landscape. It had to do with a new, electrifying phrase…

“Dot Com.”

Younger investors might not recall, but in the late 90s, the term “Dot Com” was magic. It promised vast riches from companies that had found a way to leverage the power of the internet. Virtually any company possessing even the faintest scent of “Dot Com” was investment gold.

MIS realized this and decided to signal to the business world (and Wall Street) that it was now a budding digital economy leader.

And how would it signal this, exactly?

By changing its name to include “Dot Com.” And so, MIS International became Cosmoz.com.

You know where this is going…

How much of a bump do you think the stock enjoyed?

100%…?

300%…?

From less than $0.50 a share, Cosmoz.com – which again, had never turned a dime of profit – soared nearly 1,000% to $5 a share.

Fast forward to the 2001 in the wake of the Dot Com meltdown

As analysts and commentators sifted through the wreckage of the Dot Com burst bubble, three Purdue University finance professors published a fascinating takeaway…

They looked at 95 companies that had added “Dot com” or “Internet” to their names during the ‘90s bubble run-up.

What was the impact on the stock prices of these companies in the wake of this branding shift?

On average, they enjoyed a 74% stock price surge.

It didn’t matter whether the “Dot Com” addition accurately reflected the company’s core business operations or was embellishment, the average stock surged in the wake of the name-change. That’s how much investors wanted to be a part of “Dot Com.”

How history likes to repeat itself…

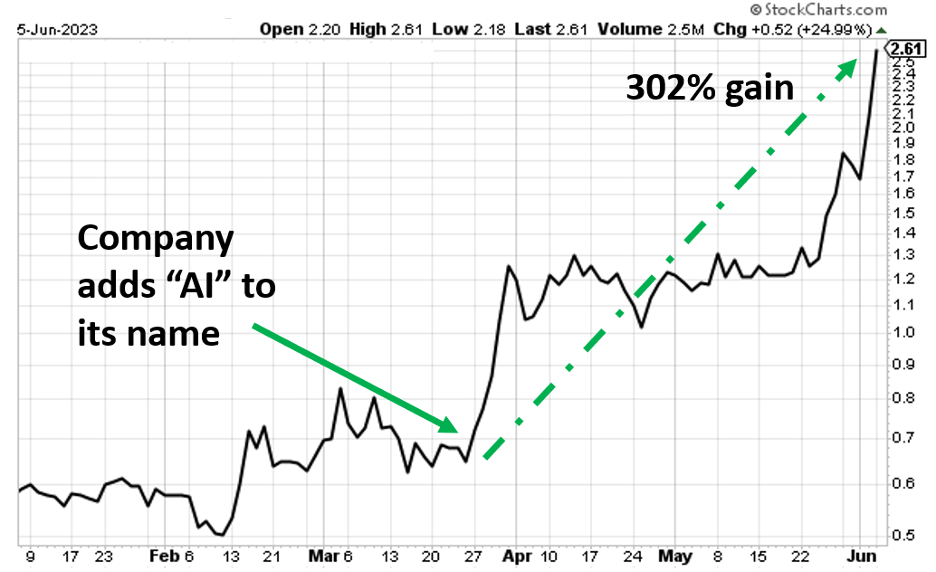

Back in March, as AI mania began to crescendo, a small company whose name I won’t reveal decided to tack “AI” onto the end of its name.

I’m not mentioning the company because I don’t want to inadvertently paint it in an unflattering light. It might be a fantastic AI addition to your portfolio and the name change could be 100% warranted – I don’t know.

My interest is in the impact of the name change on the stock price. And it turns out, this savvy business move resulted in a 302% stock explosion for shareholders between spring and early summer.

But now, let’s rewind to early June…

Say you’re looking to add AI exposure to your portfolio. You stumble upon this company, see the explosive stock gains, and figure they validate the company as a great investment.

Well, again, it could be – I don’t know. But what I do know is that after that monster 302% surge, an ill-timed investment would have lost you nearly 50% of your invested capital…in about a month.

It’s tough to win the investment race when you suddenly find yourself 47% behind the starting line only a few moments after the starting gun.

As we pointed out in the Digest last week, one of the great challenges for AI investors today is identifying the stocks that will become tomorrow’s market leaders

There’s the issue of correctly identifying the companies that will execute best on AI integration. And then there’s a separate issue – stock price volatility. After all, even if your research finds you tomorrow’s AI leader, what good is it if a stock decline of, say, 47% shakes you out of your position?

Recall the period between July 2015 and May 2016 when Apple investors lost 30%. If that decline resulted in their selling of Apple, they would have missed out on 821% gains since then.

Plus, keep in mind, this 821% return came after Apple was already a mega-stock. How much more explosive might the returns be for a small-cap AI stock that grows into tomorrow’s AI mega-cap winner?

Here’s our macro specialist Eric Fry on the mind-boggling investment wealth that AI could generate for every day, regular investors:

When ChatGPT launched, it marked a seminal moment for AI, much like streaming became Netflix’s moneymaker… or even further back when Netscape had its groundbreaking moment as the first Internet browser.

Investing in either of those technologies produced many millionaires… and I believe AI has the ability to mint billionaires… perhaps even the world’s first trillionaire.

So, let’s get down to brass tacks…

How do we increase our chances of investing in tomorrow’s AI leaders – even though it might be a bumpy ride – while doing our best to sidestep the AI underwhelmers whose “bumps” could turn into catastrophic cliff edges?

Well, before we can answer that, let’s address a more fundamental question…

What exactly is “AI investing”?

Is it the AI chat services such as ChatGPT and Bard, which means investing in Microsoft and Google?

Or is it the semiconductors powering these technologies? So, it’s more like AMD and Nvidia?

Here in the Digest , we’ve even pointed toward key rare-earth and industrial metals as the critical building blocks of all things “technology and AI.” So, should you invest in, say, lithium producer Albemarle?

Well, how to invest (and not invest) in AI is the focus of the AI Impact Event round-table discussion this Thursday at 7 PM ET with Eric, legendary investor Louis Navellier, and our hypergrowth expert, Luke Lango. If you’re looking for answers about investing in AI today, this panel discussion offers you a north star.

Back to Eric, discussing the challenge investors face today:

I look for big-picture trends that drive huge, multiyear moves in entire sectors of the market.

These megatrends can spin off dozens of triple- and even quadruple-digit gains in a span of a few years. It’s not an exaggeration when I say that catching just one of these trends — at the right time — can help anyone build wealth. And AI is the newest megatrend to burst onto the scene.

Because of AI’s limitless potential to enhance almost every aspect of daily life, it also possesses limitless potential to enrich investors.

There’s just one catch: What’s an “AI”?

Unlike electric vehicles, personal computers, televisions, or satellites, AI is not a specific, tangible product. No one builds an AI in a factory or sells six-packs of AIs in a grocery store.

Instead, AI is an amorphous, multifaceted category of innovation that is almost as broad and all-compassing as “technology.”

Therefore, opportunity-seeking investors must first parse the AI world into investible pieces.

That’s easier said than done.

Fortunately, this “parsing” is what Eric, Louis, and Luke will be doing this Thursday.

The challenge isn’t limited to identifying these pieces of AI

There’s also the issue of valuations and timing. Tying back to our earlier discussion, let’s say you find a great AI investment, but your timing is slightly off. Before you know it, you’re down double-digits.

Where’s the line between being a wise AI investor who hangs onto such a stock, giving it breathing room to maximize its potential in the years to come…versus being a foolish investor who’s clinging to a losing stock that’s likely to destroy wealth?

Again, I’ll point toward Eric, Louis, and Luke this Thursday at 7 PM ET. It’s a free evening to attend. You just need to click here to reserve your seat.

Bottom line: Eric writes, “if you catch a revolutionary technology right before it goes mainstream, then you could make massive gains in just a few years.” Well, there is no trend more “revolutionary” than AI.

If you’re looking for help in how to take advantage of this once-in-a-lifetime opportunity, click here to join us this Thursday.

Have a good evening,

Jeff Remsburg