It was a tale of two cities – or, in this case, a tale of two tech titans and their summer earnings reports.

Last night, Alphabet (GOOGL) absolutely crushed estimates, and GOOGL stock jumped in response. Microsoft (MSFT), on the other hand, delivered mixed results. And MSFT stock dropped as a result.

Does that mean GOOGL stock is a great buy and MSFT stock is a sell here?

Hardly.

Both are fantastic long-term investment opportunities for one very simple reason: the AI Boom.

It’s clear we are entering the Age of AI. In this era, companies will spend an arm and a leg on AI software and hardware to automate and optimize their operations. According to UBS, the market for AI technologies will grow by more than 60% per year to over $300 billion by 2027.

This is a huge growth opportunity.

And both Microsoft and Alphabet find themselves at the epicenter of the boom.

The Breakdown on Earnings

Why, then, is GOOGL soaring in response to earnings, while MSFT stock is dropping? After all, aren’t both firms benefiting from the AI Boom?

They are – but last night’s earnings reports weren’t about this boom. Instead, that’s something that will play out over the course of the next five to 10 years. Here in the summer of 2023, it isn’t yet significantly impacting earnings statements.

Rather, earnings this summer are being impacted by the macroeconomic situation – which, frankly, is improving quite dramatically right now.

Just yesterday morning, we learned that consumer confidence in the U.S. jumped to a two-year high in July.

And that’s why GOOGL stock is soaring right now while MSFT stock is struggling.

Alphabet runs a much more economically sensitive business than Microsoft.

MSFT Earnings Don’t Surprise

The core of Microsoft’s business is its cloud business and, primarily, its Azure cloud infrastructure division. Enterprise spending on cloud infrastructure is pretty steadfast and resilient to macroeconomic changes. In both good times and bad, companies spend big on cloud infrastructure.

And over the past few quarters, Microsoft’s cloud business has been steady as a rock. It was steady again last quarter, too. Overall cloud revenues rose 15%, as they did in the prior quarter. The Microsoft ship is sailing smoothly ahead.

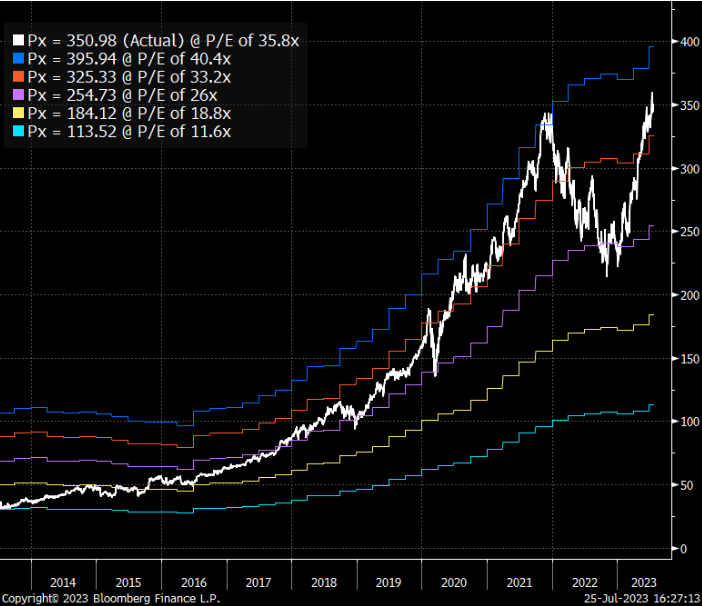

Nothing is wrong with these results. There just wasn’t any upside surprise to excite investors in yesterday’s earnings report. And given that MSFT stock ran up to a premium valuation ahead of its earnings release, it is only reasonable to see shares give back some gains in the absence of a big upside surprise.

Totally natural. Nothing to worry about.

But the story is much different with Alphabet…

GOOGL’s Upside Surprise

The core of Alphabet’s business is its ad business. Sure, Alphabet also operates a cloud business through Google Cloud. But the vast majority of the company’s revenues and profits come from its Google Search and YouTube advertising businesses.

Those businesses are exceptionally sensitive to macroeconomic changes.

When the economy hits a rough patch, consumers pull back on spending, which, in turn, leads to advertisers pulling back on their spend. Advertising is one of the most economically sensitive industries out there.

That’s why Alphabet’s Google Search and YouTube ad businesses have been struggling. The economy hit a rough patch in 2022 that extended into 2023. As a result, both businesses saw their revenue growth rates actually go negative.

But that changed this quarter.

As the economy turns a corner, Alphabet’s ad businesses are starting to turn a corner, too. Google Search revenues rose 5% last quarter. YouTube revenues rose 4%. Both businesses are growing again for the first time in a year.

That is an upside surprise.

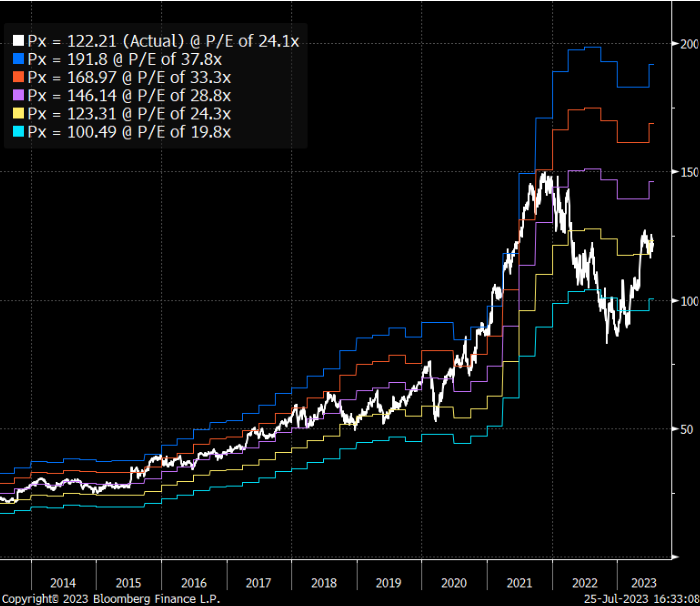

And it was a big-enough upside surprise to drive GOOGL stock significantly higher, especially since the stock was pretty cheap going into the report.

Long story short, the rally in GOOGL stock and decline in MSFT stock is thanks to the fact that the economy is turning a corner, and Alphabet operates a more economically sensitive business than Microsoft. As a result, the former is benefitting from the economic turnaround more than the latter.

It’s that simple.

But the more important thing to remember here is that GOOGL and MSFT stock are both fantastic long-term investments because of their exposure to the AI Boom.

The Final Word on GOOGL & MSFT Earnings

It’s becoming clear that we’re in a new bull market defined by the rapid proliferation of AI technologies across the global economy.

And if you want to make big money in the stock market over the next few years, you need to buy the best AI stocks out there.

Since ChatGPT’s launch in November 2022, the company’s valuation has already doubled!

But that’s just the start.

I truly believe OpenAI could be one of the world’s largest companies in the near future – if not the largest.

OpenAI represents the potential investment opportunity of a lifetime.

Too bad it is a startup that you can’t buy on a public exchange like GOOGL stock…

Though I did unearth an investment “loophole” that allows you to take a stake in OpenAI now – before its highly anticipated IPO.

This is your chance to invest in the next big thing. Like investing in Apple (AAPL) in the 1980s or Amazon (AMZN) in the 1990s, this is an opportunity you can’t afford to miss.

Learn all about this AI “loophole.”

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.