The market needs to consolidate gains … how much of a pullback might be expect? … the longer-term forecast is decidedly bullish … what a study of elevated RSI levels tells us today

The market needs a breather.

Don’t be surprised when you see it, but don’t confuse it with the end of this bull run.

To analyze what this looks like, let’s evaluate at the S&P through a technical/trading lens. To do this, we’re borrowing from our trading expert Luke Lango.

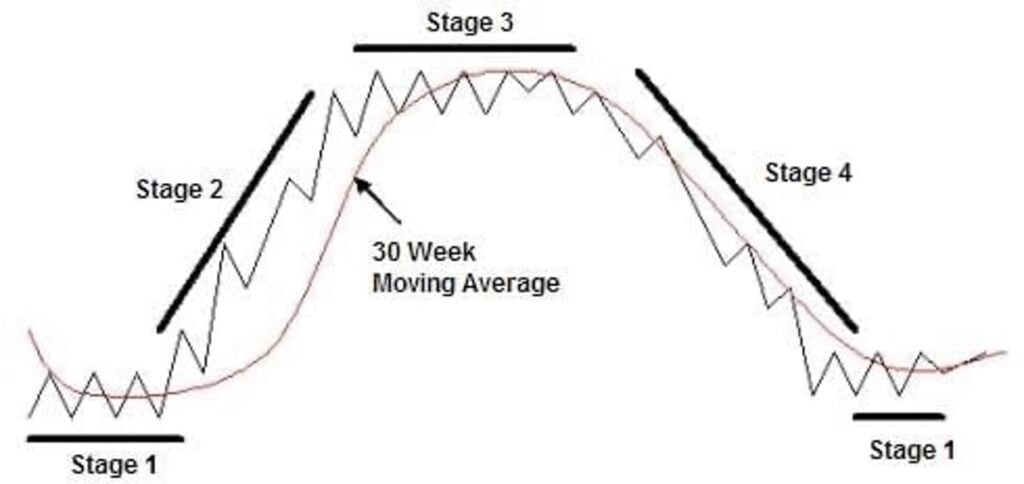

In his trading services Breakout Trader and High Velocity Stocks, Luke approaches the market from a “stage analysis” framework.

In short, every stock at any given point in time is either going up, down, or sideways.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time, and then only investing in “Stage 2” stocks that are exploding higher on heavy volume.

Stage analysis is such a helpful market approach that if you analyzed your portfolio losers, I would wager that most of them happened because you inadvertently invested in either Stage 3 or Stage 4.

We tend to get so excited about an investment opportunity that we don’t pull back and evaluate the broad trend. Too often, that’s a money-losing mistake.

So, how does the S&P look today with a stage analysis overlay?

Well, last year, the S&P was in a Stage-4 decline. That lasted until late summer, when the market began a Stage-1 consolidation period of volatile-but-sideways market action.

Finally, here in 2023, the S&P has begun a new Stage-2 breakout. Here’s how this looks:

But let’s now zero in on the Stage-2 breakout itself.

Bulls can’t sprint forever

Below, we look at the Stage-2 breakout, adding more accurate trendlines that bookend the trading channel. Our analysis begins at last fall’s lows for the S&P.

What you’ll see, circled in blue, is that recent market strength has pushed the S&P’s price outside of its Stage-2 breakout channel.

At the same time, the S&P’s Relative Strength Index (RSI) has been poking in and out of overbought levels.

For newer Digest readers, the RSI is a momentum indicator that measures the extent to which an asset is overbought or oversold. A reading over 70 suggests an asset is “overbought” (and likely poised to pull back) while a reading below 30 means it’s “oversold” (and poised for positive gains).

Here’s the S&P over the last month. In the pane below the price chart, we see the RSI level which has been flirting with overbought conditions for weeks.

Think of a rubber band being stretched further and further – nearing the limits of its elasticity.

With the S&P’s price stretched so far that it’s now above its Stage-2 channel, and with its RSI level so stretched that it’s reaching overbought conditions, the tension needs to resolve.

This redlining in the S&P won’t last – but don’t mistake price normalization for a market crash

Let’s jump to Luke’s analysis for how these overstretched conditions will play out. From his Breakout Trader Trading Room video update last Thursday:

On the technical basis, stocks are overheated at the current moment…

Things are a bit frothy in the market. And that’s coming from someone, as you know, who has been bullish on this rally this whole time.

I was bullish on this rally at the lows in October 2022, pounding on the table in November, December, all the way through January, February, March, April, May, June and into July. I’ve been bullish the whole way through, and now, I’m saying that this rally’s a bit overextended, overheated, and a bit frothy.

So, I do think we’re due for a short-term pullback of some sort. I don’t know when it’s going to happen.

I don’t know how big it’s going to be. But I do know that we are likely due for a short-term pullback sometime in the next one to two, maybe three weeks.

And I think that if I had my best guess, that pullback would be about 3% – to 5% at the index level.

Let’s look at that forecast.

If we average Luke’s estimated S&P pullback to 4%, that will mean the S&P falls to roughly 4,400 based on the S&P’s level as I write Monday morning.

As you can see below, that would put the S&P in the top half of its breakout channel. So, that would be a level that’s still very bullish yet no longer stretched.

Keep in mind, even if the S&P pulled back farther to say, 4,300 (a 6% drop), that would only take it to the approximate mid-point of this Stage-2 breakout channel.

In fact, the S&P could fall to 4,100, or nearly 11% lower, and it would still be within this Stage-2 breakout channel. As you can see in the chart, a pullback all the way to the lower limit of the Stage-2 breakout channel happened back in March, after which the S&P rallied hard.

Keep this perspective in mind if/when we see the S&P tumble in the coming weeks.

But while the likely short-term direction is “down,” Luke remains confident that the longer-term direction is resoundingly “up”

A moment ago, we referenced the S&P’s RSI level.

In Luke’s Hypergrowth Investing issue last Friday, he analyzed the S&P’s RSI through a historical-market lens to see what we might expect from stocks after a market pullback.

From Luke:

The S&P 500 has now closed more than 4.5% above its 50-day moving average for 12 straight trading sessions. And in fact, during that stretch, the market’s relative strength index has never dropped below 67.

In other words, we’ve gone through 12 consecutive trading sessions wherein the S&P 500 traded more than 4.5% above its 50-day moving average and reported an RSI of 67-plus.

After speaking to the “overextended” nature of the S&P that we’ve mapped out so far in this issue, Luke then turns to the broader, bullish implications:

…Since 1968, we’ve only seen similar technical conditions 21 times before.

Now, here’s the important part: Whenever we see these uniquely extended technical conditions, stocks usually retreat over the next month, then soar over the next one to three years.

Specifically, around 76% of the time, stocks dropped in the month after the market hit these exact extended conditions.

The average size of the pullback? Just over 2%.

More than 85% of the time, stocks rose over the following year, for an average return of 16%.

And more than 95% of the time, stocks were higher three years later, with an average return of 27%.

That’s a lot of bullishness.

I’ll point out that Luke’s subscribers have already been taking advantage of this surging market

Here in July, his Breakout Trader subscribers have locked-in profits of 15%, 35%, 40%, another 40%, and 45%.

And his High Velocity Stocks service – which debuted just three weeks ago – just took its first profit, a 50% winner. Congrats to all the traders who have enjoyed these gains.

Circling back to the S&P and our price forecasts, here’s Luke to take us out:

The data says that when the market hits the same stretched conditions it hit [last Thursday], stocks tend to drop about 2% before rallying big over the next one to three years.

The investment implication?

Let stocks drop over the next few weeks. Then, buy the dip with confidence.

Have a good evening,

Jeff Remsburg