The stock market has been crashing all month long. But after Federal Reserve Board Chair Jerome Powell’s highly anticipated speech at Jackson Hole today, stocks stabilized and even rallied a bit.

Some investors are puzzled by the positive stock reaction to Powell’s speech. After all, he did sound pretty hawkish. Powell didn’t declare victory against inflation or admit that the Fed is finished hiking rates.

Instead, he stuck to the same script he’s had for the past 12 months: Inflation remains too high, and the Fed will do what it takes to bring it down.

So, then why did stocks rally today?

Because for the first time in this rate-hike cycle, Powell noted that rates are currently in very restrictive territory.

‘Restrictive’ Leads to Rate Cuts?

Specifically, Powell mentioned that the current Fed Funds rate is “well-above” the neutral rate. That’s the U.S. economy’s natural rate, which is neither stimulative or restrictive to economic activity and inflation.

And that’s important because Powell and other Fed members have continually expressed a desire to return the Fed Funds rate to neutral levels once inflation is fully contained.

If Powell thinks that the neutral rate is well-below the current policy rate, that implies that once inflation is fully contained, the Fed will embark on a rate-cutting spree.

Most forecasts suggest inflation will be fully contained in the 2% to 3% range by 2024. Therefore, it seems reasonable that the Fed will start cutting rates next year.

In other words, the central bank is about to go from hiking rates to cutting them.

And that is very bullish for stocks.

The Final Word on Powell’s Fed Update

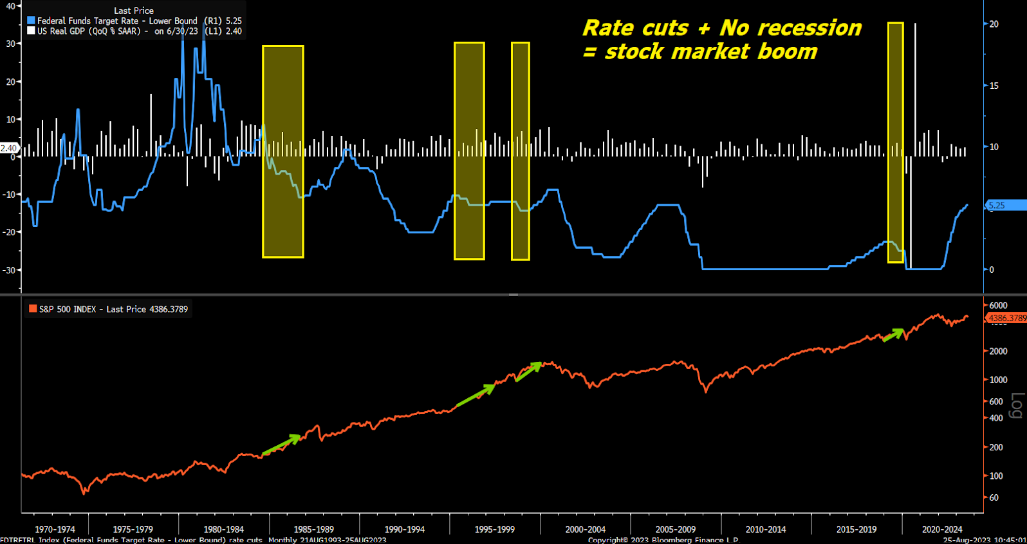

Do you know what happens when the Fed cuts rates while the economy skirts a recession? Stocks soar – every single time.

Back in 2019, the Fed cut rates while the economy kept growing. Stocks posted one of their best years of the decade.

In the mid-1990s, the Federal Reserve cut rates in a growing economy. Essentially, that kick-started the dot-com boom – or the greatest bull market run on Wall Street ever.

A decade earlier, in the mid-1980s, the central bank also cut rates while the economy continued to grow. And then stocks basically soared for two straight years.

The takeaway here is a simple one.

Rate cuts + no recession = stock market boom.

And through his remarks today, Powell suggested that is the potent combination we will get next year.

If we do get a bunch of rate cuts next year without a recession, then stocks should soar like they did in the 1990s.

Are you prepared for this big boom?

If not, let’s get you positioned for those coming gains.

I’m sure you’ve heard of ChatGPT, the AI chatbot that has taken the world by storm. And I think that OpenAI – the firm behind ChatGPT – is on track to one day become the biggest company in the world.

But OpenAI is not a public company. It doesn’t have a stock. And normal folks have no idea how to invest in this promising startup.

But I’ve discovered a ‘loophole’ that allows you to plug into the heart of the AI Boom and take your very own stake in ChatGPT.

Uncover that little-known ‘loophole’ today to prepare for this boom.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.