Go to CNBC, Bloomberg, or any mainstream financial media platform, and you’ll find two types of articles on artificial intelligence (AI). They’ll either discuss how AI is the future and AI stocks will dominate for the next decade. Or the polar opposite – how AI is a bubble and AI stocks are due for an epic dot-com-style crash.

It’s a tale of two cities out there.

But as always, the truth lies somewhere in between.

AI has its positives. It also has its negatives. And knowing the difference is the key to minting fortunes in the AI Revolution.

The AI Boom Is Not a Bubble

First, let’s start by stating firmly that the current AI boom is not a bubble. The ability for a machine to automate tasks, learn from its surroundings, and make human-like decisions is a profound concept. At scale, that ability could change the world. And while AI is still in its infancy, there are some things that artificial intelligence is already really good at these days.

For example, AI can competently replicate human conversation. Language models like ChatGPT have proven to be very useful tools. And thousands of enterprises are already using it to automate tasks that involve conversation throughout their organizations.

In fact, just yesterday on August 28, DoorDash (DASH) announced an AI voice model that will automate phone ordering for restaurants. Meanwhile, the same day, OpenAI launched ChatGPT Enterprise – its commercial language AI product for enterprise use.

Contact centers and support teams across the world are already being automated en masse. Last year, just 1.6% of all customer interactions were automated by AI. That number is expected to rise to 10% within just three years.

Frankly, AI is kicking butt and taking names in the world of automating conversation.

Changing the Game for Various Industries

Plus, AI is dominating in the world of sales and marketing, where it’s being effectively deployed to create targeted ad campaigns and content, as well as automate the spending for those campaigns.

It’s also killing it in content creation, powering billions of social media feeds with more relevant content every day.

Not to mention, AI is automating low-skill labor. Companies like Symbotic (SYM) are creating robots to automate Walmart (WMT) warehouses, and companies like Miso Robotics are creating robots to flip burgers and make chips.

And AI is making impressive inroads in the pharmaceutical industry, where it’s being used to accelerate the discovery and development of drugs.

AI is transforming several industries for the better right now. The hype is warranted.

AI’s Glaring Shortcomings

But let’s not get too far ahead of ourselves.

Every technological paradigm shift goes through growing pains. AI is no different. And while it’s kicking butt in a lot of ways right now, it is also getting its butt kicked in a handful of places, too.

Take self-driving cars, for example. Coupled with cost reductions in sensors, advancements in AI capability were expected to put a self-driving car in everyone’s driveway by now. Yet, in places like San Francisco and Phoenix, where autonomous cars are being tested these days, they can’t stop getting in accidents and causing traffic jams.

It’s quite a mess.

And it’s impossible to forget about AI’s truly “ugly side.” The SAG-AFTRA strikes have put this in the spotlight. Now, those strikes have multiple driving forces. But central to them is the idea that in the not-too-distant future, AI will be able to write scripts, create scores, cast roles, even create a whole movie by itself. And that threatens the livelihood of everyone in show business.

And it’s a threat that spans across the entire economy. While Walmart is using Symbotic robots to automate its warehouses, it is also firing warehouse workers. According to a recent report, in May of this year, AI was responsible for 4,000 layoffs across a variety of industries.

Like many things, AI has its good side, its bad side, and its ugly side.

That doesn’t make AI a bubble. It makes it real.

The Final Word

When the internet emerged in the 1990s, it, too, had its strengths and shortcomings.

While its early iterations were great for some simple tasks like selling goods and streaming music, it wasn’t so great for more complex tasks like gaming and instant messaging. And the internet also featured an ugly side, helping facilitate some illegal behavior, which remains a problem to this day.

But the internet wasn’t a bubble. It was a transformative reality – and for some, a fortune-making opportunity.

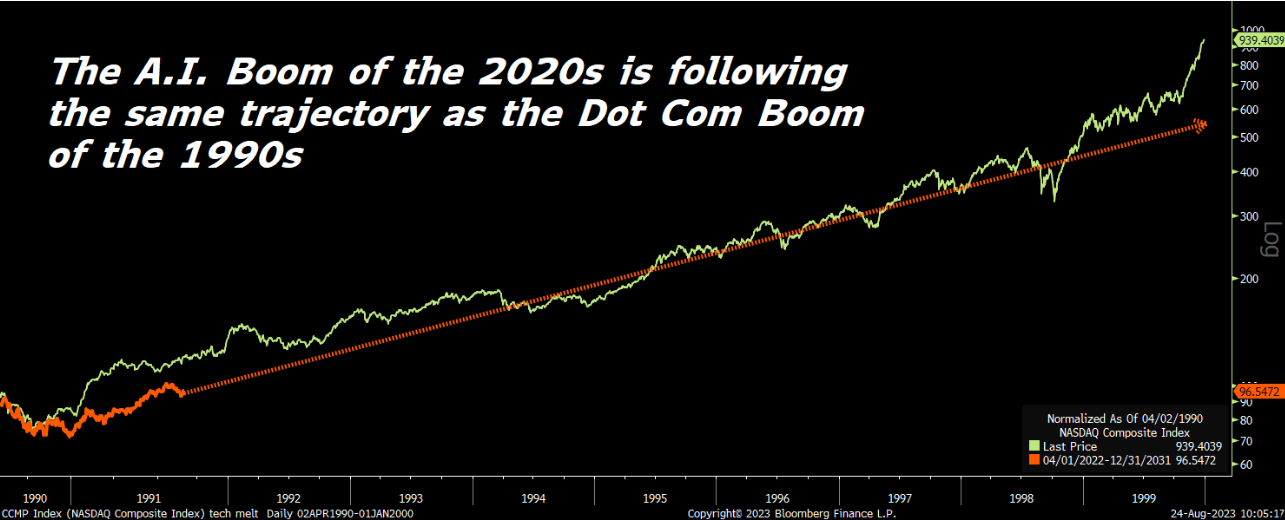

Just look at how tech stocks in the AI Boom of the 2020s are almost identically tracing the same steps they took in the dot-com boom of the 1990s.

This is the second-coming of the dot-com boom. And that boom happened despite the internet’s many flaws and growing pains. That’s because those flaws were more than offset by the world-changing productivity and convenience that the internet unlocked.

The same will be true for AI.

It isn’t perfect. There will be growing pains – plenty of them. And it will forever have its skeptics.

But it will move forward to change the world. And it will mint fortunes for those who capitalize on the opportunity.

Do you want to be one of those people?

If so, then consider investing in the companies pioneering this revolution – companies like OpenAI, the startup that created ChatGPT.

They represent the future of the global economy.

If you’re looking for the next Facebook, the next Amazon, or the next Apple, you’ll find them in the world of artificial intelligence startups.

And I’ve just discovered a way for regular investors to take a stake in some of these promising startups and invest in the ground-floor of the AI Boom.

Learn all about that investing ‘loophole.’

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.