So much for the August stock market selloff being the end of Wall Street’s monstrous 2023 stock market rally. While stocks did retreat about 5% throughout the first three weeks of August, they’ve come surging back in the final week, and now, the S&P 500 trades within striking distance of a new high. Prepare for a new stock market rally.

And stocks are about to get a huge boost in September thanks to this morning’s inflation data.

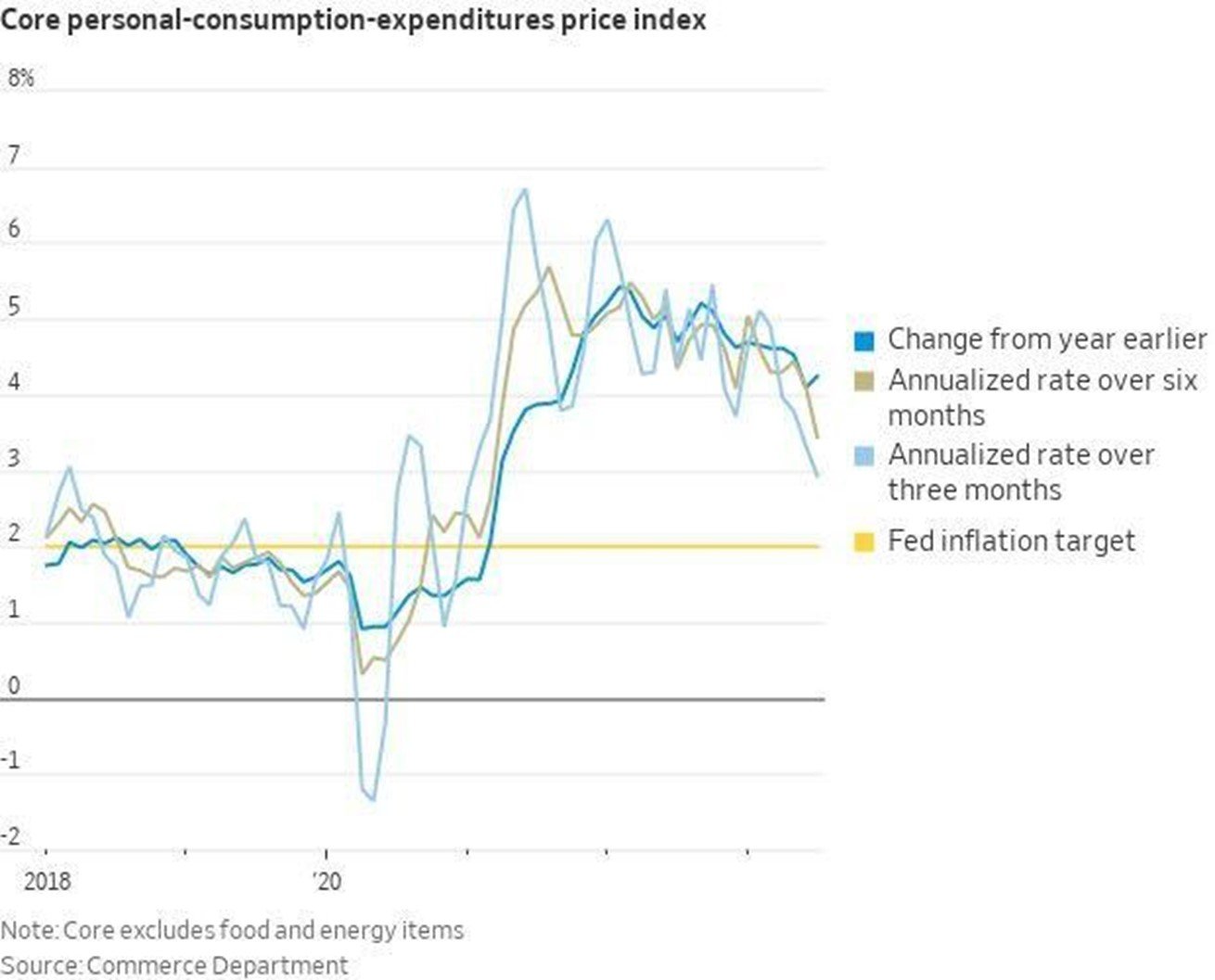

The July Personal Consumption Expenditures report was released this morning, and while it did show an increase in core inflation rates from 4.1% to 4.2% in July, the bump was exclusively due to “base effects” – or the fact that the comparable periods from a year ago had wildly different inflation rates, thereby impacting the year-over-year rates.

On a more accurate six-month rolling basis, the core inflation rate continued to drop in July to 3.4%. On a three-month rolling basis, core inflation dropped to just 2.9%. Both are very, very close to the Fed’s 2% target.

We believe this data tees up stocks for a massive September surge.

Prepare for the September Stock Market Rally

That’s because the drivers of the August stock market selloff were reinflation fears and spiking yields, and today’s data essentially eliminates those headwinds.

Clearly, any reinflation we’re seeing today is due to base effects and nothing more. Wipe away those base effects, and the core inflation trend remains lower inflation. Better yet, those base effects do become less pronounced next month, and as a result, the Cleveland Fed’s Nowcast model is calling for core inflation to drop again in August.

Shy of new geopolitical risks and a shift in market sentiment, reinflation fears should turn into renewed disinflation hopes over the next few weeks.

Meanwhile, Treasury yields – which spiked throughout August – have come crashing lower over the past week as the economic and inflation data has come in consistently soft. Most leading indicators suggest the data will remain pretty soft and that, by extension, yields will keep falling.

The spiking yields of August should turn into crashing yields in September.

While we cannot predict the future, our better judgment based on the short-term data suggests that, as reinflation fears turn into disinflation hopes and spiking yields turn into falling yields, the August selloff will turn into a September surge.

The Final Word

If not, let’s get you ready, by telling you about the potentially best investment opportunity of the decade.

This is a company sitting at the forefront of the “AI Revolution,” with the backing of the world’s most powerful companies and investors, and a technology that over 100 million people already use regularly.

Investing in this company today could be like buying Apple (AAPL) or Microsoft (MSFT) back in the 1990s, at the dawn of the “Internet Revolution.”

It’s a potential fortune-making investment.

And I’ll tell you all about it…

Uncover a remarkable opportunity on the cutting-edge of the “AI Revolution.”

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.