Eric Fry sees a “tipping point” fast approaching … don’t bet with the “flock” money … what history tells us about a bond yield reversal … Luke Lango’s forecast for a Q4 rally

There’s good news on the way.

To contextualize it, let’s begin with the bad news…

For the first time since 2007, the 10-year Treasury yield has topped 5%. It happened briefly last Friday, then again yesterday before pulling back.

In recent Digests, we’ve detailed the enormous headwind that surging bond yields are for stock prices. As you’re aware, this yield has been climbing in response to the Federal Reserve’s interest rate hiking campaign – one of the most aggressive on record.

But now, the good news…

Let’s go to our macro expert Eric Fry:

…This major depressant is in the process of reversing and – gradually – becoming a stimulant.

Even if [Federal Reserve Chairman Jerome] Powell’s team boosts short-term rates one last time, the stock and bond markets should begin celebrating the end of the rate-hike cycle… before it actually ends.

That tipping point is fast approaching…

I’ll take it one step farther. If the indicator that Eric is monitoring follows historical precedent, the tipping point is already at our doorstep.

The green shoots popping up in the barren bond market

The destruction in the bond market over the last three years has been historic.

From Yahoo! Finance:

The US bond market is braving the biggest sell-off in history, with benchmark yields quintupling since the end of 2020…

The US bond market is in the throes of an unprecedented three-year rout…

The ongoing Treasury rout ranks as the deepest bond bear market in the 247-year history of the US, according to Bank of America strategists led by Michael Hartnett.

But the indicator Eric is watching is signaling an impending reversal in bond direction – and it could happen at any moment.

Let’s jump to Eric’s most recent issue of his flagship investment service Investment Report:

…If we are to trust the bullish contrarian indicators coming from the bond market, the tipping point is fast approaching.

According to the Commitment of Traders Report from the CFTC, “non-commercial” traders have amassed a near-record short position in 10-year Treasury note contracts. In other words, these folks have placed a very big bet that long-term interest rates will continue rising.

Ironically, that’s a positive sign for the bond market. Whenever this particular group of speculators is leaning hard to one side of a particular trade, it usually pays to take the other side of that trade.

As a group, these traders are not exactly the “dumb money,” but they are certainly not the “smart money.” I would call them the “flock money” because they tend to act like sheep, especially at the extremes of a particular market.

They flock toward the identical trade at the identical time. When that happens, the trade becomes “crowded” and a reversal usually takes place.

If we want to know what the “smart money” looks like, yesterday brought us an example…

Bill Ackman is the billionaire hedge fund manager and founder of Pershing Square Capital Management. As we profiled in the Digest back in August, Ackman made a big bet against bonds at that time.

From our August 7th Digest:

Last week, we learned that Ackman is betting big against government bonds…

Here’s Ackman explaining why he’s making the bet:

“With $32 trillion of debt and large deficits as far as the eye can see and higher refi rates, an increasing supply of T [Treasuries] is assured.

When you couple new issuance with QT, it is hard to imagine how the market absorbs such a large increase in supply without materially higher rates.”

Yesterday, we learned that Ackman has covered his short bet (meaning he’s taken his profits and closed the trade, no longer expecting prices to drop).

From CNBC explaining:

Pershing Square’s Bill Ackman revealed Monday he covered his bet against long-term Treasurys, believing that investors may increasingly buy bonds as a safe haven because of growing geopolitical risks, the latest of which being the Israel-Hamas war.

“There is too much risk in the world to remain short bonds at current long-term rates,” Ackman said in a post on X, formerly known as Twitter, Monday morning. “We covered our bond short” …

Ackman also added that he removed the short because of concern about the economy.

“The economy is slowing faster than recent data suggests,” he wrote.

The magnitude of this “flock money” bet

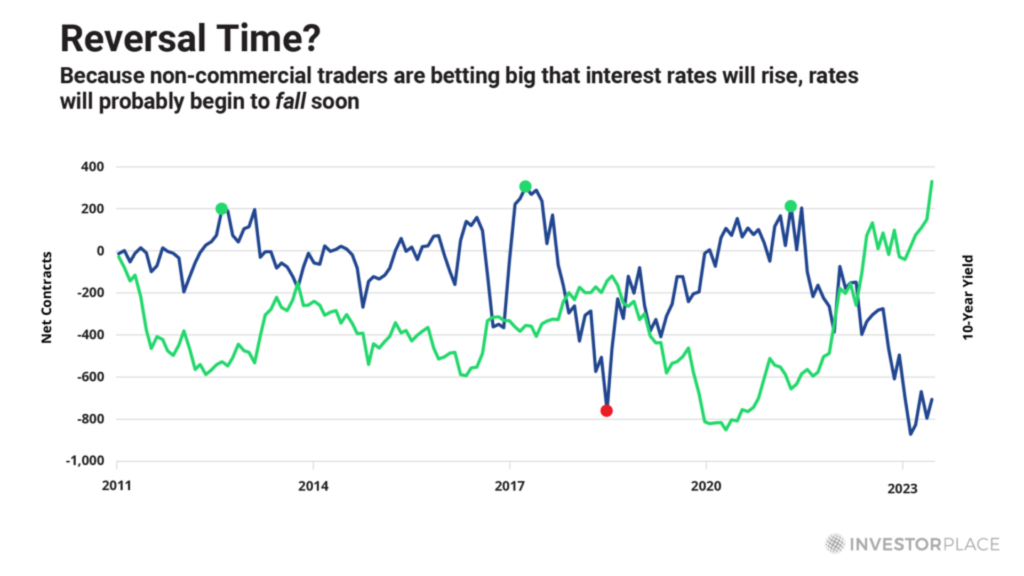

For a visual of the lopsided bet that the “flock money” is making (that Ackman is no longer with), Eric provided a chart we’ll show you momentarily.

First, here’s Eric with what to look for:

The two lines in the chart tend to move in opposite directions. That is, they are inversely correlated. (The green line is the yield on the 10-Year Treasury Bond. The blue line is the number of net contracts owned by non-commercial traders).

Whenever the non-commercials bet big that interest rates would fall (the green dots on the chart), rates started rising almost immediately.

Conversely, in 2018 when the non-commercials bet big that interest rates would rise (the red dot on the chart), rates started falling almost immediately.

Eric points out that this group of flock investors have now placed an even bigger bet that rates will rise than they did in 2018.

Here’s his takeaway:

You get the idea; betting against this crew is usually wiser than betting with them…

Once the eagerly awaited interest-rate peak does finally arrive, the ensuing drop in interest rates could power a major stock market rally.

High interest rates are like the water behind a dam. They are a kind of stored kinetic energy for the economy. But like dam water, they cannot release their energy until they fall from where they are. Once they fall, however, they can spin the turbines of economic growth for years at a time.

That moment has not yet arrived, but it is drawing near.

Our hypergrowth expert Luke Lango agrees that we’ve likely seen peak rates and yields

Let’s jump to Luke’s Daily Notes from Innovation Investor:

Over the past few months, it seems everyone has been calling for the 10-year Treasury yield to hit 5%. It finally did [last Friday]. And, once it did, it collapsed.

To catch us up to the latest market movements as of this writing, the yield collapsed, climbed again yesterday, then collapsed again yesterday. As I write Tuesday morning, it’s dropped to roughly 4.87%.

Back to Luke:

To us, it feels like 5% was the psychological top for yields. Fed talk has turned increasingly dovish in recent weeks, too, and there are two fairly major wars going in the world right now, so the backdrop just isn’t there for higher rates and yields.

We think rates and yields have peaked, providing support for equity multiples at current levels.

Notice that Luke’s commentary echoes that of Ackman. Global geopolitics are simply too dicey to bet against a rush into the perceived safety of bonds in this atmosphere.

Stepping back, we continue to believe the edge goes to bulls for a short-term rally trade headed into the end of the year

Though regular Digest readers know we have longer-term concerns about the economy and the market, we’re optimistic about stocks in the shorter-term due to the heavily oversold condition of the market in recent weeks.

A study of market history shows that the indexes tend to enjoy healthy mean-reversion rallies after bears drag down prices into oversold conditions. That’s where the S&P has found itself after the selloff that began in August.

So, combine deeply oversold conditions with the likely sustained reversal in bond yields that Eric and Luke see coming, then throw in a dash of seasonality (November and December are two of the best months for stock market performance over the past 20 years), and we have the makings of a major rally on the way. Let’s trade it higher.

In Luke’s Innovation Investor Daily Notes, he ends with some helpful and encouraging perspective on the recent market weakness, and why now isn’t a good time to throw in the towel.

We’ll let him take us out today:

We understand that the choppiness in the stock market has been tough to stomach over the past three months. But this volatility is par for the course when it comes to a stock market battling its way out of a bear market – which is exactly what is happening today.

The stock market is just battling its way out of the 2022 bear market.

In the first year of a bull market, stocks soar in a quasi-straight-line fashion – which is what we did in the last few months of 2022 and through the first seven months of 2023.

But, in the second year of a new bull market, stocks encounter volatility. They keep on rallying, but they hit lots of bumps in the road. Usually, stocks suffer a 10% correction or two in the second year of a new bull market – but they also always post positive net returns in that second year, too.

The S&P 500 is currently about 8% off its recent highs. In that context, this is a perfectly normal correction in the second year of a new bull market.

The investment implication?

Stick with stocks.

Have a good evening,

Jeff Remsburg