Enormous divergence between the Magnificent 7 and the average stock … a veteran blue chip Eric Fry likes today … how to create your 2024 AI portfolio … an AI event tomorrow night with Eric

This year has largely been a story of “AI/Big Tech” versus everything else.

As of last Friday, the “Magnificent 7” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, Tesla) had returned an average of roughly 99% in 2023.

The S&P 500, being a market-cap weighted index, has benefited from this extraordinary “Magnificent 7” performance. Year-to-date, it’s up 14%.

However, it’s the S&P 500 Equal Weight Index that gives us the purest illustration of how the average stock in the S&P has done this year.

As you can see below, it’s down 1.3% in 2023.

So, while we have AI/Big Tech up basically doubling in 2023, the average stock has done zero…zilch…nada.

That’s quite the divergence.

***One of the biggest questions as we head in 2023 is “will the AI/Big Tech outperformance continue, or is it time to bet on some of 2023’s laggards?”

We know AI is the future. But that doesn’t necessarily mean most AI stocks are still fantastic buys today after their monster performance in 2023.

So, what do we do with the Magnificent 7 and AI/Big Tech in general today?

Will these AI leaders continue their dominance in 2024? Or is it time to move into the 2023 laggards?

As you’d expect, the answers are all over the place.

For example, the CEO of DoubleLine Jeffrey Gundlach, known as “the bond king,” is bearish on the Magnificent 7.

In an interview last week with Yahoo! Finance, Gundlach was asked “What is your message to those investors that essentially have concentrated their wealth in seven of the world’s biggest stocks, otherwise known as the Magnificent Seven?”

Here’s Gundlach:

Of course, [they] will obviously be the worst performers in the upcoming recession. Whatever is leading the charge going into the economic downturn invariably must lead the charge on the way down.

So, I would get out of them. I would go into an equal-weighted basket as opposed to a market-weighted basket.

On the other hand, there are plenty of analysts who remain very bullish. One of them is Callie Cox from eToro U.S Investment. Not only is Cox “not getting out of them,” she’s recommending investors load up.

From Cox:

…We’re actually leaning into [greater Magnificent 7] exposure…

Recessions are known for washing out the weak hands in the market. And you have to think about which companies are durable enough to survive a recession. When you think about that. I mean, it’s hard to look past big tech.

(By the way, we’re ignoring the fact that both analysts are suggesting we’ll get a recession. That’s a topic for another Digest.)

So, what are we to do?

Well, what if you could invest in a budding AI leader that’s not on everyone’s radar? What if you could find a Big Tech veteran with blue-blood pedigree that hasn’t seen the same extraordinary price run-up as the Magnificent 7…yet?

That’s what our macro investor Eric Fry believes he’s found.

And as my colleague Luis Hernandez pointed out in Saturday’s Digest, Eric’s nickname around our offices is “Mr. 1,000%” due to the 41 different 1,000%+ returning stocks that Eric has dug up over the decades. We’re unaware of any other money manager who has produced a similar performance. Given such a track record, it’s wise to pay attention when Eric is bullish on something.

So, what’s the AI/Big Tech company on his radar as we look ahead to 2024?

IBM.

***A veteran blueblood, back from the dead

Decades ago, IBM was the technology company. It was also the bedrock of millions of mom-and-pop portfolios.

But IBM was slow to change as technology advanced, and the company fell behind. However, the last few years have witnessed the beginnings of a turnaround.

Here’s Eric with more:

IBM has been reinventing itself as a hybrid cloud and artificial intelligence company. To accelerate this transformation, the company has been pursuing an out-with-old-in-with-the-new growth strategy.

Since 2019, IBM has divested 17 legacy businesses, while also making more than 30 acquisitions.

One of the most impactful acquisitions during its shopping spree was Red Hat, which IBM acquired in 2019 for $34 billion. Although the price tag seemed a bit rich at the time, this acquisition brought a market-leading hybrid cloud platform into the IBM family.

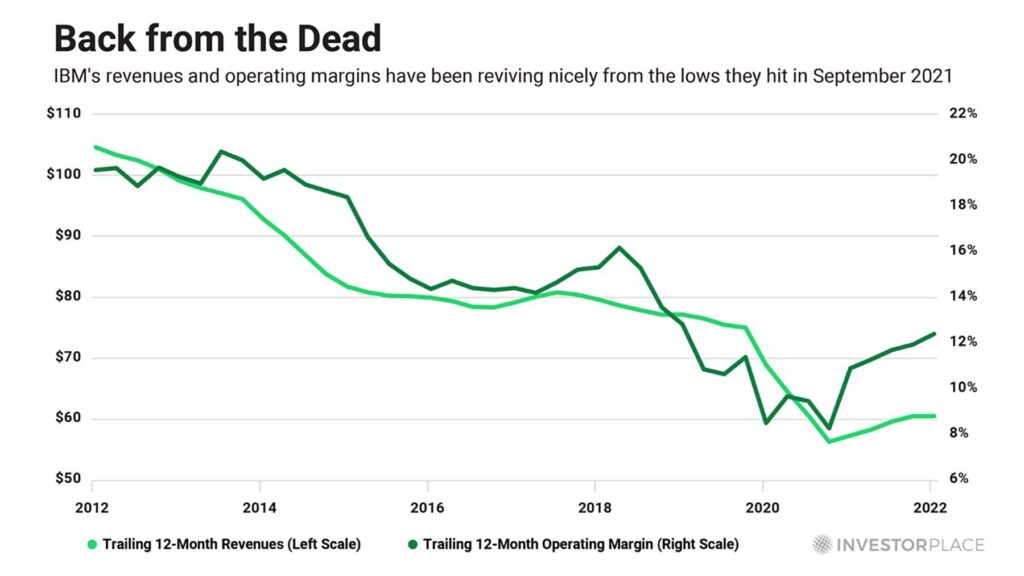

If we look at IBM’s revenues and operating margins, we see the impact of these divestitures and smart acquisitions. After more than a decade of declines, they’re now climbing.

Back to Eric:

After hitting a 30-year low in Sept. 2021, IBM’s revenues and margins have been making a noticeable recovery.

These favorable financial trends do not prove IBM has embarked on a new growth trend, but they do support that thesis.

Not only are IBM’s revenues and operating margins trending higher, but profits are on the move north as well.

Eric points out that operating income has jumped 77% during the last two years.

***Looking ahead, IBM’s moves have put it in position to accelerate its recovery and become an AI leader

Let’s return to Eric’s point about IBM becoming a hybrid cloud and artificial intelligence player.

The growth prospects for these two megatrends are enormous. And with IBM sitting squarely in the middle of them, the tailwinds are brisk.

Back to Eric:

According to Grand View Research, the global cloud-computing market will grow 150% over the next seven years – from about $600 billion this year to more than $1.5 trillion in 2030.

The global artificial intelligence industry will reach a similar size by 2030, according to Fortune Business Insights.

IBM is riding the current of both of these powerful megatrends.

Putting it altogether, here’s Eric’s bottom-line for IBM today:

Because IBM’s fast-growing AI and hybrid cloud businesses will power most of its future growth, I expect the company to become a dominant leader of the AI boom.

***To be clear, Eric isn’t avoiding smaller AI companies that could bring even more explosive growth

But finding the right smaller AI plays comes with greater challenge.

Here’s what Eric wrote earlier this summer:

Finding cutting-edge AI plays that can become market-leading AI stocks is not easy.

It is not the proverbial “shooting fish in a barrel” process; it is more like grabbing cobras from a basket.

Many of the “pure-play” AI companies are producing sizeable losses and offer a lot more hope than substance.

Secondly, the AI initiatives at many established companies are so early in their development that they will not boost overall profit growth any time soon.

But this doesn’t mean Eric is recommending investors completely steer clear of this type of AI company. After all, today’s AI leaders were themselves once small and operating at losses as well. Of course, some decades and several-hundred-thousand-percent of gains later, we all wish we’d put even a few dollars into those moonshots of yesteryear.

It’s for these reasons that Eric recommends investors approach AI stocks in 2024 with what he calls a “barbell” approach.

Back to Eric:

Broadly speaking, all up-and-coming technologies like AI present investors with daunting challenges. Many of the most exciting plays on the technology are upstarts that stand on the clay feet of poor balance sheets and perpetual quarterly losses.

That’s why a “barbell” approach often works best.

On one end of the bar, you invest in leading tech companies that are already profitable and established. But then you stack the other end of the bar with a basket of small, promising tech companies that are not yet producing consistent profits… or any at all.

IBM is establishing itself as a leading tech company – yet without a leading-tech-company price tag. It’s up just 11% this year.

As for that basket of small, promising tech companies, put tomorrow night at 7 PM Eastern on your radar. That’s when Eric is holding a live event that he’s calling Extreme Alpha 2.0.

Eric will be discussing the type of AI stock he’s bullish on today, and more exciting, how he’s adding artificial intelligence to his research process to improve the results. Keep in mind, these are the same results we highlighted earlier that have resulted in 41 different 1,000%+ returning investments.

If you’re looking for a balanced way to play AI as we head into 2024, join us to learn more about how this veteran investor is positioning himself. You can reserve your seat by clicking here.

We’ll give Eric the final word:

…Most of the [AI related] big money has already been made for Microsoft, Alphabet, Nvidia, and Amazon.

That’s why I’m zeroed in on the less obvious choices…

And they carry far more profit potential…

We’re only in the very early stages of this trend, and as I’ve said in the past, catching just one of these megatrends at the right time (i.e., now) can lead to life-changing gains…

To better explain, on Tuesday, Nov. 14, at 7 p.m. ET, I’m going live with the Extreme Alpha 2.0 Summit to share with you how I’m using AI to enhance my recommendations.

Have a good evening,

Jeff Remsburg