The U.S. continues to spend more money on healthcare than any other country. Healthcare spending totaled $4.3 trillion, according to the American Medical Association. That works out to nearly $13,000 per person, or 18.3% of the nation’s gross domestic product (GDP). The U.S. also continues to lead the world in medical research, innovations and healthcare advancements. New prescription drugs, medical devices, and scientific breakthroughs tend to come from America more than any other nation. That’s largely because nearly $250 billion a year is spent on medical research and development (R&D) in the U.S. Any way you look at it, healthcare is big business and getting bigger, especially in a country with an aging population where more senior citizens than children are expected by 2035. Here are three healthcare stocks to scoop up as they change the medical landscape.

Eli Lilly (LLY)

What more can be said about Eli Lilly (NYSE:LLY) and its weight loss medication? The drug, sold under the name “Zepbound,” has just been approved by the U.S. Food and Drug Administration (FDA) and is expected to help treat obesity and chronic diseases ranging from diabetes to heart disease. Many analysts and healthcare professionals call the treatment a “miracle drug.” It’s expected to save healthcare systems worldwide billions of dollars a year.

Some analysts forecast that Zepbound will become the biggest selling drug of all time. The biggest issue Eli Lilly faces now that the FDA has granted approval is how it will meet the overwhelming demand for Zepbound. Currently, Eli Lilly only faces one competitor for its weight loss medication—Novo Nordisk’s (NYSE:NVO) similar medications, Wegovy and Ozempic. However, demand is strong enough that industry observers see billions of dollars in future sales for Eli Lilly.

Indeed, in its recent third-quarter earnings report, Eli Lilly reported that Mounjaro sales topped $1 billion, up from less than $100 million a year earlier. Currently taken as an injection and priced at over $1,000 for a month’s supply, Eli Lilly is working on a much cheaper pill version of Zepbound for consumers. Eli Lilly is also trying to secure insurance coverage for the medicine. LLY stock is up 62% this year and growing.

Boston Scientific (BSX)

Boston Scientific (NYSE:BSX) is a medical device manufacturer specializing in devices used to treat various ailments. However, the company is arguably best known for developing devices used in heart surgery and to treat cardiovascular disease. Boston Scientific’s main claim to fame is that it invented the “stent,” used to open clogged arteries. Today, the company has more than 50,000 employees and nearly $13 billion in annual revenue.

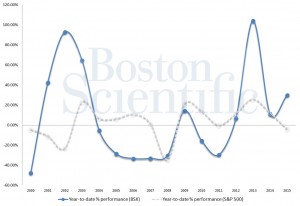

BSX stock has been a strong performer for healthcare stocks in an otherwise down year. Year-to-date, Boston Scientific’s share price has gained 20% versus a 5% decline in the S&P 500 Health Care Index. The company continues to grow through acquisitions, recently completing an $850 million purchase of Relievant Medsystems, which makes products to treat lower back pain. And Boston Scientific continues to post strong financials, recently announcing a 56% year-over-year profit increase.

Danaher (DHR)

Danaher (NYSE:DHR) is constantly pushing the boundaries of the medical landscape with its innovative healthcare devices. The company has been particularly successful with the development of diagnostic medical equipment. Since its founding in 1969, Danaher has created precision diagnostics equipment that can detect diseases ranging from cancer to lung ailments, often at a molecular level. This innovation has made DHR stock a great long-term outperformer, growing more than 300% in the past decade.

Currently, a lot is happening with Danaher. The company recently spun off its water testing business unit into a new publicly traded company called Veralto (NYSE:VLTO), a move it made to focus more on its healthcare products and innovations. Danaher also reported better-than-expected Q3 earnings primarily due to higher revenue from its respiratory testing equipment. DHR stock has been on an upswing recently, gaining 7% in the past month.

On the date of publication, Joel Baglole held long positions in LLY and DHR. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.