Commercial landlords can’t pay off mortgages … rising defaults … but have regional banks been de-risked? … Bill Gross’ recent bank trades … how the sector looks through Stage Analysis

The dumpster fire that is the commercial real estate sector continues to burn.

According to Moody’s Analytics, during the first nine months of 2023, only one out of three expiring securitized office mortgages were paid off.

Here’s The Wall Street Journal from yesterday with more:

That is the smallest share for the first nine months of any year since at least 2008 and well below the nadir reached in 2009, when 47% of these loans got paid off.

That share is also well below the rate before the pandemic, when more than eight out of every 10 maturing securitized office mortgages were paid back in some years.

Regular Digest readers know that we’ve been running a “commercial real estate watch” segment all year, monitoring this critically important sector of the U.S. economy.

Legendary investor Warren Buffett once quipped, “You only find out who is swimming naked when the tide goes out.” Well, with Federal Reserve Chairman Jerome Powell saying there’s zero discussion of rate cuts on the table, and with $1.4 trillion in commercial real estate debt coming due by the end of next year, the tide is going out…

And no sector has more “naked swimmers” than commercial real estate.

***What the numbers tell us about the commercial real estate meltdown

The WSJ article explains that many office owners can’t pay back their old loans because they can’t get new mortgages.

To make sure we’re all on the same page, the office sector relies on debt. Landlords buy astronomically priced buildings with huge mortgages. When the mortgages mature, the landlords can’t pay off the building in full, so they just take out a new mortgage.

The post-Covid trend of remote work has resulted in a wave of office vacancies that have pushed down rental rates (slashing revenues for the owners).

Meanwhile, the Fed’s rate hikes have boosted financing (and refinancing) costs, while also pushing down building values (due to higher discount rates).

Given these shifts, the mathematics just don’t work anymore for many new commercial mortgages. Back to the WSJ for the result:

That combination is fueling a rise in defaults. The share of office CMBS loans that are delinquent has tripled over the past year to 5.75%, according to Trepp.

To give you more perspective on just how bad it is, let’s compare 2023 with 2019.

Before the pandemic, when offices were full and interest rates were low, landlords could just roll over their maturing debt into new, low-rate loans. In the first nine months of 2019, 88% of commercial landlords paid off their loans at maturity (by rolling into new loans).

Last year, we began to see the first wave of refinancing contagion during this new era of higher vacancies, higher rates, and lower building values. That translated into only 71% of landlords being able to pay off their loans.

And this year? The figure has plummeted to 31.2%.

***While we’ve looked at the potential contagion effect in various office REITs before, let’s switch our focus to a silver lining…and perhaps a trade

So, we have landlords unable to pay off their old mortgages because they can’t find new mortgages.

Well, who’s on the other side of the negotiating table in that equation?

Regional banks.

As we’ve pointed out in prior Digests, the commercial real estate sector is highly connected with the regional banking sector. Regional banks are responsible for most commercial real estate loans. Bank of America puts the number at roughly 68%.

Now, you might be raising an eyebrow. If commercial real estate is in trouble, it would seem obvious that regional banks would be in trouble too. In fact, back in the spring, we highlighted this analysis from JPMorgan:

We expect about 21% of commercial mortgage-backed securities outstanding office loans to default eventually, with a loss severity assumption of 41% and forward cumulative losses of 8.6%…

Applying the 8.6% loss rate to office exposure, it would imply about $38 billion in losses for the banking sector…

So, what’s different now?

Well, even though Powell & Co. aren’t making sounds about cutting rates yet, Wall Street currently believes we’ll see our first cut in May (and our own Louis Navellier is calling for it to come in either January or February).

To be clear, the beginning of rate cuts won’t mark the end of stress in the commercial real estate sector. But remember, Wall Street always looks ahead roughly 12 months. So, it will be trying to price-in how the economy and banking sector will look after another year of easing conditions.

This means banking stocks are likely to move higher well before we see the actual improvements in banking bottom lines.

***On this note, earlier this month, the “Bond King” Bill Gross, the co-founder of PIMCO made a bullish call on regional banks.

From CNBC:

Longtime investor Bill Gross said Thursday that regional banks are poised to bounce back with the tailwind of falling interest rates.

“Regional banks … benefit from lower interest rates,” Gross said on CNBC’s “Last Call” …

Gross also noted that regional bank shares are now very cheap, and many of them offer hefty dividends.

“Many of them are at 50% of book value, which is historically low. They yield, in many cases, 7% plus with a 40% payout ratio, which provides a decent amount of protection,” he said.

Here are four regional banking names that Gross likes along with their dividend yields. You’ll see the yields are slightly lower than the 7% that Gross references as they’ve been bid-up over the last weeks. Still, pretty nice:

- Truist – 6.51%

- Citizens Financial – 6.15%

- KeyCorp – 6.69%

- First Horizon – 4.90%

***If we step back and evaluate the regional banking sector from a trading perspective, it appears a bullish trade is setting up

Let’s borrow a tool from one of our trading experts, Luke Lango.

Regular Digest readers know that Luke roots his AI Trader trading service in a market approach called “stage analysis.”

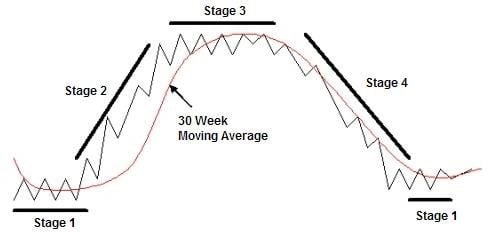

In short, every stock at any given point in time is either going up, down, or sideways.

To that end, every stock is always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.

The key to scoring big returns consistently is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out.

Below is a chart of the SPDR S&P Regional Banking ETF, KRE with a crude stage analysis overlay.

You’ll see its prior Stage-2 bullish explosion back in 2020/2021 (in green) … which turned into a Stage-3 topping pattern (in yellow) … which collapsed into a Stage-4 decline (in red) … and is now saw-toothing, appearing to be in Stage-1 consolidation (orange).

To be clear, Gross has already pulled the trigger on his trades. He has purchased the stocks we highlighted above.

If you want to follow Gross into this trade, just be careful as you approach the approximate $49 level. As you can see in the chart above, this is the top of the Stage-1 consolidation range. KRE could bump its head on this resistance level, resulting in a sharp pullback.

If you’re more of a conservative investor and/or you want to follow the traditional Stage Analysis rules, you would wait until KRE breaks above this $49 level on heavy volume. That would suggest that the sector is, in fact, beginning a new Stage-2 bullish surge.

Obviously, that will mean you miss out on some early gains. But that’s the tradeoff for a greater sense of confidence that we’re watching a true bullish breakout rather than a bearish fake-out.

We’ll keep you updated as this plays out. But I will say that those juicy dividend yields look great today, especially in light of historically low book values.

We’ll keep you updated.

Have a good evening,

Jeff Remsburg