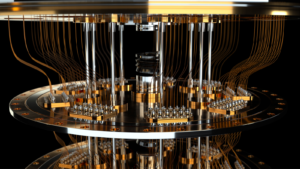

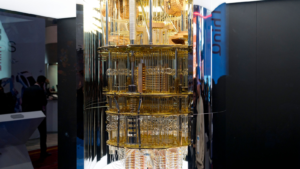

Quantum computing looks like it will be a tremendous game changer for society because it provides “massive operational power advantages over classical computers.” In fact, quantum computers can carry out calculations in minutes vs. today’s supercomputers, which take at least several days or years to perform. Reportedly, the technology can significantly improve many sectors, including manufacturing, where it will enable “more accurate and realistic prototyping and testing” and drug research where its ability to foster “a superior and more precise understanding of molecular structure” will be transformative.

Among the other fields that quantum computing could significantly improve are artificial intelligence (AI), financial modeling and cybersecurity. Despite the vast potential, the value of most quantum computing stocks is quite low, allowing patient investors to generate huge profits as the technology matures. Such investors should consider snapping up these three quantum computing stocks, which appear to be tremendously undervalued.

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI) “develops quantum computers and superconducting quantum processors,” along with “a quantum-computing-as-a-service platform adaptable for various cloud setups,” another InvestorPlace columnist, Matthew Farley, noted.

Impressively, the company was founded by Chad Rigetti, a “physicist and computer scientist” who developed quantum computing for IBM (NYSE:IBM) before launching his own company in 2013. Although Rigetti left his namesake firm earlier this year, he obviously left a tremendous imprint on it.

Rigetti Computing seems to be making significant progress, as it sold its first quantum processing unit in the second quarter, leading research firm Benchmark to predict the company will make similar, additional deals going forward. Indeed, RGTI delivered another QPU last quarter.

Praising the ease of use of RGTI’s offerings, Benchmark raised its rating on the shares to Buy from Hold and placed a $4 price target on the name versus its current price of just over $1.

Another big achievement by the company was its attainment of a five-year deal to provide the Air Force Research Lab with the ability to create “customized quantum systems.”

The market capitalization of RGTI is just $150 million, a level that vastly undervalues the company’s long-term potential.

D-Wave Quantum (QBTS)

D-Wave Quantum (NYSE:QBTS) has reportedly created “the first quantum computer ready for industrial applications,” giving it an important, first-mover advantage in the space.

And somewhat validating D-Wave and its technology, the company has several very impressive customers, including Volkswagen (OTCMKTS:VWAGY), Toyota (NYSE:TM), Lockheed Martin (NYSE:LMT) and Japanese auto parts maker Denso (OTCMKTS:DNZOY).

Moreover, in the first three quarters of the year, D-Wave’s bookings jumped 125% year-over-year to $8.4 million, while its “Average Deal Size per booking increased by 172% for commercial customers and 178% for all customers when comparing the most recent four quarters with the immediately preceding four quarters.”

Given D-Wave’s rapid growth and huge potential, its $134 million market capitalization is clearly quite low, making it one of the best quantum computing stocks to buy.

Arqit Quantum (ARQQ)

Arqit Quantum (NASDAQ:ARQQ) developed a “quantum encryption” system that’s “unbreakable” and can, relatively cheaply, protect “every edge device and cloud machine in the world,” according to Seeking Alpha columnist Jay Capital.

He and many other commentators predicted that quantum computers will be able to hack Public Key Infrastructure (PKI) systems over the longer term. PKI is currently the most popular means of protecting data. As a result, new methods of protecting data will have to be found, and ARQQ appears to have a first-mover advantage in that area.

Among ARQQ’s customers are the “U.K. Government [and] the European Space Agency,” along with BT Group, a huge British telecom company and Sumitomo (OTCMKTS:SSUMY), a Japanese conglomerate.

Among those testing the product are Verizon (NYSE:VZ), BP (NYSE:BP) and Northrup Grumman (NYSE:NOC).

Arqit looks poised to become a gigantic cybersecurity company, and almost none of that potential is reflected in its current market capitalization of $82 million.

On the date of publication, Larry Ramer did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.