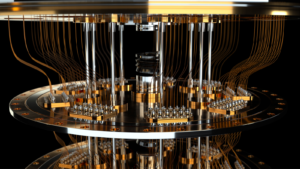

Much like artificial intelligence (AI) stocks, a quantum computing stock could be explosive. In fact, as just noted by Forbes’ contributor Jim McGregor, “In just five years, quantum computing could take computing and humanity to a new level of knowledge and understanding.”

Even better, it could lead to “a revolution for humanity bigger than fire, bigger than the wheel,” according to Haim Israel, Head of Global Thematic Investing Research at Bank of America, as quoted by Barron‘s. Plus, according to Fortune Business Insights, the market – currently valued at about $717.3 million could grow to $6.52 billion by 2030.

Again, much like we saw with AI so far, there’s big excitement with quantum computing. All of which could lead to substantial gains for stocks, including:

Quantum Computing Stock 101: IonQ (IONQ)

The first time I mentioned IonQ (NYSE:IONQ), it traded at just $4.56 on March 13. Today, after hitting a high of $19.68, it trades at $12.45, with plenty of upside potential.

All thanks to a booming quantum computing market, which could fuel big upside for quantum computing stocks. Granted, the company’s Q3 EPS of 22 cents missed by seven cents, and Q3 bookings did fall from $28 million to $26.3 million quarter over quarter.

However, revenues were up 121% year over year to $6.1 million, which beat by $1.1 million. Also, IONQ increased its full-year revenue guidance to $21.2 million to $22 million from prior guidance for $18.9 million to $19.3 million. Better, full-year bookings are expected to come in between $60 million and $63 million from prior guidance of $49 million to $56 million.

Rigetti Computing (RGTI)

There’s also Rigetti Computing (NASDAQ:RGTI), a $153 million company that develops quantum integrated computers, and the superconducting quantum processors, as noted on the company’s website.

Fueling interest, it was just awarded Phase 2 of a Defense Advanced Research Projects Agency (DARPA) Quantum Benchmarking Program to “develop benchmarks for quantum application performance on large-scale quantum computers,” as noted in a press release. Even better, it also signed a five-year Indefinite Delivery Indefinite Quantity contract with the Air Force Research Lab Information Directorate to supply its researchers with quantum foundry services.

Defiance Quantum ETF (QTUM)

Or, for solid diversification and low cost, look at the Defiance Quantum ETF (NYSEARCA:QTUM).

The last time I mentioned the QTUM ETF, it traded around $50. Now, after some wild volatility, it’s back to breakeven and still has plenty of upside potential. That’s especially true with the quantum computing market expected to explode higher.

With an expense ratio of 0.40%, the fund provides exposure to cloud computing, quantum computing, artificial intelligence, and machine learning stocks. Some top holdings include Ionq, Rigetti Computing, Intel (NASDAQ:INTC), Nvidia (NASDAQ:NVDA), and Applied Materials (NASDAQ:AMAT) to name a few. This is a great quantum computing stock to add to your portfolio.

On the date of publication, Ian Cooper did not hold (either directly or indirectly) any positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines