Louis Navellier here.

It has been one heck of a year…

So much has happened that when I think back to events from the first half of the year it doesn’t feel possible that it all happened this year: the collapse of Silicon Valley Bank and the ensuing regional banking crisis, the AI catalyst driving the “Magnificent 7” to new heights, gas prices surging and then plummeting, the Russia-Ukraine war passing the one-year mark, and rising key interest rates…

It all happened in 2023!

The second half of the year hasn’t been any less chaotic, with Treasury yields jumping to new heights, Hamas’ attack on Israel and the ensuing war, the U.S. barely averting a government shutdown, those AI-fueled stocks pulling back, energy stocks reasserting themselves, tightening interest-rate policies, and global economic growth hitting the brakes.

And that’s just a sampling!

No wonder Wall Street has been so distracted – and the market so seemingly chaotic – this year.

Interestingly, despite all the volatility, the three main broader indices remain in positive territory. In fact, even after the dismal months of August, September, and October, the stock market has retraced its steps back near the year’s late-July highs.

Now, the great news is that I think 2024 will be an even better year for the stock market. So, as we look forward to 2024, what can we expect? In the words of the Greek philosopher Heraclitus, “There is nothing permanent except change.” In other words, change is coming in 2024.

On Tuesday, December 12, at 7 p.m. Eastern time, I will be sitting down with fellow InvestorPlace analysts Eric Fry and Luke Lango for our Early Warning Summit 2024. During that event, we’ll share our predictions for next year. Click here to register for the event now.

Today, though, I’d like to share two of my own predictions for the New Year…

Prediction No. 1: Energy Prices Will Perk Back Up

Now, I know what you’re thinking… “Energy prices have moderated recently.” And you’re correct. They have moderated, with crude oil prices trading below $75 per barrel right now.

As I see it, there are three primary reasons why oil prices have moderated…

- First, it is abnormally warm in Europe, and fears of a liquified natural gas (LNG) shortage have abated given that Europe’s storage levels are full.

- Second, the American Petroleum Institute recently reported that U.S. crude oil inventories rose by a larger than expected 11.9 million barrels.

- And third, China’s economy continues to struggle, as its exports declined by 6.4% in October. Imports did rise by 3% in October, but that’s the first increase in seven months, so it’s too early to proclaim China’s economic demand will pick back up.

I should add that crude oil demand is typically lackluster in the winter months.

Despite all this, crude oil prices are anticipated to climb as global supplies remain tight. Saudi Arabia and Russia have both reiterated that their crude oil production cuts will persist through the year’s end. Plus, the Energy Information Administration notes that the inventories of crude oil and refined products that tend to grow in the winter remain low. So, any flare-up in the Middle East could cause prices to soar.

Natural gas and LNG prices also tend to rise in the winter – and that’s definitely a possibility this winter. An El Niño weather pattern should make it abnormally cold in the Northeast U.S. and Europe, which will boost natural gas demand and prices. In addition, LNG exports from Egypt to Europe could be disrupted if Middle East tensions escalate and Iran blocks the Strait of Hormuz.

Overall, crude oil and natural gas prices should remain elevated as we head into the New Year. In turn, energy companies will likely reassert their leadership, especially as they continue to benefit from tension in the Middle East and the possibility that Russia could halt its crude oil production in the Arctic Circle.

Prediction No. 2: Inflation Continues to Cool

Great news: Inflation has started to collapse around the world.

In the Eurozone, consumer prices were at a 2.9% annual pace through October, which was down from a 4.3% annual pace in September. That’s the lowest rate of inflation in more than two years. In the past 12 months, energy prices have fallen 11.1%, and food prices have risen 7.5%. Both Ireland’s and Germany’s GDPs contracted in the third quarter, and that has also helped to reduce inflationary pressure.

Here in the U.S., inflation on the consumer and wholesale levels also has cooled.

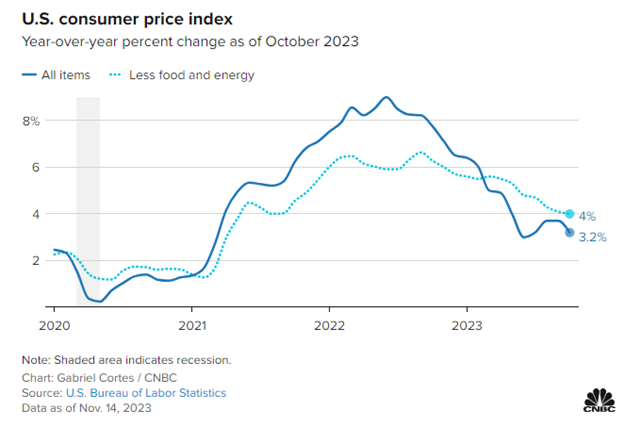

As the chart below illustrates, the latest Consumer Price Index (CPI) showed that headline inflation was flat in October and up 3.2% in the past 12 months. Core CPI, which excludes food and energy, increased 0.2% in October and was up 4% in the past 12 months. That was below economists’ expectations for a 0.3% month-to-month rise and a 4.1% annual pace.

The Producer Price Index (PPI) showed that wholesale prices dropped 0.5% in October, significantly below estimates for a 0.1% increase. Core PPI, which excludes food, energy, and trade, rose 0.1% in October and was up 3% in the past 12 months.

Also, wholesale service costs were unchanged after rising for six months, so service inflation is cooling. The fact that wholesale inflation continues to cool off quickly bodes well for lower consumer prices in the upcoming months.

So, the latest inflation reports are great news and indicative that inflation continues to moderate all around the world.

These two predictions – along with others from myself, Luke, and Eric – are informing the recommendations we’re right now putting together for the Early Warning Summit 2024. These are the kinds of stocks investors will be able to use to profit throughout the next year. (Register for the event here.)

Remember, we’re hosting that event on Tuesday, December 12, at 7 p.m. Eastern time. We’ll also address some of the most common concerns investors have about 2024. Plus, we’ll give away three FREE stock recommendations.

It’s going to be an exciting event, so make sure to click here and reserve your spot today!

Sincerely,

Louis Navellier