This article is an excerpt from the InvestorPlace Digest newsletter. To get news like this delivered straight to your inbox, click here.

“Ding-dong! Inflation is dead!”

That’s what the Federal Reserve would like you to remember as we move into the holiday season. It took the central bank 11 interest rate hikes, pulling $650 billion of liquidity out of the market, and plenty of other government actions to reduce inflation from almost 7% last year to 3% today.

Happy holidays!

However, the inflation-fighting “medicine” has triggered some serious side effects. High mortgage rates mean buying an average U.S. house will now cost $3,300 in monthly payments (assuming a 10% down payment), a rate that would consume roughly 62% of the median household’s income after tax. And credit card debt is back on the rise. According to the Federal Reserve, the average American now sits on $3,100 of these loans… if you also include children in that calculation.

No matter where you look, you’ll see the fallout from the Fed as clear as a tornado through a wheat field.

That means the outlook for U.S. corporations has also soured. According to I/B/E/S analysts, the average S&P 500 company is now expected to grow earnings by only 9% this year, down from 22% last year. Valuations have also gotten rich, since earnings have not kept up with prices. The long-term price-earnings (P/E) ratio for the S&P 500 now sits at a 31X multiple, far higher than its 17X historical average.

In other words, growth-seeking investors are seeing trouble going into 2024.

Many former high-fliers are quickly becoming “growth traps,” a term used to describe stocks that fail to hit lofty growth expectations. Research has shown that these growth traps get crushed when they fail to hit Wall Street targets.

Others are seeing a more natural slowdown. As InvestorPlace.com’s Dana Blankenhorn notes this week, shares of high-growth Palantir Technologies (NYSE:PLTR) now look overvalued after the “Generative AI boom has… brought competition to Palantir’s party.”

That’s why our writers at InvestorPlace.com, our free news site, have become particularly selective with growth stocks going into 2024. Here are the companies they see with an excellent road through the next year…

5 Blue-Chip Growth Stocks to Buy for 2024: Alphabet (GOOG)

It’s often easy to overlook Alphabet (NASDAQ:GOOG, NASDAQ:GOOGL) when thinking about the Magnificent 7 stocks. The search engine giant missed the boat on AI-driven chatbots and remains worryingly dependent on its digital advertising business. In 2022, the firm generated less than 10% from its cloud and “Other Bets” services combined.

But the AI pioneer is quickly realizing its mistakes. As Vandita Jadeja notes this week for InvestorPlace.com, Google’s teams have been working on a game-changing chatbot of its own.

A huge catalyst for Alphabet will be the launch of Gemini… there is high excitement surrounding the same since it could outperform OpenAI’s ChatGPT.

She also notes that Google’s search advertising continues to provide the firm’s balance sheet with plenty of financial support. Increased spending going into the 2024 presidential election will also turbocharge results; analysts expect Google’s advertising revenues to grow 10% in 2024.

Most importantly, Google’s cloud services remain a high-growth business. The segment could generate up to a fifth of total revenues by 2025, driven by Google’s AI offerings and a secular shift to the cloud. Shares trade at a reasonable 22 times forward earnings, the second-lowest of the Magnificent 7 stocks.

2. Meta Platforms (META)

Meanwhile, the cheapest of the Magnificent 7 stocks is also looking strong. Meta Platforms (NASDAQ:META) trades at just 20X forward earnings, making it the least expensive of the large-tech companies.

The discount is overdone, as Yiannis Zourmpanos writes for InvestorPlace.com this week:

Meta strategically focuses on expanding business messaging, especially in regions like India. It reveals a concerted effort to capitalize on the burgeoning potential of messaging platforms for commercial activities…

The emphasis on business AI [also] highlights Meta’s vision to democratize access to sophisticated tools for customer interaction… META is easily one of the best stocks to buy for 2024.

Essentially, Meta remains a high growth stock despite reaching limits on how many more users it can add. (Facebook counts 3 billion monthly active users of the 7.9 billion people on Earth!) By shifting Facebook users onto messaging apps and other platforms, Meta has figured out how to keep users on its online properties for longer, which increases advertising revenues. Net income is expected to surge 62% this year and see 21% growth in 2024.

The launch of the Apple Vision Pro VR headset in Q1 will also renew interest in Meta’s VR headset, the Quest 3. And though this will unlikely be a significant source of profits for years to come, experience tells us that retail excitement in these technologies usually translates into sudden share-price gains.

3. PDD Holdings (PDD)

PDD Holdings (NASDAQ:PDD) is China’s third-largest e-commerce company behind Alibaba (NYSE:BABA) and JD.com (NASDAQ:JD). The company is the youngest of the three firms and operates Pinduoduo, a fast-growing e-commerce marketplace that focuses on high-turnover products like groceries. Users can buy directly from farmers and individual producers.

A recent move into American e-commerce (through its subsidiary Temu) has now put PDD on an even faster growth track. The company now counts almost 1 billion active users around the world, and the success of Temu could pave the way for even greater gains. Average cart size at PDD is still roughly 63% lower than Alibaba’s according to estimates by Morningstar analysts.

Joel Baglole notes in a recent update at InvestorPlace.com that these wins are turning into significant financial gains.

PDD Holdings is proving to be a major growth stock… Revenue in Q3 totaled 68.8 billion yuan ($9.7 billion USD)… well above the consensus estimates…

PDD stock is now up 67% this year and appears to have momentum behind it, making it one of the top growth stocks recommended right now.

If you can only buy one growth stock in December, Baglole says it should be PDD Holdings.

4. Visa (V)

Marc Guberti writes this week at InvestorPlace.com how healthy profit margins and vital products at Visa (NYSE:V) should set the stage for a strong 2024.

The fintech company has healthy profit margins ranging from 45% to 50% of revenue. As long as consumers use credit and debit cards frequently, Visa will continue to reward long-term investors… People will continue to use credit and debit cards in any economy, which will help Visa stock reach new heights.

The rise of mobile payments (especially in international markets) also is helping fuel Visa’s double-digit growth. Analysts expect sales and net income to rise at 10% annually through 2026, and that consistent share buybacks will add an extra 2%-3% growth rate annually to earnings per share. That makes Visa one of the fastest-growing blue chips investors can buy today.

Most importantly, Visa is seeing a resurgence in cross-border transactions. It’s a particularly high-margin business for payment networks and is driven by international travel. The International Air Transport Association now expects spending on air travel to surge 7.6% to a record $964 billion in 2024, and for passenger counts to exceed 2019 pre-pandemic levels for the first time.

Though Visa isn’t your typical growth company (i.e., it’s not a Silicon Valley startup), these spending tailwinds are making its financials look like one anyway.

5. Dell (DELL)

Hang on… Dell Technologies (NYSE:DELL) is a growth company?

Senior Investment Analyst Luke Lango makes a strong case this week in a detailed Hypergrowth Investing report on “AI PCs,” personal computers with artificial intelligence built straight into them. Dell will launch a lineup of these in 2024, and the results could be game-changing.

They’ll come with the standard Central Processing Unit (CPUs) and Graphics Processing Unit (GPUs) that all advanced computers are outfitted with today. But they’ll also have Neural Processing Units (NPUs), which allow for AI to be run locally on the computers themselves…

Imagine being on your computer, pulling up Microsoft Office or Excel, and boom; there’s an AI assistant right there to help you craft whatever document or spreadsheet you’re working on.

You don’t need to open a separate window for ChatGPT or download and pay for Copilot. You just tap into the AI that is already built into your computer.

That is the widely accessible future that AI PCs will usher in next year.

Put another way, Dell’s AI PCs provide a compelling way for the firm to steal market share from lower-cost rivals while continuing to build its dominance in the higher-end segment. The firm is already the top player in branded x86 servers, and AI could be the edge that helps Dell build a competitive advantage in the more competitive PC market, too.

Of course, Wall Street hasn’t yet realized this potential. The average Street analyst expects Dell to see revenues fall 13% this year, and for sales to recover only 5% in fiscal 2024. Profits are also expected to remain muted; shares of the Texas-based firm trade at only 10 times forward earnings.

That gives Dell’s stock enormous upside potential, if things go right. Though Dell doesn’t look like your typical growth stock, the company’s plans suggest it might soon be.

More Growth Stocks for 2024

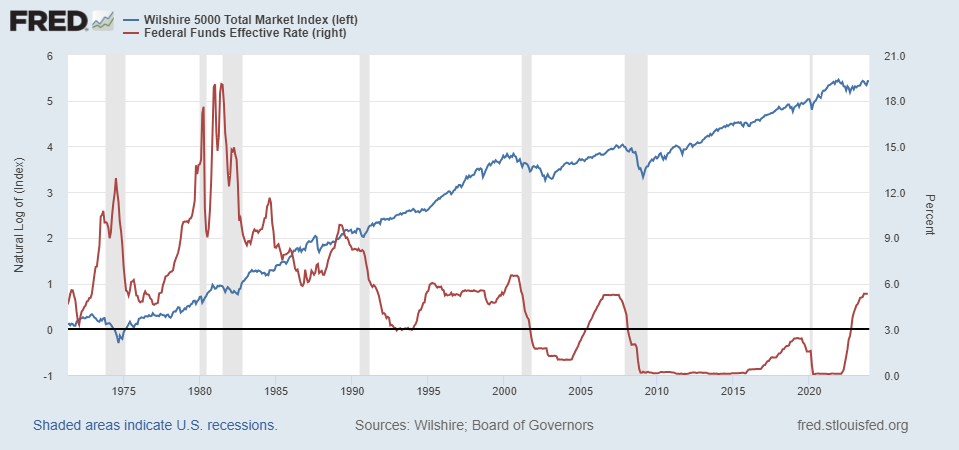

History tells us that recessions typically begin six months after the Fed begin cutting rates. Below is a graph from the Federal Reserve showing how the federal funds rate (red line) tends to fall right before recessions. Stocks (blue line) also decline as the economy goes in reverse.

2024 might see a similar selloff. The International Monetary Fund estimates that U.S. GDP will grow just 1.5% next year which could lead to as much as an 8% selloff in stocks, according to analysts at JPMorgan. Many are recommending utilities as a safe haven.

But the writers at InvestorPlace.com see things differently. This round of rate cutting comes after a major inflation fight, which means our current economy looks much like the bear market of 1982… not the recessions in 2000, 2009, or 2020 where rates were cut to stimulate demand.

That’s a bullish signal. In 1982, the Dow Jones Industrial Average took just 83 days after the market bottomed to reach a new record. This period is now known as the “Volker Bear” and is a rare case of a slow decline (1.7 years) being followed by a sudden surge. (Usually, recessions are the other way around, where a sudden drop is followed by a slow recovery.)

That means investors will need to have plenty of growth stocks in their portfolio to make sure they don’t miss out.

This week, our three chief investment analysts, Louis Navellier, Eric Fry, and Luke Lango – come together to warn you about the monumental moves that will rock the markets in 2024. And they’ll show you how to find the growth stocks that will put you on the right side of these big moves.

So, if you’re ready to discover the big market moves that will define 2024… and what sectors and stocks will lead to the biggest potential gains in the New Year… then tune in to their Early Warning Summit 2024 on Tuesday December 12 at 7 p.m. Eastern.

It’s FREE to attend but you do need to sign up. You can RSVP right here.

On the date of publication, Tom Yeung held a LONG position in GOOG and GOOGL. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.