Could the market for aerial urban mobility soar to new heights in 2024? Anything’s possible, and if you’re ready to get on board and invest in flying cars, take a look at EHang (NASDAQ:EH). It’s risky to own EH stock by itself, though, so I’ll give you two other flying-car stock picks to add to the mix.

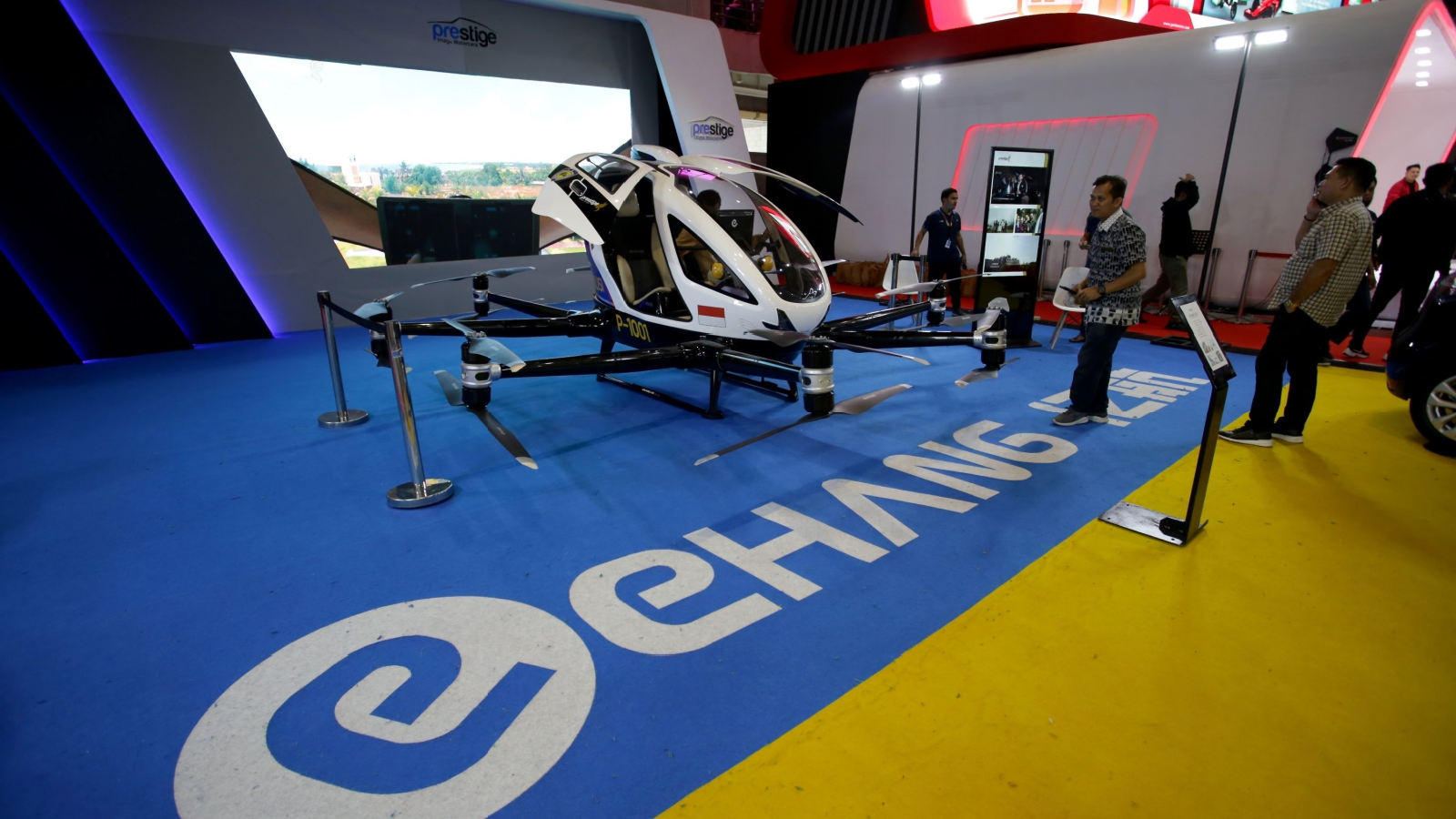

EHang is a China-based company that builds electric vertical takeoff and landing aircraft, also informally known as flying cars or flying taxis. Before you consider buying EHang stock, consider your risk tolerance. As we’ll discuss in a moment, there’s a short report floating around that might cause investors to think twice about EHang.

EHang’s Improving Financials

The eVTOL is still in its early stages. Therefore, before jumping into a trade with an eVTOL business, it’s important to check the company’s financials. They don’t have to be perfect, but they should at least be moving in the right direction.

Fortunately, EHang passes that test. In 2023’s third quarter, EHang’s revenue increased 248% year over year and 186% quarter over quarter. That’s pretty impressive, wouldn’t you agree?

Furthermore, EHang’s gross margin remained high at 64.6%. On top of all that, the company’s non-GAAP adjusted net earnings loss improved (i.e., shrank) 43.1% YoY and 39.5% QoQ. So, if you can forgive EHang for not being profitable, you might actually conclude that the company’s financials look pretty decent.

EHang CEO Huazhi Hu reminded investors that the company has “forged strategic alliances with key entities such as the Bao’an District Government of Shenzhen and the Hefei Municipal Government.” Hopefully, these partnerships will provide significant, ongoing revenue sources for EHang.

Should a Short Report Dissuade You From Buying EH Stock?

So far, I’ve provided a bullish argument in favor of EHang stock. At the same time, there’s a report from short seller Hindenburg Research which you might choose to read before making an investment.

I can’t confirm or deny any of the claims made in the Hindenburg report. It’s quite lengthy, so I recommend using InvestorPlace contributor Thomas Yeung’s handy guide to help you summarize its contents.

This is the snippet from the Hindenburg report that you’ll definitely want to take note of.

“After examining every preorder and partnership, itemized below, our research indicates that over 92% of EHang’s preorder book is based on deals that were later ‘abandoned’ or came from customers in no financial position to purchase EHang’s aircraft in volume, or at all,” they wrote.

Again, I can’t confirm or deny the accuracy of Hindenburg’s claims. Frankly, I don’t know if EHang’s 1,300-plus-unit order book is real or exaggerated.

EHang strenuously rejected Hindenburg’s fraud allegations. Here’s EHang official statement on the matter: “The Company firmly denies the allegations in the short seller report that the Company misled investors about its order pipeline and sales, and will take appropriate actions to protect its and its shareholders’ interests.”

EHang Stock: Two Alternatives for Portfolio Diversification

As you can see, there’s a lot to consider with EHang. I encourage you to consider all sides of the debate surrounding EHang. Be sure to weigh the risks and potential rewards, and don’t over-leverage yourself on EHang stock.

Finally, investors should think about diversifying their portfolios by adding two similar stocks to EH stock. For broader exposure to the eVTOL market’s growth, check out Joby Aviation (NYSE:JOBY) stock and Archer Aviation (NYSE:ACHR) stock.

I consider both of those stocks, JOBY and ACHR, to be must-own assets. So, feel free to look at those two flying-car stocks along with EHang stock for better diversification and less risk.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.