Fast 25% trading gains … why Luke Lango took profits … how the S&P looks through that same lens … get ready for a short-term consolidation … why Luke sees a monster 2024 coming

25% gains…in about two days.

That’s what Luke Lango’s AI Trader subscribers locked in with one of their latest trades last Thursday.

Let’s examine it, focusing on why he took profits quickly. It’s instructional for why caution about the broad market is warranted over the next week or so.

But then we’ll look beyond that caution to why Luke sees extraordinary bullishness on the other side of any near-term softness.

What’s behind Luke’s quick in-and-out profits with Blend Labs

Regular Digest readers know that Luke anchors his AI Trader trading service in a market approach called “stage analysis.”

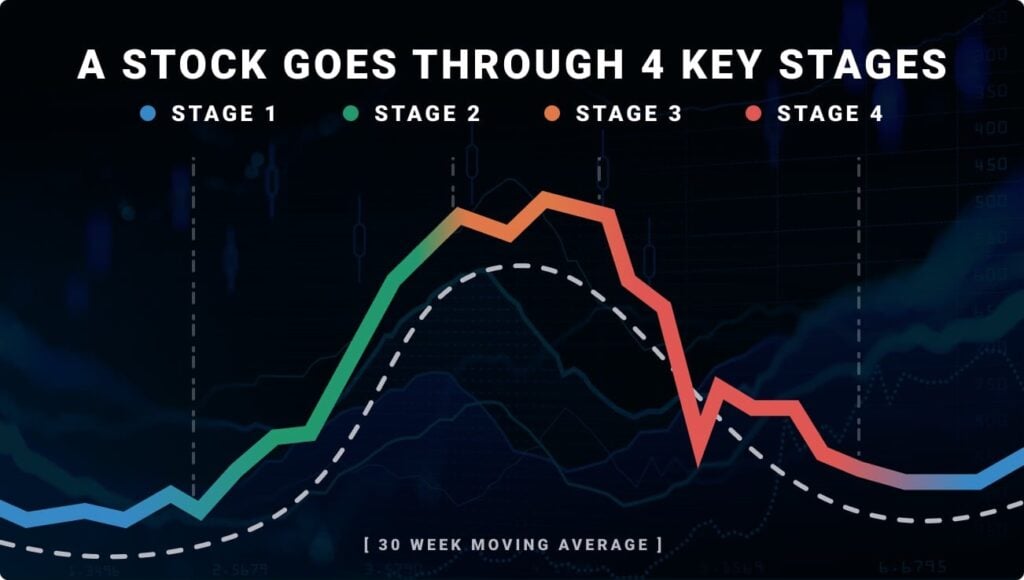

In short, every stock at any given point in time is either going up, down, or sideways.

To that end, every stock is always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.

The key to scoring big returns consistently is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out.

Luke’s proprietary artificial intelligence tool, named “Prometheus,” highlighted Blend Labs (BLND) last week. Luke recommended the stock Tuesday after market close.

Let’s jump to his Trade Alert for how he analyzed the trade:

We’re seeing a well-defined Stage-2 breakout that has successfully tested support six different times, which gives us tremendous confidence in this trade’s downside strength.

As to its upside, we’re currently breaking above critical technical resistance levels. We’ve pushed north through all the localized highs from summer, as well as the isolated high from March of this year (which has now turned into support) …

The relative strength index (RSI) level is at 71, so very strong. In other situations, we might prefer to wait until this RSI has normalized slightly; but based on the price breakout above resistance, we want to go ahead and take our position…

Everything we’re analyzing is very bullish, which explains why our Prometheus rating is one of the highest we’ve ever seen – Prometheus rating: 99.2.

And here is what BLND has done since (as of Monday early-afternoon as I write).

Given this meteoric jump, Luke recommended his subscribers lock in profits on a 1/3rd portion of the trade on Thursday – two days after the recommendation.

Here was his thought process in his profit alert:

BLND’s relative strength index (RSI) is now deep into overbought territory, and the moving average convergence/divergence (MACD) line is entirely blown out, too.

This stock is overextended and overbought here, so it’s time to take some profits off the table.

What Luke’s reference to RSI and MACD means, and how you can apply them in your own portfolio

We’ll begin with the Relative Strength Index (RSI).

For newer Digest readers, the RSI is a momentum indicator that measures the extent to which an asset is overbought or oversold. A reading over 70 suggests an asset is “overbought” (and likely poised to pull back as traders take profits) while a reading below 30 means it’s “oversold” (and poised for gains as bargain hunters step in and buy).

Below, we look at BLND’s price chart over the last three months to give us more context.

As you can see, given last week’s extraordinary surge higher (in green), BLND’s RSI level exploded to 83 (in red). This is wildly overbought.

Think of an overbought (or oversold) market like a rubber band. The greater you stretch it, the farther/faster the ensuing snap-back can be when the tension eventually releases.

With BLND so incredibly stretched, Luke decided it would be wise to lock in profits in case such a snap-back happens.

As to the MACD indicator, it stands for “moving average convergence/divergence.” It reflects changes in a price trend’s strength, direction, momentum, and duration. Traders use this tool by analyzing the location of the MACD line relative to its signal line.

At its most basic interpretation, if the MACD crosses above the signal line, it’s considered a bullish crossover, and potentially a buy signal. The opposite is true as well.

Consideration is also given to whether the MACD and signal line are trading above or below the zero line. The farther the MACD and signal line are from zero, the more stretched prices are in that direction.

As we noted a moment ago, Luke’s description of BLND’s MACD was, “entirely blown out.”

Here’s what that looks like.

A big “congratulations” to Luke’s AI Trader subscribers on this lightning-fast win.

But now, let’s pivot to the S&P and use this same analysis to understand why the risk of a short-term pullback is elevated today.

Technical warning signs are flashing for the broad market

Below, we look at the S&P 500 along with its RSI and MACD charts on a 52-week timeline.

Note how the RSI is at its highest level of the entire year – nosebleed overbought.

Similarly, the MACD is at its highest level, and borrowing Luke’s phrase, is “entirely blown out.”

Now, regular Digest readers know the market is not one big monolith that rises and falls in unison. It’s made up of thousands of different stocks with wildly different fortunes and fates. So, this focus on the broad market doesn’t mean that no specific stocks are “buys” today.

However, the overbought condition of the S&P should serve as a starting point of “caution.” Any individual stock buying should be done with full awareness of these market conditions.

Whether the next week or two brings a pullback or not, Luke is urging readers to position themselves for an enormous 2024 for stocks

Let’s jump to Luke’s issue of Hypergrowth Investing last Thursday:

[Last Wednesday], the U.S. Federal Reserve gave the stock market its ‘blessing’ to keep on rallying. And in so doing, it has also set the stage for stocks to potentially have a monster 2024.

That may sound rather bold. But the rationale behind our bullishness is pretty simple.

To us, the data has long confirmed that the U.S. economy will avoid a recession and, instead, will keep expanding in 2024. Job growth remains robust while unemployment rates remain low. Consumer and enterprise spending are still strong. All the data says the economy is on very solid footing right now.

But those are only half of the ingredients necessary for a soft economic landing. We also need rate cuts.

And [last week], the Fed confirmed that multiple rate cuts are likely coming in 2024.

That means it’s time for investors to get ready for a major potential rally.

In his update, Luke highlighted the Summary of Economic Projections, with the forecast suggesting interest rates will drop from 5.4% in 2023 to 4.6% in 2024. This means the Fed is signaling that there will be three or four rate cuts next year.

Back to Luke:

With this update, the Fed confirmed that we will very likely get an ultra-rare, ultra-powerful “soft landing” in 2024.

In such soft landings, interest rates move lower while the economy continues to expand. Such combinations rarely happen. In fact, the U.S. economy has achieved a soft landing only four times over the past 50 years.

But each time it did, stocks went on to soar.

The U.S. economy achieved soft landings in 2019, 1998/99, 1995/96, and 1984-86. During those periods, interest rates moved lower, and the economy kept expanding.

And in all four soft landings, stocks roared higher, as shown in the chart below.

Short-term cautious, longer-term bullish

Putting it altogether, the technical charts are telling us to be careful right now. As you saw, conditions are overbought and blown out. However, if the Fed comes through with three or four rate cuts in 2024, that will be like pouring gasoline on a fire.

If you’re looking for guidance on how to position your portfolio for next year, last week, Luke sat down with our other InvestorPlace experts Louis Navellier and Eric Fry for their Early Warning Summit 2024.

Here’s Luke discussing the evening:

We detailed our market outlook and investment gameplan for the promising year ahead.

At the end of that broadcast, we unveiled our brand-new portfolio of the best stocks to buy for 2024.

If you missed the presentation, worry not. You can catch the replay right now – but only for a limited time.

The earlier you prepare for the 2024 stock market boom, the more money you’ll stand to make next year. Wait too long, and you could see all the potential gains disappear.

You can click here to catch that free replay.

Congrats again to the AI Trader subscribers. You can learn more about that trading service here. Meanwhile, we’ll keep you updated on the market’s technical conditions here in the Digest.

Have a good evening,

Jeff Remsburg