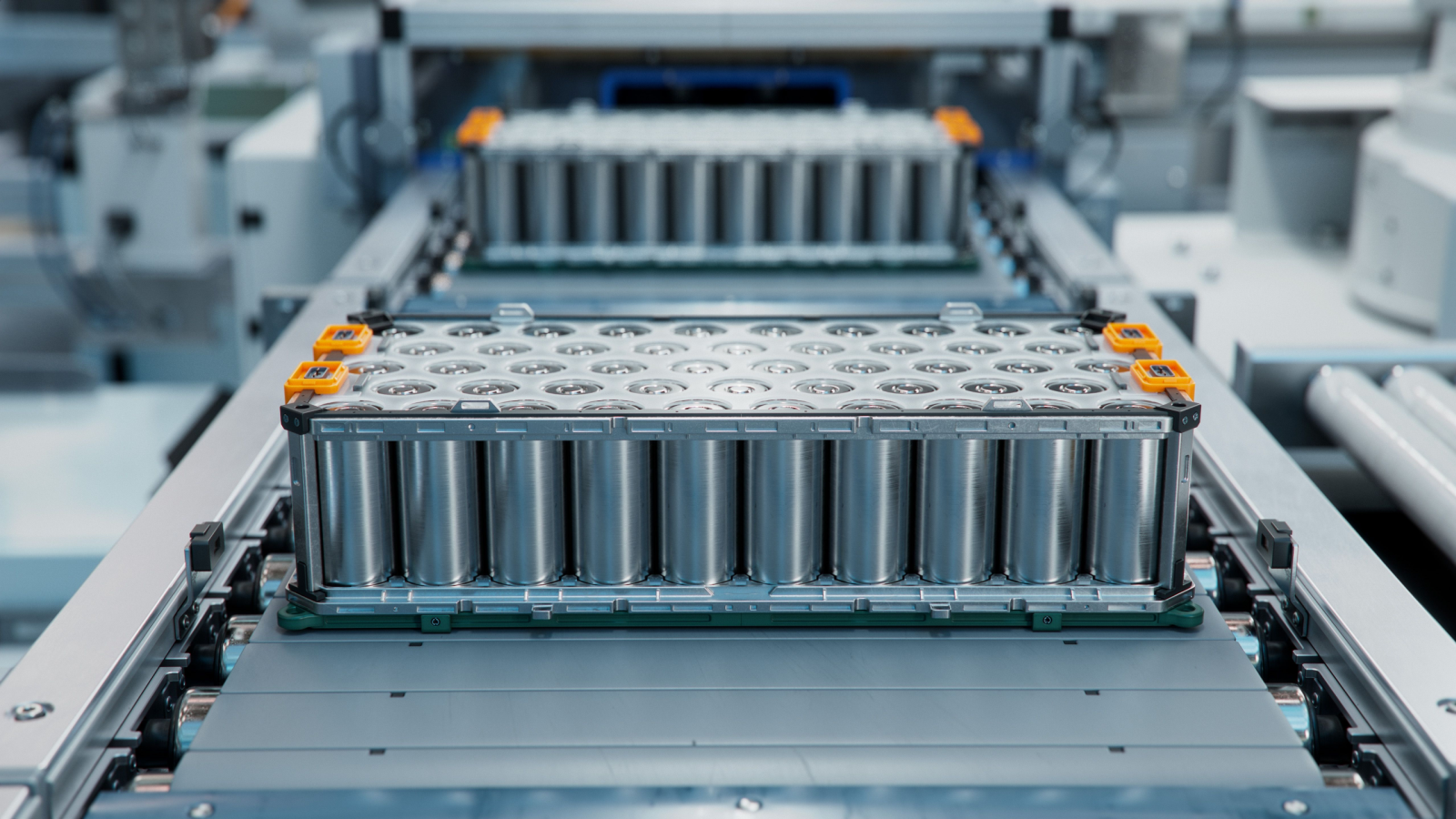

Battery stocks play a critical role in the burgeoning EV revolution. Moreover, McKinsey’s’ forecast shows the battery market is expected to grow to a whopping $400 billion by 2030. This represents a hefty 30% bump from 2022, outpacing estimates and electrifying investor prospects.

Amid a robust U.S. economy, the Federal Reserve’s current hold on rate cuts hints at a fertile ground for future investment opportunities. This holds particularly true in growth sectors, including battery technology.

Moreover, the automotive industry is shifting towards a greener horizon. This charge is led by stalwarts such as Tesla (NASDAQ:TSLA) and followed by Ford (NASDAQ:F), General Motors (NYSE:GM), and others. This demand surge places battery stocks in a pivotal position, promising a high-voltage future for investors.

Panasonic Holdings (PCRFY)

Panasonic Holding’s (OTCMKTS:PCRFY) has ambitious plans to construct four additional global factories by 2031, catering to the burgeoning market demand.

This expansion is set to increase its production capacity to an amazing 200 gigawatt-hours. In turn, this will enhance its current capabilities. And, it will improve the energy density of its batteries to 1,000 watts per liter. At the heart of this growth strategy is the construction of a new $4 billion lithium-ion battery plant in Kansas. It will showcase Panasonic’s commitment to improving battery efficiency and sustainability.

Additionally, Panasonic’s sales forecast for the next quarter shines at $14.11 billion, consistently outperforming its industry. By diversifying its partnerships, including the recent collaboration with Lucid, Panasonic adds further to its prowess in the niche. Also, this strategic move underscores Panasonic’s commitment to innovation and its dedication to powering a sustainable automotive future.

Albemarle (ALB)

Albemarle (NYSE:ALB), being a global titan in lithium production, is at the forefront of the high-demand battery market, especially for EVs.

This fully integrated operation demonstrates a significant footprint in the global market. Beyond lithium, Albemarle excels as a major player in bromine and oil refining catalysts. And, TipRanks analysts project a 16.31% price jump to an average target of $142.6. Therefore, confidence in its growth trajectory is evident.

Moreover, the company’s recent fourth-quarter financials report shows a jaw-dropping net sales surge to $2.4 billion. The jump is primarily driven by a 35% upswing in energy storage volume despite a net loss from specific charges. Additionally, strategic measures are set to unlock over $750 million in cash flow. Further, the completion of the Meishan lithium plant marks a milestone towards resilience and innovation.

Albemarle’s positive 2024 outlook and workplace diversity and responsibility recognition highlight its commitment to sustainable growth and operational excellence.

Honeywell International (HON)

Honeywell International (NASDAQ:HON) stands as a cornerstone in the battery stock landscape. Celebrated for its robust presence in various sectors, this is a low-risk investment option. TipRanks analysts predict a substantial 16.5% stock surge, reaching $229.80, reflecting the company’s solid position in the market.

Diving into HON’s portfolio, its array of energy storage solutions is impressively diverse. HON features lithium-ion, flow, and hydrogen batteries, each tailored for different discharge cycles. These offerings are housed within the performance materials and technologies segment, showcasing consistent long-term growth. Additionally, a noteworthy development is Honeywell’s strategic partnership with Duke Energy (NYSE:DUK), hinting at groundbreaking possibilities in advanced energy storage solutions for American cities.

Looking ahead, the company anticipates a prosperous trajectory, with sales expectations ranging from $38.1 billion to $38.9 billion. This forecast represents a year-over-year (YOY) organic growth of 4% to 6%. Therefore, this underscores the company’s positive outlook and commitment to sustained advancement.

On the date of publication, Muslim Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines