Hello, Reader.

U.S.-based EV manufacturers seem to be pursuing a “Field of Dreams” strategy…

Build it… and they will come.

In this case, the “they” are not customers; they’re battery metals.

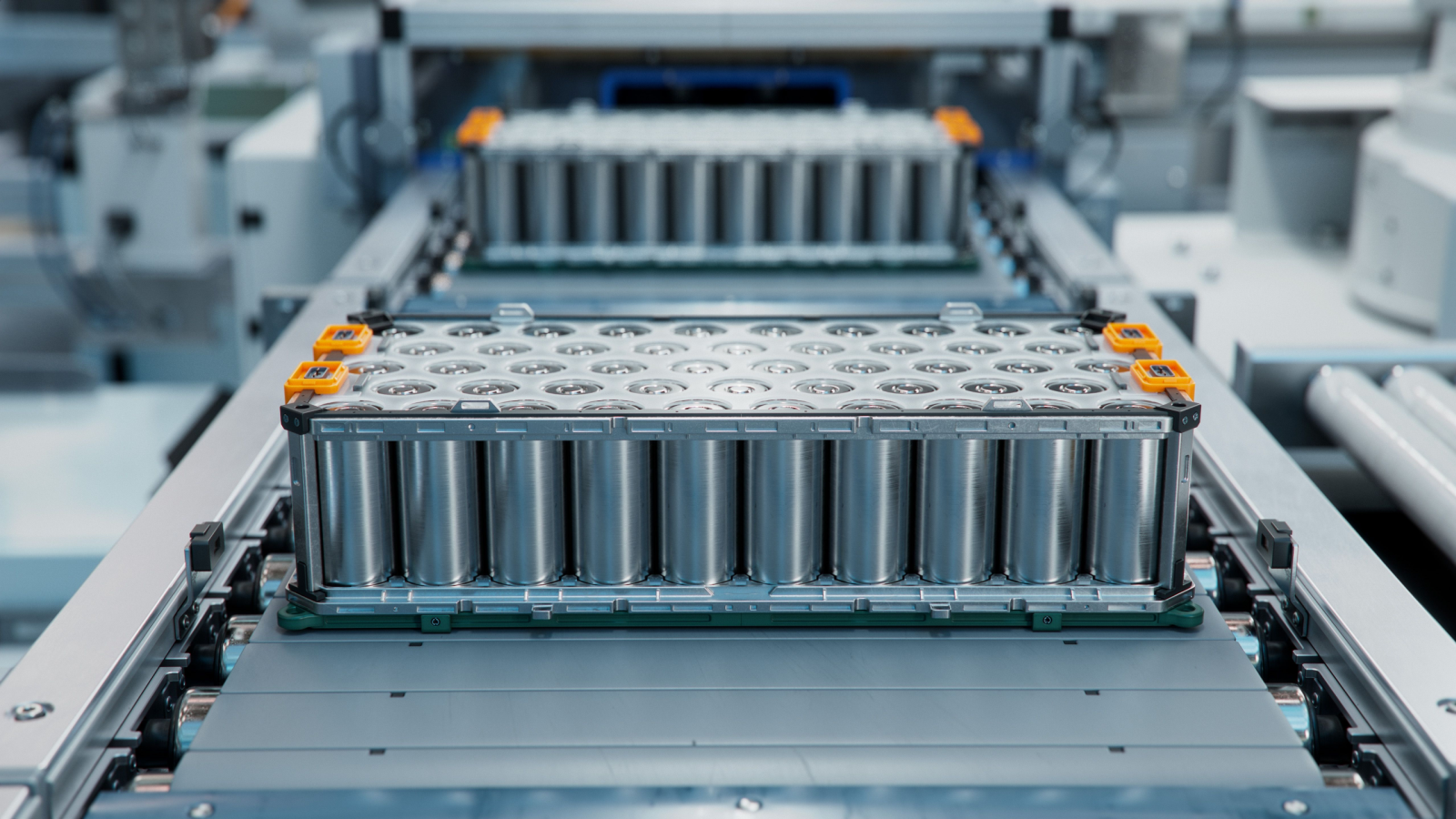

Battery metals are such a critical enabler of the energy transition that the scale of demand growth for some of them is mind-boggling.

For example, as the new energy analysts at BloombergNEF state…

2050 lithium demand from the energy transition alone looks to be about 17.5 times more than demand in 2020.

Energy transition-related demand for cobalt, nickel and copper… also exceeds total demand in 2020 for these metals.

This exponential growth will require newer technologies that increase the scale of production, without compromising the sustainable extraction of these metals.

So, battery metal suppliers will have to go pedal to the metal to keep up with demand in this new phase of the EV boom…

Allow me to repeat that forecast: Annual renewable energy-related demand for lithium, cobalt, nickel, and copper in 2050 will be greater than the total annual demand for these metals today.

That’s a lot of metal.

And let’s also not forget that metal demand will continue to grow from traditional sources that have nothing to do with EVs.

The combination of new demand from renewable energy, atop traditional demand sources, could produce an explosive multidecade commodity supercycle.

Recycling will satisfy some of the upcoming demand growth, but probably not enough to impact the markets significantly. Widespread battery recycling faces a number of challenges – both commercially and chemically.

As Mark Mills, a senior fellow at the Manhattan Institute of Technology, explains…

Even if all batteries were entirely recycled, it couldn’t come close to meeting the enormous increase in demand that will arise from the proposed (or mandated) growth path for EVs. In any case, there are unresolved technical challenges regarding the efficacy and economics of recycling critical minerals from complex machines, especially batteries. While one might imagine someday having automated recycling capabilities, nothing like that exists now. And given the variety of present and future battery designs, there’s no clear path to such capabilities in the time frames policymakers and EV proponents have in mind.

The bottom line is this: Robust future demand growth for battery metals is fairly certain, but the mining industry’s capacity to satisfy that growth has not been…

Until now…

As I mentioned in Saturday’s Smart Money, I have some special information to share with you…

There is a fascinating discovery out in the American West – specifically, on a 616-square mile slice of Nevada, close to the Oregon border.

This location is the site of an ancient volcano that has been dormant for millions of years; and this volcano likely holds the single largest deposit of lithium anywhere on Earth!

While I still can’t reveal all of this information just yet, I’ll explain all about this amazing discovery – and what is means for the future lithium boom – later this week.

So, continue to keep an eye on your inbox…

There are exciting developments ahead.

Regards,

Eric Fry