Is there anything Nvidia Corp. (NVDA) stock can’t do?

After the AI-chip titan reported spectacular earnings Wednesday evening, its stock rocketed more than 15% to add a tidy $265 billion to its market value. That’s more than the entire market value of iconic American companies like McDonald’s Corp. (MCD), The Walt Disney Co. (DIS), and The Coca-Cola Co. (KO).

The S&P 500 celebrated Nvidia’s pyrotechnics by soaring to a new all-time high, which is great news for investors.

These impressive achievements by Nvidia and U.S. stocks certainly deserve praise, if not also a ticker-tape parade.

At the same time, though, we must not forget that all glory is fleeting… not least the glory of high-flying stocks. Lofty valuations do not last forever.

Nvidia’s stock is selling for 65 times annual earnings – or about triple the market average. Perhaps that lofty valuation is appropriate for a company that is as dominant as Nvidia. Or maybe it should be trading for 100 times earnings.

Stocks like Nvidia make their own rules, at least for a while. But during Champagne-popping moments like these, we investors might want to keep in mind that markets are cyclical. High valuations yield to low valuations… eventually.

In other words, Nvidia is like a triumphant Roman general of ancient times who would ride a chariot along a lavish victory parade upon returning from battle. According to anecdotal accounts, the general would ride in the chariot with a special companion – a slave who would hold a golden crown over his head, while whispering in his ear, “Memento mori,” which roughly translates to, “Remember you are mortal.”

In the euphoria of the moment, it is easy to ignore high valuations – Nvidia’s as well as those of the overall U.S. stock market. But based on decades-long data, the S&P 500 is trading in the top decile of its historic valuation range. That’s high.

However, to borrow from Shakespeare, I did not come to bury the U.S. stock market, but to praise it.

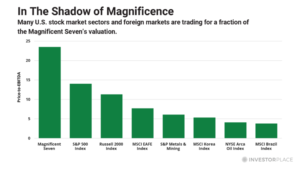

It’s true that the U.S. stock market is pricey, on average. But if you look past the “Magnificent 7” stocks like Nvidia – and as you can see in the chart below – the other 493 stocks in the S&P 500 aren’t pricey at all, which means many precious, undervalued nuggets are hiding among the bright, shiny stocks that are captivating the attention of investors.

Therefore, rather than fret about the stock market’s high average valuations, investors should consider making gradual reallocations from the priciest stocks to some of the least pricey ones. Many great investment opportunities remain here in the U.S. market.

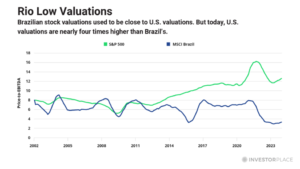

Select foreign stock markets also deserve a fresh look. Even though multiple expansion has been inflating U.S. stock prices during the last 15 years, multiple contraction has been deflating many foreign markets. Brazilian stocks provide a textbook illustration.

As the chart below shows, Brazilian stocks and U.S. stocks traded at nearly identical valuations throughout the early 2000s. But they parted company a decade ago and have been diverging ever since.

Today, U.S. stocks are nearly four times pricier than Brazilian stocks, based on almost any metric you choose. This massive discount does not definitively mean Brazilian stocks are a “Buy,” but I believe they are and that they possess significant upside potential.

Regards,

Eric Fry