If there was one company that grabbed business headlines the most on Tuesday, it would have to be consumer technology giant Apple (NASDAQ:AAPL). According to a CNBC report, AAPL stock dragged the broader tech space down. An unflattering report urged investors to approach the stock carefully, sending shares down 3%.

Counterpoint Research stated yesterday that Apple iPhone sales in China dropped a staggering 24% in the first six weeks of 2024. The company faces increasing competition from local smartphone manufacturers such as Huawei and Oppo.

That presents massive questions for longer-term viability. After all, AAPL stock has long thrived on its brand and pricing power. Consumers are willing to pay extra for the privilege of owning Apple products – and thus becoming integrated with its ecosystem. Lose that advantage and AAPL could sharply correct over the next several months as investors digest this new reality.

Here’s our game plan: We don’t care.

Understanding Apple Stock’s Pitch Count

If you’ve ever watched a professional baseball game, you know that players don’t swing at every pitch. Instead, they analyze the pitch count and many other factors that could influence the next pitch thrown. In some sense, baseball players are data analysts, waiting for the right moment to swing the bat.

That’s a similar situation to what we have with AAPL stock here. Because shares suffered a steep drop yesterday, there’s a good chance that Apple could open today’s session in the red.

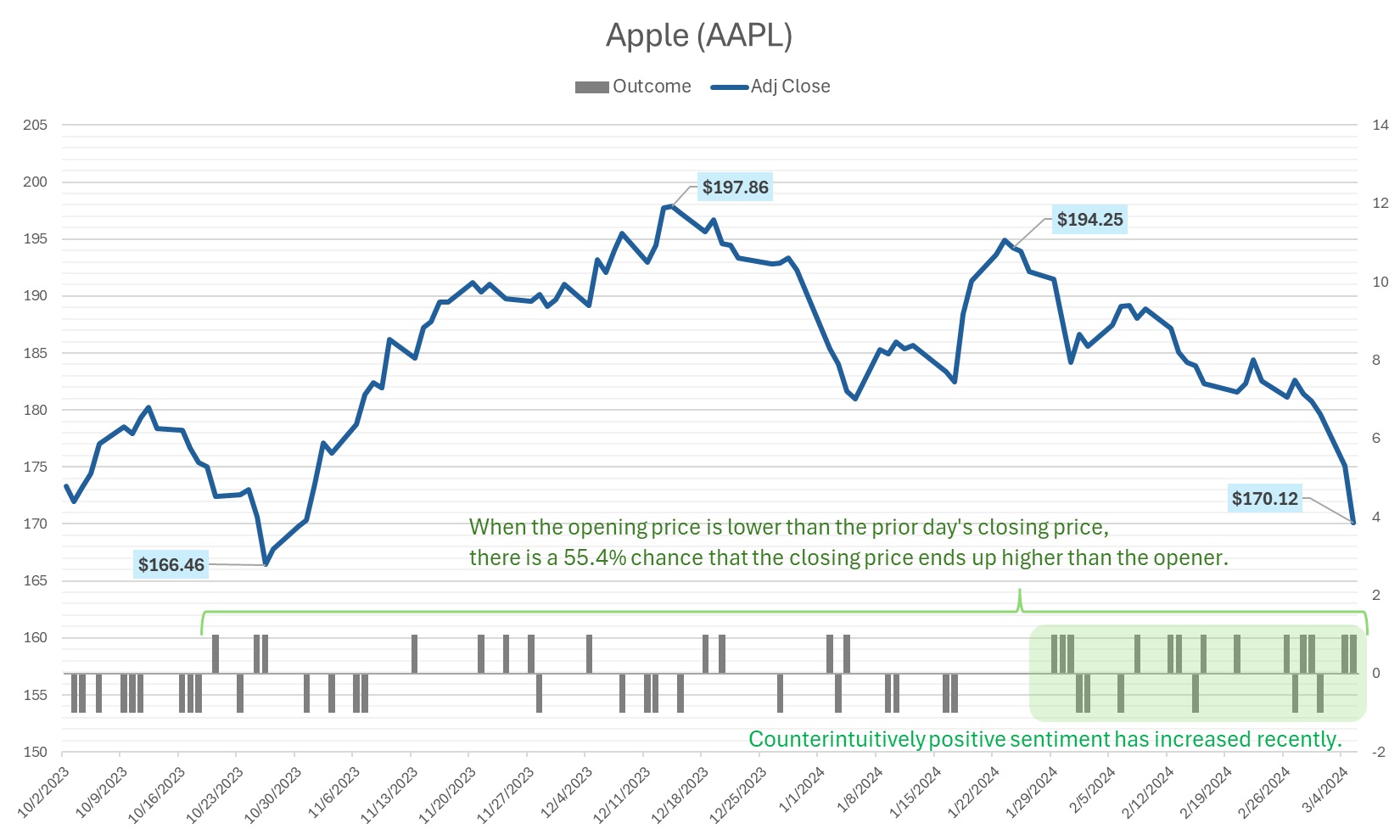

Notably, since the beginning of October 2023, whenever the opening price of a session was lower than the prior day’s closing price, there is a 55.4% chance that the price of the current session will end higher. Further, when the opener is positive, there’s a 54.9% chance that the current session will likewise end higher.

Chart by Josh Enomoto, InvestorPlace.com

In other words, AAPL stock has an upward bias in its near-term pricing dynamics. And when the opening price is negative, the bulls are just that extra bit motivated to push shares northward.

We’re going to use this math to our advantage.

Trade of the Day: Buy AAPL Stock Near-Expiry Call Options

Armed with Apple’s pitch count, we’re going to swing the bat if AAPL stock opens below Tuesday’s closing price of $170.12. Statistically, this should give us the best odds of AAPL moving higher.

To make this trade work, we need leverage, and that’s where Apple’s call options come into play. In particular, I’m looking at the slightly out-of-money (OTM) 8 March 2024 $172.50 call. On Tuesday, this contract closed with a premium of 95 cents. Using Barchart’s options calculator, if AAPL stock rises to $171 (a little more than a 0.5% move), the contract value could theoretically jump to $1.26.

Please be aware that no matter what happens, you need to enter this trade today and exit today. Due to the derivative market’s time decay, you can’t afford to spend quality time with this option. It’s get in, get out, move on.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.