A handful of brick-and-mortar retailers stepped up to the deck earlier this week with their latest quarterly earnings reports, with some big names you may recognize announcing: Target Corporation (TGT), Nordstrom, Inc. (JWN) and Costco Wholesale Corporation (COST).

Their results follow the disappointing January retail sales report from February 15, so Wall Street was closely watching these earnings results for any clues on what to expect from the February retail sales report (scheduled to be released on March 14.)

So, let’s use today’s Market 360 to find out how these big-box retailers fared in the latest quarter. Then, I’ll tell you which retailer my Portfolio Grader system says is the better buy.

Breaking Down the Numbers

Target Corporation – Tuesday, March 5

For the fourth quarter, sales grew 1.7% year-over-year to $31.9 billion, which beat estimates for $31.4 billion. For full-year 2023, sales decreased 1.7% to $105.8 billion, down from $107.6 billion in full-year 2022. This also reflects a 3.7% decrease in same-store sales, which was partially offset by revenue from new stores.

The good news, however, is that fourth-quarter adjusted earnings grew 57.7% year-over-year to $2.98 per share, up from $1.89 per share in the fourth quarter of 2022. Analysts expected adjusted earnings of $2.40 per share. Full-year earnings per share of $8.94 were nearly 50% higher than in 2022.

Looking ahead to the first quarter, company management expects comparable sales to decline 3% to 5%. First-quarter earnings per share are expected to be around $1.70 to $2.10, while full-year earnings per share are expected to range between $8.60 to $9.60.

In the press release, CEO Brain Cornell stated:

Our team’s efforts changed the momentum of our business, further improving our sales and traffic trends in the fourth quarter while driving profitability well ahead of expectations… Looking ahead, we’ll continue to invest in the strengths and differentiators that have delivered strong financial performance over time.

While it doesn’t look like the company expects sales to bounce back quickly, Target emphasized its progress, as well as its commitment to growing store and website traffic, sat well with investors. As a result, shares of Target jumped as high as 13% on Tuesday.

Nordstrom, Inc. – Tuesday, March 5

Nordstrom, Inc. (JWN) reported fourth-quarter earnings of $0.96 per share, up from earnings of $0.74 per share in the same quarter a year ago. This beat analysts’ estimates for earnings of $0.89 per share.

Revenue jumped 2.3% year-over-year to $4.42 billion, topping analysts’ expectations for $4.38 billion. However, it is important to point out that Nordstrom claims $109 million of those sales came from having an extra week in the fiscal year.

In the company’s earnings release, CEO Erik Nordstrom said:

In 2023, we continued to make progress against the priorities we identified at the outset of the year to improve the customer experience and drive better financial results… This year, we’ll build on the progress in merchandising and other green shoots across our business as we focus on efforts on our refreshed 2024 priorities.

Speaking of looking ahead in the year, Norstrom issued a wide revenue guidance, ranging from a 2.0% decline to an increase of 1.0% as well for as earnings per share of $1.65 to $2.05.

Following this vague outlook for the year ahead, shares of the company dipped nearly 15% lower on Wednesday morning.

Costco Wholesale Corporation – Thursday, March 7

For Costco’s (COST) second quarter in fiscal year 2024, the company achieved earnings of $1.74 billion, or $3.92 per share, and total sales of $57.33 billion. That compared to earnings of $3.30 per share and sales of $54.24 billion in the same quarter a year ago. Analysts expected earnings of $3.62 per share and total sales of $59.16 billion.

During the first six months of its fiscal year 2024, Costco noted that total sales increased 5.9% year-over-year to $114.05 billion. Earnings also rose 17.7% year-over-year to $3.33 billion, or $7.49 per share, in the first two quarters of the year.

Shares of COST slipped more than 4% on Friday following the mixed results.

The Better Retail Buy

If you’re looking to invest in retail stocks, which is the better buy? Well, according to my Portfolio Grader, the answer is Costco.

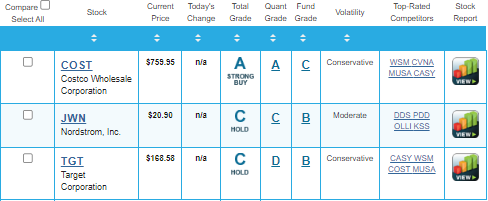

Now, the fundamentally superior retail stocks are fueling this bounce back. Just take the three stocks above as an example. If we compare them in Portfolio Grader, only Costco holds an A-rating while the other two stocks hold a C-rating.

As you can see in the report card above, only Costco holds an A-rating. Nordstrom and Target earn C-ratings, making them “Holds” right now.

Now, I should mention that Costco is a member of my High-Growth Investments Buy List over at Growth Investor. And since adding it to our Buy List in January, we’re up by about 15%. Not only is Costco outperforming the S&P 500 and Dow, which are up about 8.6% and 3.1% year-to-date – it’s also beating the retail sector by a hefty margin. The SPDR S&P Retail ETF (XRT), which tracks retail stocks, is up about 5.5% this year.

And that brings me to my next point…

If you want to beat the market, your best bet is by investing in fundamentally superior stocks, i.e., companies that are consistently growing their sales and earnings and posting positive forward-looking guidance.

And, at Growth Investor, we’ve taken steps to align our Buy List to prosper in the current environment, as we’ve loaded up on companies with accelerating earnings and sales momentum. Thanks to this strategy, my High-Growth Buy List is up about 25% year-to-date – nearly tripling the S&P 500 and NASDAQ gains this year!

Much of the strength that my Buy List stocks have exhibited this year can be attributed to earnings. The fact is, for the fourth quarter, my average Growth Investor Buy List stock posted 17.9% average annual sales growth and 147.5% average annual earnings. In comparison, the S&P 500 reported 4.2% average sales growth and 4.0% average earnings growth for the fourth quarter.

And I expect my Growth Investor stocks to continue to rally throughout the year. To learn more about Growth Investor and how it can help you grow your portfolio, click here.

(Already a Growth Investor subscriber? Go here to log in to the members-only website.)

Sincerely,

Louis Navellier

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Costco Wholesale Corporation (COST)