Semilux International (NASDAQ:SELX) stock is falling on Monday as the optical technology company’s shares give up unexpected gains on Friday.

SELX stock has been volatile recently, with its shares jumping 69% during normal trading hours on Friday. That came without any clear news concerning Semilux International.

Instead, shares of SELX stock were lifted higher with heavy trading. That saw more than 9.4 million shares change hands that day. For the record, the company’s daily average trading volume is closer to 658,000 shares.

It’s worth noting that SELX stock only went public in mid-February. This followed a merger between it, Taiwan Color Optics and the special purpose acquisition company (SPAC) Chenghe Acquisition.

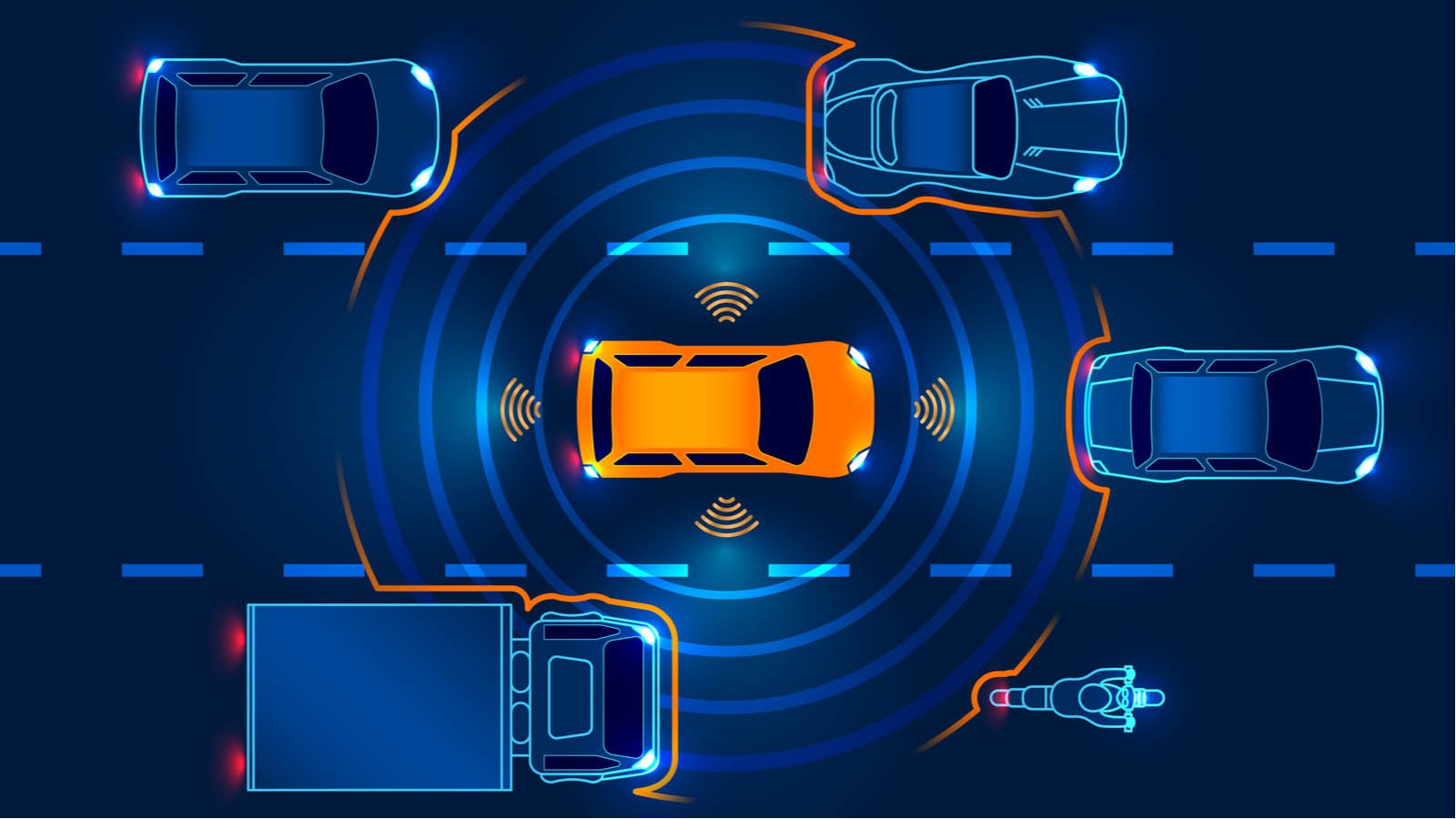

Following that SPAC merger, Semilux International completed a $50 million stock purchase agreement with White Lion Capital. It will use these funds as working capital for its ASIC, LiDAR, and ADB technologies.

SELX Stock Movement on Monday

Following its surprise rally on Friday, shares of SELX stock are down 16% as of Monday morning. That comes alongside some 478,000 shares changing hands. This is closing in on its daily average trading, even if it’s nowhere close to Friday’s movement.

Investors seeking out even more of the most recent stock market stories on Monday are in luck!

We’re offering insight into all of the hottest stock market news today! A few examples include why shares of Fangdd Network (NASDAQ:DUO) and Kidpik (NASDAQ:PIK) stock are up today, as well as the biggest pre-market stock movers this morning. You can catch up on these matters at the links below!

More Monday Stock Market News

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of publication, William White did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.