February’s CPI report comes in slightly above estimates … is it too late to buy into Bitcoin? … two versions of crypto sentiment … what Luke Lango likes more than Bitcoin

This morning, we learned that February’s Consumer Price Index (CPI) came in slightly hotter than expected.

While its 0.4% month-to month increase matched estimates, it’s 3.2% jump on the year was just ahead of the 3.1% forecast from the Dow Jones consensus.

Stripping out volatile food and energy prices (which gives us “core” CPI that the Fed prefers), prices rose 0.4% on the month and 3.8% on the year. Both were one-tenth of a percentage point higher than expected.

The main sources of inflation were energy and shelter (together, making up more than 60% of the increase in today’s CPI data). You might be noticing gas prices ticking higher. They’re up 3.8% on the month. Meanwhile, owner’s equivalent rent is up 0.4%.

While this wasn’t a blazing hot inflation report, it doesn’t give the Fed much reason to accelerate the timing of its first rate cut.

The Fed wants confidence that inflation is consistently, sustainably dropping back to 2%. And as you can see below, the downslope for both headline and core CPI seems to have leveled out at levels well-above the Fed’s target.

I was discussing this with fellow-Digest writer Luis Hernandez. He pointed out that the Fed might have to ease up on its “2% or bust” inflation goal. It’ll be interesting to see if the Fed begins to soften its language on this in the meetings to come.

In the meantime, the market is shrugging off this morning’s report. As I write, all three indexes are up solidly.

Now, real-time data suggests that inflation has been picking up again in March. We’ll dig into this in a coming Digest, but today, let’s turn our attention to the biggest story of the last two months…

Bitcoin.

If you buy into Bitcoin and/or altcoins today, is it foolish?

Would you be the latecomer to the crypto party who’s buying from the “smart money” investors who are cashing out just before a knife-edge sector crash?

While there’s no crystal ball, the single best timing indicator we have suggests “no, you’re not too late.”

That indicator is sentiment.

Neither Bitcoin nor altcoins have intrinsic cash flows that enable us to value them using traditional ratios or discounted cash flow models.

Instead, cryptocurrencies are more like gold, wherein its price reflects investor sentiment. Fear and greed drive crypto prices, period.

So, if we want to see how close we are to a cycle top, we need to look at sentiment. The more maniacally bullish that sentiment is – with everyone buying and making money – the closer we are to a peak (and by extension, an ensuing crash).

How close are we?

There are two narratives today regarding sentiment

The first narrative is what the mainstream press are claiming; the second is what the actual data are showing.

The press are telling us that crypto mania is already here, so watch out because the bear-market guillotine chop is right around the corner.

Here are a few headlines as examples, all from within the last week or so:

- The Street: “Bitcoin is setting itself up for another fall”

- DL News: “Bitcoin halving euphoria masks an existential threat”

- The New York Post: “Bitcoin briefly tops $70K as crypto mania sparks another record high”

- The Telegraph: “Bitcoin’s record high means a record crash is inevitable”

- Fortune: “Is Bitcoin due for a major correction?”

Now, perhaps we are, in fact, standing on the precipice of a crash. But a study of Bitcoin’s history suggests that crashes typically require a specific market condition…

Everyone is bullish, so everyone who wants to buy cryptos has already invested, so there’s no one left to sell to.

Is this where sentiment stands today based on the data, not the headlines?

No.

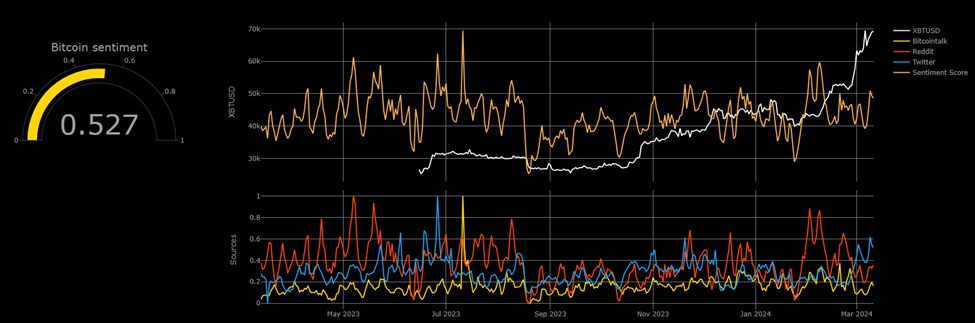

For our first illustration, let’s go to Augmento.ai

This is a website that scans social media posts to gauge sentiment.

Here’s how the service describes how it works:

Augmento constantly collects cryptocurrency related conversations from Twitter, Reddit & Bitcointalk. Using a classifier trained on crypto specific language the data is analyzed according to 93 sentiments and topics…

The graphs show how bullish/bearish conversations about Bitcoin (BTC) are on social media.

0 is extreme bearish, 1 extreme bullish.

Below is the graph. If you have trouble interpreting it, the Bitcoin sentiment score (on the left) is just 0.527.

That is not a manic reading.

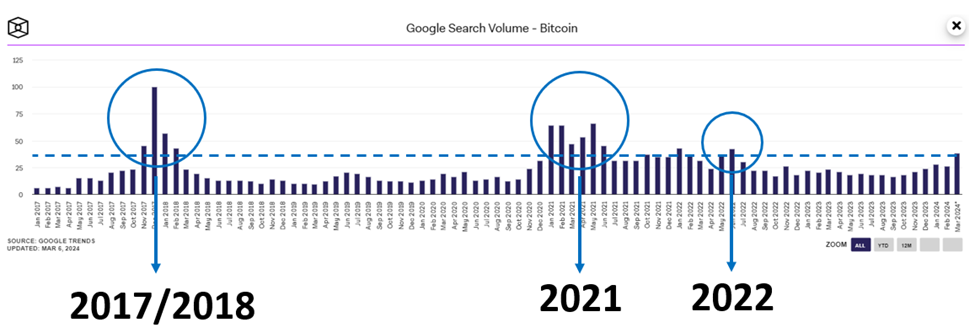

For illustration number two, let’s use Google Trends to evaluate search volumes for the term “Bitcoin”

If “everyone” is all-in on Bitcoin and we’re near a top, logic suggests that search volumes would be in the stratosphere.

They’re not.

Below, we look at a chart showing us data dating to January of 2017. You’ll see that while search volume has ticked up in recent months, we’re far below the peaks that preceded Bitcoin’s major crashes in 2017/2018 and 2021.

Now, we are near the level preceding the 2022 crash, but this dovetails in the third reason why we don’t believe peak bullishness sentiment is here yet…

It’s not just retail investors driving up prices today

For the first time ever, today’s Bitcoin surge is supported by institutional investors, but sentiment there is only beginning to turn bullish.

From Reuters:

Since bitcoin has less than two decades as a financial asset, predicting its price trajectory remains extremely challenging. Just months after retail exuberance helped drive bitcoin to its previous record in November 2021 the cryptocurrency crashed, taking half the crypto industry with it.

But more institutions committing long-term money could help the token sustain its high levels this time around, analysts and executives said.

“Traditional institutions were once sitting out; today, they are here in full force as the principal drivers of the crypto bull market,” said Nathan McCauley, CEO of Anchorage Digital, a crypto platform.

Within the institutional space, if we equate “sentiment” with “buying authorization,” then we’re nowhere close to a bullish blowout manic top.

Here’s Stephane Ouellette, chief executive of FRNT Financial, an institutional platform focused on digital assets:

The rally does appear to be majorly influenced by the BTC ETFs.

Some estimates suggest that less than 20% of investment advisers have been approved by their firms to put their clients into the product. That is a process that’s likely to play out over the course of a year.

Bottom line: The headlines can claim “mania” all they want, but the underlying data suggest that’s simply not the case yet.

That said, there is a reason why you might want to avoid Bitcoin – but it’s probably not what you think.

A change in crypto leadership suggests this rally is broadening beyond Bitcoin

For these details, let’s go to our crypto expert Luke Lango, editor of Crypto Investor Network:

So far in this crypto boom cycle, Bitcoin has been leading the charge. Bitcoin dominance – which measures Bitcoin’s value as a percent of the total crypto market value – has been steadily rising over the past several months as Bitcoin has climbed above $20K, $30K, $40K, $50K, $60K, and now $70K.

But, this past week, something super interesting happened.

Bitcoin dominance dropped pretty sharply as “meme coins” like FLOKI, Shiba Inu, Pepe, and dogwifhat all rose more than 100% in a matter of days.

Specifically, Bitcoin dominance noticeably dropped this week from 55% to 53%, one of its biggest weekly drops in the past year in which Bitcoin also rallied in the same week.

That is, a lot of times, Bitcoin dominance drops because Bitcoin falls more than other altcoins in a bad week. But, this week, Bitcoin dominance fell because Bitcoin rose less than other altcoins in a good week.

That’s a bullish signal of a healthy broadening of this crypto rally.

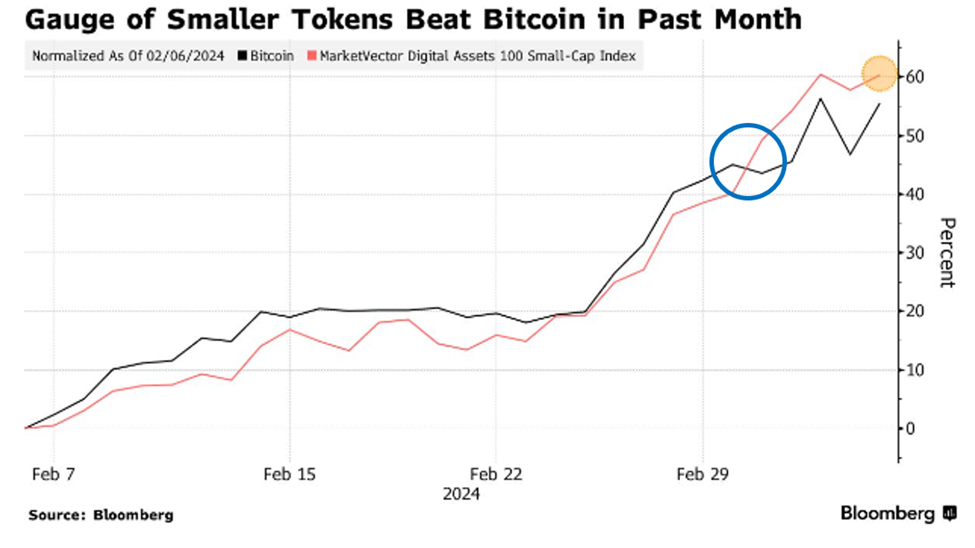

Luke points toward the MarketVector Digital Assets 100 Small-Cap Index. It’s a collection of the top 100 cryptos outside of Bitcoin. Last week, it crushed Bitcoin’s performance.

Below is a chart from Bloomberg showing this outperformance. The MarketVector Digital Assets 100 Small-Cap Index is in red while Bitcoin is in black.

You can see altcoins taking the lead from Bitcoin last week (circled in blue).

It’s likely that the press’s insistence that Bitcoin is in full manic mode is because it’s hitting new all-time highs

But even if we’re to interpret this as bearish for Bitcoin (which is a weak conclusion), it doesn’t hold up for leading altcoins. Many of them still have enormous runways before they hit their prior highs.

Back to Luke:

Consider this: Bitcoin eclipsed its 2021 highs this past week, but multiple other major altcoins remain way off their 2021 highs.

Ethereum is still about 30% off its 2021 highs. Tron and Binance are about 40% off their 2021 highs. Solana is still 50% below its 2021 highs. Polygon is 65% from 2021 highs. Both Uni and Avax are 70% from 2021 highs. And Dogecoin, XRP, and Litecoin are all 80% from their previous highs.

Across the board, altcoins have a long way to run before they recapture their 2021 highs, despite Bitcoin doing so this past week.

So, are you nervous about investing in Bitcoin as it hits new all-time highs?

Okay, well, you have your pick of a handful of surging altcoins that remain well below their prior peaks.

But as always, keep in mind where we are in the crypto cycle and be ready for the correction

If Bitcoin (and leading altcoins) follow their historical patterns, there will be a meaningful correction sometime around the halving next month.

If you’re new to the Digest, the halving is an event specific to Bitcoin in which “Bitcoin miners” (think, computer whizzes) solve complex computer puzzles to release new Bitcoins. Their reward for doing so is an amount of Bitcoin that’s already baked into the system.

Each halving reduces this reward by half, hence the name “halving.” This time around, the reward per block of mined Bitcoin will decrease from 6.25 to 3.125.

Historically, these halving events have been very bullish for Bitcoin’s price for months on either side of the event. But many traders often take profits right around the actual halving, resulting in a short-term drawdown.

Here’s Bitpay.com:

In each of these cycles, the halving effect on the Bitcoin price was similar and displayed a pattern: a substantial rally leading up to the halving, followed by a brief correction and period of consolidation before the major bull run and blow-off top.

The peak occurred approximately 18 months after the halving each time.

I asked Luke about the size of this potential drawdown, and he suggested 20% wouldn’t be unusual. Just keep this in mind for perspective if you’re investing today.

But if you can stomach the potential volatility, history suggests that what’s coming on the other side of a correction is a continuation of this major crypto bull run – for both Bitcoin and leading altcoins.

Here’s Luke’s bottom line:

Bitcoin soared to an all-time high [last] week, but altcoins finally started to meaningfully outperform Bitcoin. The baton appears to be getting passed in the crypto markets from Bitcoin to other, smaller cryptos.

That’s very bullish. It means some altcoins could go on an absolute tear over the next few months.

For the specific altcoins that Luke likes the most, as well as his latest crypto research, click here.

Have a good evening,

Jeff Remsburg