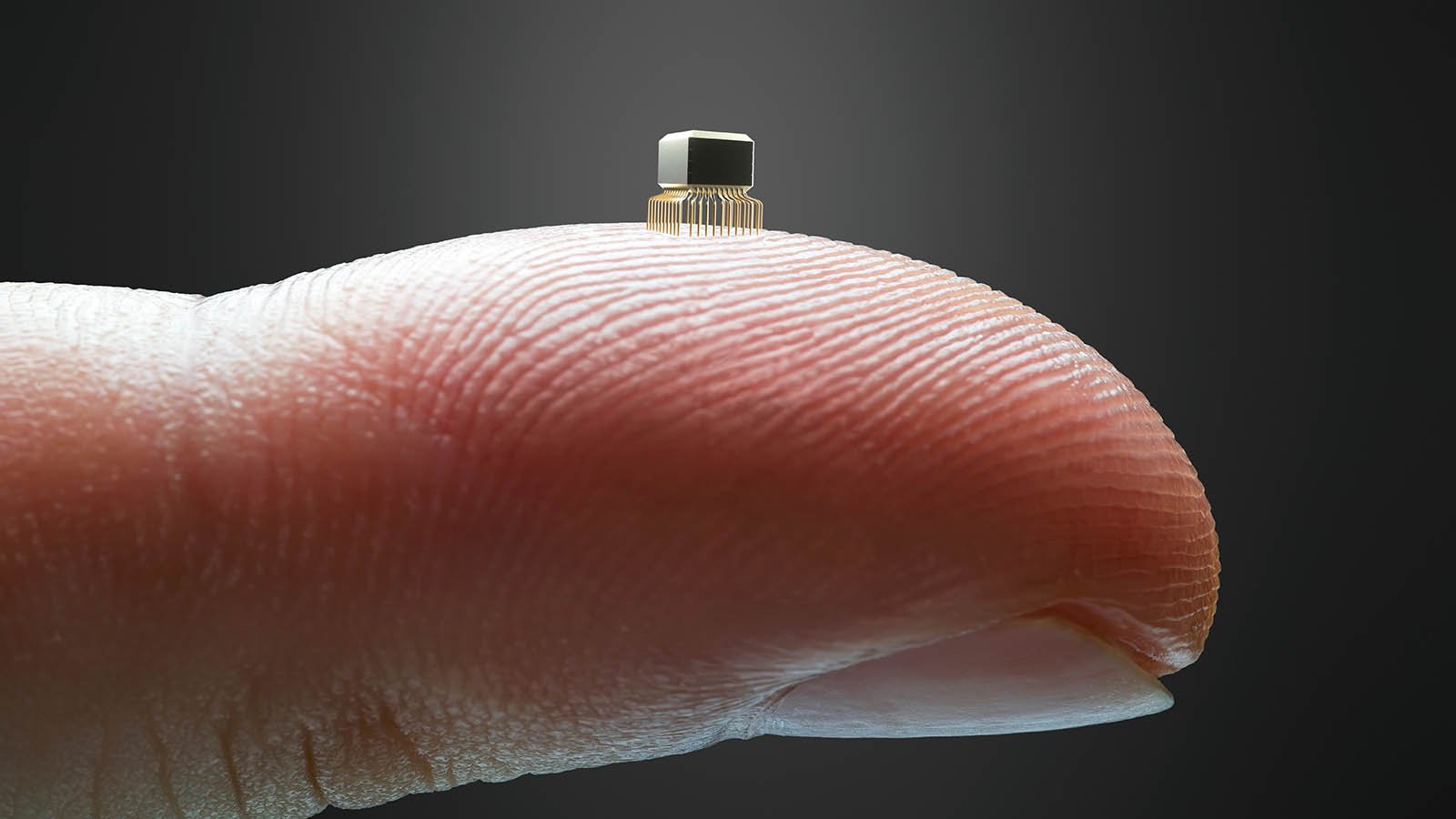

A rapidly growing field, nanotechnology deals with the manipulation of matter at the atomic and molecular scale. This allows for the creation of materials and technological applications beyond the size of standard microelectronics or chemical structures. Several companies currently pursue projects that define them as nanotechnology stocks.

Of note to investors, predictions for the global nanotechnology market see it reaching USD 38.23 billion by 2032, with a CAGR of 14.4% during the forecasted period. Currently there are several growth factors such as increasing investment in research and development and the growing demand for novel products. Furthermore, growing interest in nanotechnology as an alternative to traditional chemical practices has many investors wondering if nanotech is the next big thing.

The technology currently has a wide range of applications in a variety of industries, including medicine, electronics, energy and consumer goods. As such nanotechnology could revolutionize many sectors of the economy and provide tremendous upside for investors.

Thermofisher Scientific (TMO)

As one of the most successful biotechnology companies, Thermofisher Scientific (NYSE:TMO) possesses great potential for exploring the nanotechnology sector. With several inventions that have revolutionized the way molecular science is conducted, TMO has experienced a unique level of success.

Currently, the company conducts nanoparticle research, using transmission electron microscopy to study the delivery of next generation drugs and vaccines. By using these evaluation techniques, TMO visualizes scale images in chemical data on the nanometer and sub-nanometer size.

For investors, TMO’s strong performance in the last half of 2023 has put it on a new trajectory. This success could continue to grow as the company explores nanotechnology ventures in 2024. Though the stock price is high, and it may seem like TMO doesn’t have much room to grow, keeping an eye on its nanotech progress could be the key to significant returns.

International Business Machines (IBM)

International Business Machines (NYSE:IBM) has been in the game of miniaturizing technology since the 1980s. The company’s approach as a research-first business has resulted in it consistently investing in the projects of high-profile scientists like Donald Eigler and Gerd Binning. The history doesn’t stop there, however, with IBM being one of the first companies to develop a scanning tunneling microscope.

In the decades since this invention, IBM’s understanding of nanotechnology has allowed it to flourish in other technologies and research. Currently, IBM is focusing on researching nanostructures and other nanoscale applications for its medical technologies.

Furthermore, IBM’s dominance in computing technologies means that it has some of the most cutting edge methods for evaluating nano data in determining product viability and feasibility for the future. For investors interested in taking advantage of nanotechnology stocks IBM might just be one of the safest ways to go.

DuPont De Nemours (DD)

As ubiquitous as it is controversial, DuPont De Nemours‘ (NYSE:DD) contribution to the world of nanoparticles and technology cannot be understated. From its invention of Teflon to endless other particles for industrial applications, the company has seen historically steady performance.

As a nanotech company, however, DD may have the deepest pockets of all nanotechnology stocks currently venturing into the space. Its decades of chemical expertise also mean its industrially applied nanoparticles are more likely to succeedthan its competitors. Such a legacy has kept DD around for over 200 years a one of America’s most valuable chemical companies.

Of course, all of these projects in the works can only succeed if Dupont learns from its mistakes. Whether or not the company will change its ways remains to be seen, but from a nanotech perspective, the ventures possess potential. For investors, DD remains a stock worth keeping an eye on if interested in steady, long-term portfolio growth.

On the date of publication, Viktor Zarev did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.