The flying car, or vertical aviation, market is one of the fastest growing segments of the transportation industry. Analysts and market enthusiasts predict eVTOL stocks could very well revolutionize urban mobility and create a multi-billion-dollar market. With enough investment and consumer interest, this nascent market could become a force to be reckoned with, similar to how the electric vehicle (EV) market has grown in the past decade.

Some of the companies in the space appear to be doing better than others. In this article, I will go through three eVTOL stocks with the best opportunities for investors interested in the up-and-coming flying car sector.

Vertical Aerospace (EVTL)

Founded in 2016, Vertical Aerospace (NYSE:EVTL) is an aerospace and technology start-up that designs and manufactures eVTOL aircraft in the U.K. The company has been focusing its investments not only on developing its technology, but also in receiving certification from the relevant authorities in the U.K. to be able to operate its vehicles.

Vertical continues progress with its necessary certifications, already having received a critical one that the company will require to develop and certify its VX4 air taxi. The eVTOL start-up expects to receive target type certification sometime in late 2026. In late January, the company’s founders committed $50 million of equity capital, which should help Vertical to meet its objectives. The company also received an 8-million-pound grant from the U.K. government’s Aerospace Technology Institute to develop propellers for the VX4 aircraft. This underscores the firm financial backing the U.K eVTOL startup has.

Trading under $1, Vertical Aerospace could make a decent investing opportunity, especially as the company reaches its engineering and regulatory goals.

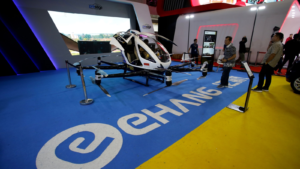

EHang (EH)

China-based EHang (NASDAQ:EH) designs and manufactures autonomous aerial vehicles (AAVs) for applications such as tourism, logistics and emergency response. Unlike many AAV manufacturers, EHang has actually delivered a number of products and generated sales.

Towards the end of last year, EHang received airworthiness certification from China’s aviation safety authority, making it the first company in the world to receive such a certification. The safety certification came after a number of compliance and safety assessments.

Despite the economic overhang from the pandemic as well as an ongoing property debt crisis, EHang has still been able to grow its business and gain traction in a number of major Chinese cities. In February, the company signed an agreement with Guangzhou city authorities that will initially focus on airspace management, infrastructure development and policy support. This agreement will allow EHang to help develop an eVTOL industry in the city.

EHang’s recent Q4’2023 earnings report also showed meaningful strides in not just improving revenue growth but also narrowing its adjusted net loss. Revenue increased by 261% in the fourth quarter, and EHang’s adjusted net loss improved by 63% from the same period in 2022.

Joby Aviation (JOBY)

While Chinese companies have certainly made strides to make flying cars a reality in the world’s second largest economy, Joby Aviation (NYSE:JOBY) has been working to build the eVTOL space in the U.S. In particular, this California-based company aims to create a scalable eVTOL aircraft that can carry passengers and cargo over short distances.

The company has made significant strides in preparing cities across the U.S. for flying taxi infrastructure. In mid-January, Joby announced a partnership with eVTOL company Atlantic to electrify current aviation infrastructure in southern California and New York. This would eventually pave the way for Joby to kickstart the release of its long-awaited air taxi service.

Furthermore, Joby signed a contract Dubai’s Road and Transport Authority that would give the start-up exclusive rights to launch and run an air taxi service in the UAE’s flagship city for six years. The air taxi service should launch by 2026. While Joby is definitely still pre-revenue, these various partnerships give us a glimpse into the company’s long-term potential as a major player in the nascent space. Joby’s share price is down nearly 24% in 2024, but the company’s stock could rebound as its flagship vehicle receives more certifications.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.