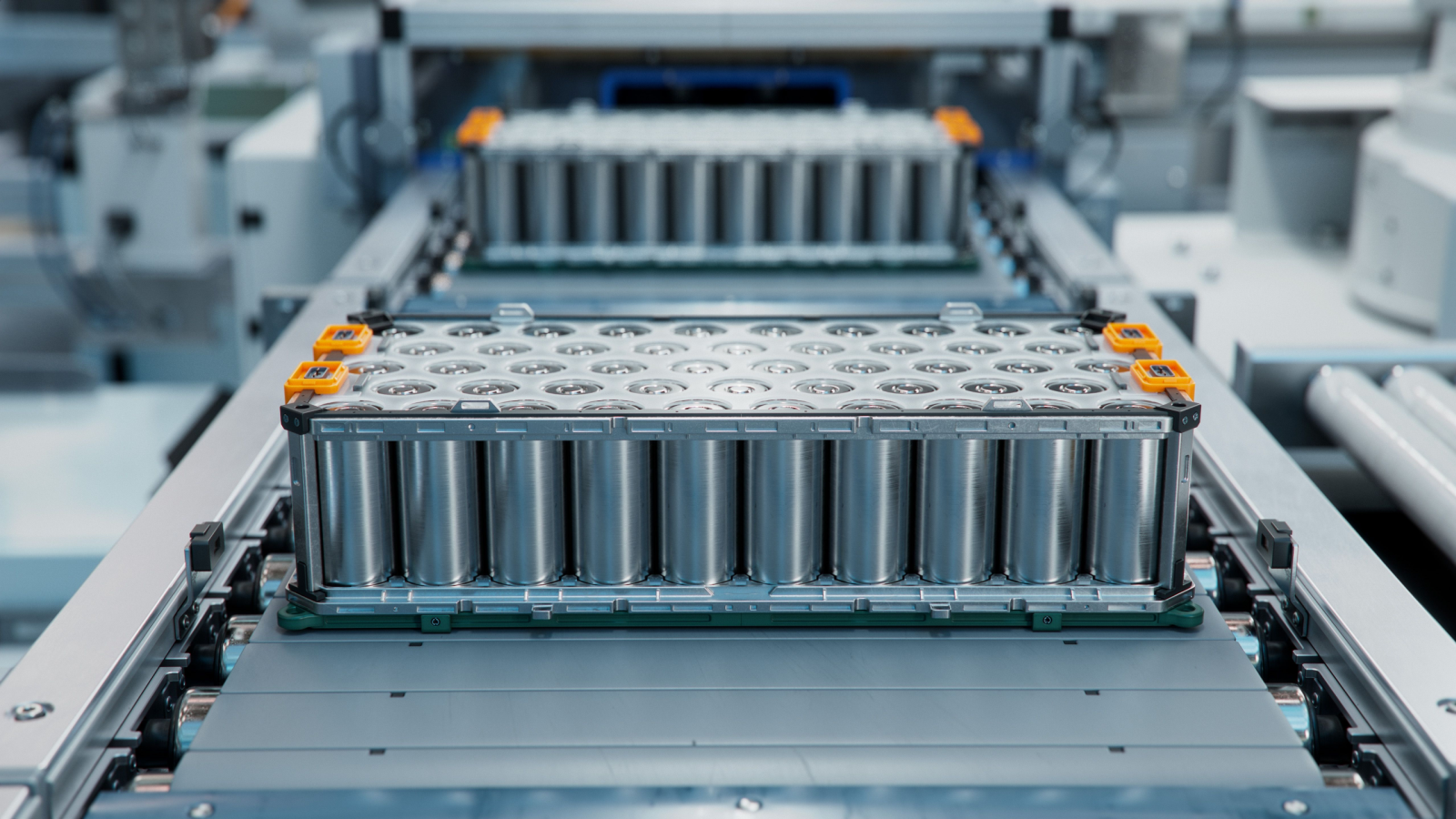

Overall, the sentiment for the electric vehicle (EV) sector has turned from significantly positive to negative. The obvious reasons include competition and macroeconomic headwinds. As a result, there are multiple undervalued ideas from the sector. The battery companies form an important part of the industry, and this column discusses three underrated battery stocks with massive growth potential.

I have discussed one blue-chip battery stock and two emerging names. The common factor for these companies is focused on innovation-driven growth. Once the EV sector growth accelerates, these battery companies will likely benefit and their stocks will surge higher.

In terms of market potential, the International Energy Agency believes the installed battery capacity worldwide will increase tenfold to sixteenfold by 2030. Therefore, there is ample headroom for growth for some of the best battery companies.

Let’s discuss three battery stocks that represent companies with promising potential for value creation.

Panasonic Holdings (PCRFY)

Panasonic Holdings (OTCMKTS:PCRFY) is among the EV battery stocks underrated by the markets. My view is underscored by the fact that PCRFY stock trades at a forward price-earnings ratio of just 9.7. Further, the stock offers an attractive dividend yield of 2.32%.

It’s worth noting that Panasonic is an innovator. The company will likely maintain or increase its EV battery market share in the coming years. In terms of innovation, the current focus of the company is to increase the volumetric energy density of batteries by 25% from current levels by 2031. Panasonic is also looking at developing solid-state batteries for drones and factory robots.

Another point to note is that Panasonic has ambitious expansion plans. The company is targeting to quadruple battery capacity to 200GWh by 2031. Therefore, healthy revenue growth is on the cards with EBITDA margin expansion. I believe once there are renewed positive sentiments for the EV industry, PCRFY stock will be re-rated.

Solid Power (SLDP)

Solid Power (NASDAQ:SLDP) is among the underrated battery stocks to buy for multibagger returns. In January, Chardan opined that the battery maker is likely to triple.

The re-rating came after the company expanded its partnership with Korean conglomerate SK On. The agreement would allow “SK On to use Solid Power’s cell technology for research and development and to produce batteries on a new SK On solid-state line in Korea.”

Besides this partnership, Solid Power has the backing of automotive majors like Ford (NYSE:F) and BMW (OTCMKTS:BMWYY). The company already delivered A-1 Sample cells in October 2023 to formally enter the automotive qualification process. For this year, Solid Power is focused on A-2 Sample cells.

Clearly, the progress towards commercialization has been steady, and R&D collaborations with SK On and BMW would help accelerate the timeline for mass production. Therefore, at current levels of $1.6, SLDP stock looks massively undervalued and poised for a strong reversal rally.

QuantumScape (QS)

QuantumScape (NYSE:QS) is another company working towards the commercialization of solid-state lithium-metal batteries for EVs. In the last 12 months, QS stock has trended lower by just over 25%. However, business developments have been encouraging, and I expect a strong reversal rally.

In December 2022, the company shipped A0 prototypes for an automotive qualification process. This year, the company is trying to achieve a low-volume production of QSE-5, the first commercial product. This will likely be followed by higher-volume production of QSE-5 in 2025 and beyond.

Clearly, the developments are encouraging, and QuantumScape claims to have commercial agreements with six automotive original equipment manufacturers. I must add here that Volkswagen (OTCMKTS:VWAGY) is a strategic investor and joint venture partner. The backing of an automotive major infuses confidence to invest in this potential multibagger story.

Another important point to note is that Quantum ended 2023 with a liquidity buffer of $1 billion. The company forecasts its cash runway to extend into the second half of 2026. Therefore, I don’t see any equity dilution concerns.

On the date of publication, Faisal Humayun did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.