Why your analysis can be right, yet you lose money … the simple yet powerful question that can goose your portfolio returns … a primer in Stage Analysis … tonight’s live event with Luke Lango

Say you read an article about XYZ Stock that gets you excited.

You do your own due diligence, and sure enough, you see an opportunity. The balance sheet is sturdy, its earnings are growing, and its valuation is cheap.

So, you invest…and find yourself down 20% a month later.

Why? What happened?

Well, there’s a good chance that despite your analysis – which could have been 100% accurate – you ignored one of the most important details of investing…

The trend.

In this case, perhaps the stock was trending lower at the time of your purchase, and you didn’t notice. Unfortunately, all your bullish research meant nothing in the face of months of selling pressure that was weighing on the stock.

Basically, you tried to swim against the current. And history shows that’s a great way to lose money.

So, for a moment, forget fundamental analysis… forget all the advice of the financial talking heads… forget your discounted cash flow models…

Instead, let’s look squarely at one simple question that could make a profound difference in your wealth.

Is your pattern to invest with the trend, or against it?

An easy explanation for why your returns might have disappointed you in the past

Newton’s First Law of Motion states that an object in motion stays in motion with the same speed and in the same direction unless acted upon by an unbalanced force.

“Trend” is the rough equivalent in investing.

A trending stock tends to remain in that same direction until some sort of outside force changes its direction. But let’s be clear – a “trend” doesn’t necessarily mean “up.” Stocks can trend up, down, or sideways. And unfortunately, the most common trend direction is “sideways.”

Here’s Investopedia with some basic stats:

Markets tend to trend higher or lower about 25 percent of the time in all holding periods and get stuck in sideways trading ranges the other 75 percent of the time.

The article didn’t break out that 25% of higher/lower trends into their respective, smaller percentages. But over the long-term, the edge clearly goes to trending higher. So, to make it easy, let’s suggest that stocks trend higher 15% of the time, lower 10%, and sideways 75%.

Understanding the trend makes the stock market far easier to understand.

With stocks trending up only about 15% of the time, it makes sense why all my bullish fundamental analysis of stocks could be spot-on, but powerless against a sideways or down trend.

In fact, I’d wager that if you perform a postmortem of all your portfolio losses, you’ll see a common theme: You invested at a time when the broad trend was either “flat,” “down,” or in the final, exhausted stages of an “up” trend, shortly before it rolled over.

How trend simplifies everything

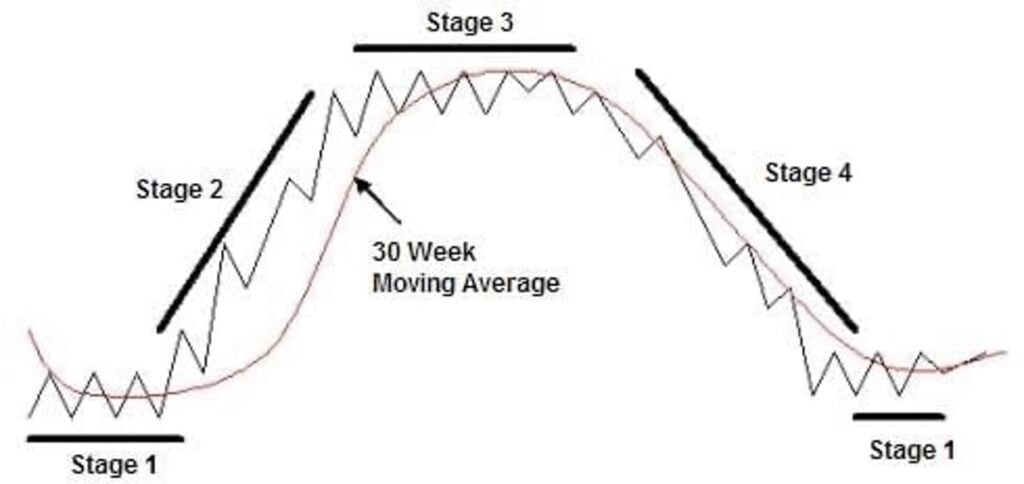

This awareness of trend investing has birthed a market approach called “stage analysis.”

In short, at any given point in time, every stock is either going up, down, or sideways.

To that end, every stock is always in one of four unique stages: 1) going sideways at a bottom, 2) going up, 3) going sideways at a top, or 4) going down.

Stage analysis is the science behind figuring out which of these four stages a stock is in at any given point in time.

The key to scoring big returns consistently is to find stocks on the cusp of entering Stage 2 – or stocks that are already breaking out in Stage 2.

And the key to avoiding big losses consistently is to sidestep stocks that are on the cusp of entering Stage 4, already in Stages 4, or are going nowhere in Stages 1 or 3.

In short, you want to limit your market exposure to that 15% of time when a stock is trending north.

Pretty simple, right?

Stage analysis is the foundation for Luke Lango’s market approach in his trading service, High Velocity Stocks

Here’s Luke describing it:

I’m an expert in technology and quantitative analysis. And that’s why I’ve developed a proprietary quantitative model to help me identify high-flying stocks as they begin to take off.

[Our system] uses a core quantitative stage analysis strategy to find the most explosive stocks in the market – stocks that can soar hundreds of percent in a matter of weeks.

Now, using stage analysis as the north star for finding attractive trades simplifies the entire process considerably. But sometimes, things get even easier…

Every now and then, a new event, law, or cutting-edge technology will cause an entire sector to enter Stage 2.

This can be big. After all, it’s one thing for a specific stock to be in a Stage-2 breakout, bucking the trend against its broader sector that might be meandering sideways. But returns can be even easier to come by (and far bigger) when an entire sector is churning higher. It’s the difference between sailing with the wind rather than against it.

There’s one sector with an enormous volume of wind at its back today

Here’s Luke:

Among the industries poised to generate substantial winners, one in particular stands out as a key player, alongside artificial intelligence and a few other promising sectors.

As the economy strengthens, it is likely to bolster corporate earnings, further fueling this high-growth sector’s advance.

Behind the strength of this sector is something unexpected – the U.S. government.

Luke highlights a “monumental law change” that “could be one of the most important law changes of our lifetimes.”

Here he is with more:

This change in law deals with something called “Section 3209,” which we believe could open up a massive wealth window in a specific subsector of artificial intelligence.

I’ll spill all the tea on this law change tonight in a new urgent presentation that starts at 8 PM Eastern, but in a nutshell, Section 3209 reverses a decades-old federal law that has been ridiculed by experts as being antiquated, silly, and just flat-out wrong…

This change in the law unshackles this industry and allows it to flourish like never before. That’s a huge deal.

I’ll leave it to Luke to reveal all the details tonight, but you can click here to immediately reserve your seat for this evening’s live presentation.

Coming full circle, would it help your returns to approach the market with a greater awareness of trend?

If you’re a long-term buy-and-hold investor, perhaps not. You’re likely comfortable investing in top-tier stocks, waiting for a payoff that’s years into the future after long-term “up” trends outweigh the “down” and “sideways” trends. And that can be a fantastic market approach for those with the patience.

But if you’re investing with a medium- or shorter-term horizon, then paying more attention to trend could have an enormous impact on your entry and exiting timing – and by extension, your wealth.

Here’s your rule of thumb: The shorter your anticipated investment hold period, the more critical it is that you factor in the trend before buying in.

After all, fundamental analysis is great, but price is truth. And if a stock is consistently falling, that’s a massive red flag for the short term, even if its fundamentals appear strong.

On the other hand, if a stock is consistently climbing, well, take note. The only thing that matters to your wealth is whether your sale price is higher than your purchase price. And as they say, a bullish trend is your friend.

Meanwhile, if Luke’s right, there’s one sector that’s offering an incredibly friendly, bullish trend right now. Join him tonight for the details.

Here’s Luke to take us out:

I plan on sharing this subsector, along with other extremely timely information about how to invest before you miss the boat tonight at 8 PM Eastern.

I’ll reveal all the details on this monumental law change and the tiny industry it is set to put into hyperdrive. And, most importantly, I’ll give you the keys to my top five stocks to play this hidden AI boom for potentially huge profits.

Each one of these stocks has up to 10X upside potential. So you can invest just a few hundred in each — nothing more than you can stand to lose — and potentially get back thousands.

Reserve your spot now and be the one to tell the story no one else knows! Have a good evening,

Jeff Remsburg