The collapse of the Francis Scott Key bridge in Baltimore, Maryland represents a terrible, gut-wrenching tragedy. At the same time, the accident – which was caused by a powerless cargo ship ramming into a support column – highlights the urgent need for advanced infrastructure development. As such, engineering and construction specialist Southland Holdings (NYSEMKT:SLND) appears a credible candidate for future build-out initiatives. Thus, SLND stock has garnered investor attention recently.

According to the American Society of Civil Engineers, the Francis Scott Key bridge is one of the longest continuous-truss bridges in the U.S. Construction for the bridge began in 1972, with now-defunct Greiner Engineering Sciences leading the project. Back then, the U.S. population was just under 210 million people.

Today, the population stands at around 341 million people. Just the workforce alone clocks in at nearly 161 million. In other words, the bridge and the nearby Port of Baltimore have witnessed a significant increase in commercial activity in the last 50 years.

The nation must build advanced infrastructures that reflect the growth, dynamism and needs of an expanding and interconnected society. Thus, it’s not surprising that SLND stock popped higher on Tuesday. And there could be more gains ahead.

Collapse Shines Critical Spotlight Infrastructure on Vulnerabilities

For clarity, SLND stock does not appear to be connected to the Key bridge or the incident itself. On Tuesday, President Joe Biden stated that he plans for the federal government to pay the entire cost of reconstruction. This announcement didn’t specify which companies may be involved in the efforts. However, even without a direct catalyst, SLND stock may still continue on a northward trajectory.

That’s mainly because the incident highlighted a critical spotlight on other infrastructural vulnerabilities. For example, the media turned its eyes to the San Francisco Bay Area in California. In the past, there have been glancing blows by container ships on bridges in the region. Moreover, the increasing sizes of modern ships present major concerns for engineers.

While SLND stock has moved higher on speculation regarding the Key bridge accident, the company could also rise over the long term because the incident reflects a much wider concern.

Trade of the Day: Buy SLND Stock as a Relevant Infrastructure Play

With SLND stock lacking an options market, the trade of the day is a simple one: Buy Southland shares in the open market.

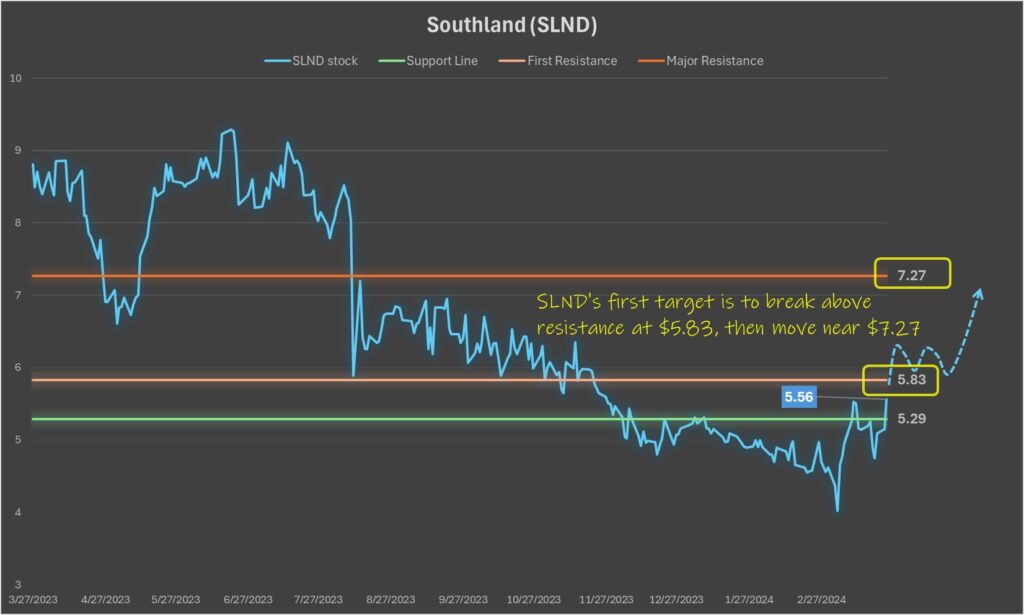

Primarily, the bulls will be looking to take out the first level of resistance at $5.83, as Barchart defines in its Trader’s Cheat Sheet. This price point also coincides with a prior support line that held SLND stock in place from August through late November 2023. With renewed fundamental interest in critical infrastructure, Southland shares should reclaim this level.

From there, the next significant target would be the major resistance level at $7.27. This may be a more difficult point to break as this line previously acted as an upside barrier in August last year. Therefore, short-term traders may want to consider taking profits at this juncture. Even long-term investors may want to take some of the gains off the table as there could be a huge battle ahead.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.