There’s a famous quote that says, “History doesn’t repeat itself, but it often rhymes.”

This is also true for the stock market, especially when it comes to the market’s response when the Federal Reserve cuts key interest rates. Over the past 35 years, the Fed has cut rates on seven different occasions. And every time it has, the NASDAQ soared.

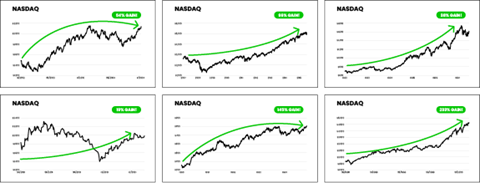

Take a look for yourself…

And here’s something to keep in mind: These rallies were anything but small. The smallest post-rate cut rally saw the NASDAQ jump by a decent 19.7%. On average, rate cuts have led to 98% mega-rallies in the NASDAQ.

That includes a couple of whopping 100% plus surges – one in the early ’90s…

And another significant one in 1998.

So, we’re looking at a consistent pattern here… at the stock market “rhyming.”

Is the Fed Cutting Rates This Year?

I’m bringing this up to you today because after raising rates 11 times since March 2022, the Fed is gearing up to lower rates this year.

At the December Federal Open Market Committee (FOMC) meeting, the Fed revealed in its “dot plot” survey that it expected three rate cuts in 2024 and another three to four rate cuts in 2025. That’s six to seven rate cuts over the next two years, bringing the federal fund rate to between 3.5% and 3.75%.

But once inflation data for 2024 began rolling in, it became clear that inflation was still running a little hot. This had Wall Streeters wondering if the Fed would maintain its rate-cut expectations at its March FOMC meeting.

As we learned from the updated dot plot, the Fed still plans on cutting key interest rates three times this year, though it anticipates three additional rate cuts in 2025 instead of four.

Since we are virtually certain the Fed will cut rates this year, it’s just a matter of figuring out when.

I’m on record that the first rate cut will be in June. And I stand by that. As I explained in a recent Market 360…

One reason is because of what Christine Lagarde, the president of the European Central Bank (ECB), said during a speech in Frankfurt, Germany, on Wednesday. Lagarde stated that “by June we will have a new set of projections that will confirm whether the inflation path we foresaw in our March forecast remains valid.”

So, it looks like the major central banks – the Federal Reserve, ECB and the Bank of England – are planning to cut rates at the same time. In other words, come June, we will see worldwide rate cuts. By coordinating their rate cuts, the central banks should be able to keep the currencies in sync.

However, a friend of mine, who is also an experienced analyst, has a different date in mind. So, I’ve invited him to join me for my Election Shock Summit so he can explain why (his answer may surprise you).

He’ll also share when he expects the Fed to cut rates, and why the May FOMC meeting could have a massive impact not only on the stock market but on the presidential election. Plus, we’ll talk about how to best position your portfolio to profit.

The Election Shock Summit is set for next Wednesday, April 10, at 8 p.m. Eastern time. You can reserve your spot by clicking here.

Sincerely,

Louis Navellier

Louis Navellier

Editor, Market 360