Investors wait for the Fed starting gun … earnings provide profits no matter what … and why traders love market volatility

After this week, I feel a little like Inigo Montoya, the Spaniard determined to get revenge in “The Princess Bride.”

Specifically, the following quote is from when he first meets the Man in Black. The Man in Black is climbing a cliffside, at the top of which Inigo is waiting to face him in a duel. Inigo has asked the man to speed his ascent.

Inigo Montoya: But, I promise I will not kill you until you reach the top.

Man in Black: That’s VERY comforting, but I’m afraid you’ll just have to wait.

Inigo Montoya: I hate waiting.

We were told there would be rate cuts from the Fed this year … and we’re still waiting.

Inflation progress has stalled.

The seven quarter-point rate cuts traders had priced in from the Fed has fizzled out. Now, it’s looking like two cuts … maybe just one … and maybe not until November.

So, we wait for the next catalyst, the next big thing to boost the overall market.

But if you hate waiting… there are great plays in the market now.

You just have to pick your battles.

Louis Navellier continues to profit in earnings season

In an update to his Growth Investor subscribers, Louis notes that three big things moved the market enough this week that it finished in a positive trend.

First, the 10-year Treasury yield fell a bit after Federal Reserve Chair Jerome Powell’s comments on Wednesday. Treasury yields above 4.7% had weighed heavily on markets in April. As I write Friday, the 10-year Treasury yield has fallen back to 4.52%.

Second, Powell confirmed that the Fed was more likely to cut rates than raise them. He stated that a rate hike was “unlikely,” despite the slowing of progress on inflation.

This was confirmed by the jobs number on Friday. The downside surprise of 175,000 nonfarm payrolls rise, versus the estimate of 240,000 confirmed the job market was still strong, but not overheated.

And the third reason relates to how Louis has made his reputation for the last 40 years: earnings.

Here is how he described it to his Growth Investor readers.

First-quarter earnings results have poured in over the past week, and our Model Portfolio positions have posted wave-after-wave of positive earnings surprises and provided strong guidance. As a result, our Model Portfolio rallied 1.5% higher in the first three trading days of May, vastly outperforming the S&P 500’s 0.4% gain.

Specifically, we had stocks like Carpenter Technology Corporation (CRS), Eli Lilly & Company (LLY), Powell Industries, Inc. (POWL), UFP Technologies, Inc. (UFPT) and Woodward, Inc. (WWD) emerge as new market leaders in the wake of their better-than-expected quarterly results. In fact, these stocks were up between 3% and 19% this week.

Earnings can also signal when to take profits

Of course, it’s great when everything in an earnings report is rosy, but we know that doesn’t always happen.

In his Investment Report, macro investing expert Eric Fry took profits in a tech stock after it ran short of expectations this week.

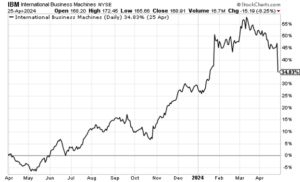

Eric initially recommended International Business Machine (IBM) in April 2023 as a resurgent force in the artificial intelligence megatrend.

The stock started out a little slow, but Eric’s analysis was spot on about why the market would like the stock and send it higher. Below is a chart showing the performance from when he made the buy alert to when he recommended his subscribers take profits.

Why the stock took a sudden U-turn was its earnings report. Here is Eric’s summary from Fry’s Investment Report.

On the surface, IBM’s quarterly report did not seem so terrible. Revenues and earnings both topped analyst estimates. Additionally, the company did not revise revenue or cash flow guidance for 2024.

But below the surface, IBM’s consulting division, which generates about 30% of company revenues, reported no growth whatsoever.

The company blamed a soft IT-spending environment for the lackluster consulting results. That explanation is at least partly valid, as other tech companies have been reporting a similar softness.

On the other hand, IBM management has been touting its consulting division as the driving force behind its transformation into an AI leader in the enterprise market.

This quarterly result does not completely invalidate that claim, but it does raise concerns about how effectively IBM’s consulting division can deliver Big Blue’s AI solutions.

Despite the last tough report, Eric’s subscribers still got a 30%+ gain and a nice win.

Where is Eric looking for gains next? Technology. Specifically, a breakthrough that seems like it is out of a science fiction story.

Simply put, it’s a strange, sci-fi-like device that can be implanted in the human brain. You could even find yourself wearing it one day.

You see, earlier this year, Musk launched an unbelievable experiment, known as PRTIME, to test this new type of AI. And the thing is … it worked!

I believe PRIME will change humanity as we know it… and make a lot of people wealthy in the process.

So, I recently recorded this video right outside Musk’s headquarters, and you won’t believe what I uncovered.

How to profit regardless of market direction

There’s a reason most investors want to see the Fed cut rates. It will provide a clear signal … a definite direction. Most investors fear volatility.

But traders don’t fear the volatility – they relish it!

Why?

Because volatility can lead to outsized gains!

A few months ago, our colleague Jonathan Rose launched Masters in Trading Live and the feedback has confirmed everything we knew about Jonathan.

For more than 16 years, Jonathan traded in the “pits” of some of the biggest exchanges in the world – including the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

Aside from just his trading skills, he is a gifted teacher with a skill for simplifying trading concepts. If you’ve watched even one of Jonathan’s Masters in Trading Live videos, you know what I mean.

Next week, during a special Masters in Trading event, Jonathan is going share the details behind one of the most consistent and lucrative trading strategies he discovered over 15 years as a professional trader.

His approach is based on a “quantitative” formula that’s predicted major market moves time after time. In fact, over the last three years, 90.3% of the calls Jonathan made using this formula have gone up. During the event, you’ll discover how to use this formula to find gains as high as 197%, 317%, or even 1,147%—all in 30 days or less.

Sign up here now in order to join us on May 8th at 10 am Eastern as Jonathan pulls back the curtain and shares how he makes big profits—no matter which way the market.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace