EV carnage continues … how politics is weighing on the sector … what this means for oil and gas stocks … your resource for more analysis of politics and investing

Before we jump into today’s Digest, an important reminder…

Wednesday morning at 10:00 AM Eastern, master trader Jonthan Rose is holding his first ever Masters in Trading Summit.

Jonathan is a market veteran who has made more than $10 million from trading over the course of his career. And Wednesday morning, he’s walking investors through the nuts and bolts of how we does it.

Hopefully, you already have an idea how – that’s because Jonathan has been open about it, providing free daily livestreams at 11:00 AM Eastern for the last couple months, helping his viewers score some astonishing returns.

Last Friday, we profiled one such winner from QQQ, the Nasdaq ETF. Investors who acted on Jonathan’s official guidance cashed-in on overnight gains of a 116% and 279%.

To be clear, this type of overnight triple-digit return isn’t the usual, but clearly, it’s possible. It’s enabled by a “quantitative” formula that’s been able to predict major market moves time and time again. In fact, over the last three years, 90.3% of the calls Jonathan made using this strategy went up.

To learn more about this market approach (which enabled Jonathan to achieve financial freedom by age 35), click here to join him on Wednesday morning at 10:00 am Eastern.

One week ago today, news broke that Chinese authorities removed restrictions on Tesla’s cars after they passed the country’s data security requirements

Tesla’s stock surged 15% on the day, its best performance since March of 2021.

Could this news help jumpstart the ailing electric vehicle (EV) sector?

Perhaps, but be careful before cannonballing back in here.

There’s a fascinating push/pull happening in our auto industry, and the short takeaway is “be cautious about investing in electric vehicle (EV) stocks and be equally cautious before you get rid of your oil stocks.”

As a brief recap, it was only a few years ago that investors flooded into EV stocks. Tesla was the poster child for EV investment riches.

As you can see below, between spring 2019 and fall 2021, Tesla soared more than 3,000%.

The general belief was that EVs were the future as global governments began a hard push to phase out fossil fuel production, and by extension, internal combustion engine vehicles.

But then came reality.

The headwinds of consumer demand, economics, convenience, and politics

For overall context, here’s CNBC:

The buzz around electric vehicles is wearing off.

For years, the automotive industry has been in a state of EV euphoria. Automakers trotted out optimistic sales forecasts for electric models and announced ambitious targets for EV growth. Wall Street boosted valuations for legacy automakers and startup entrants alike, based in part on their visions for an EV future.

Now the hype is dwindling, and companies are again cheering consumer choice.

Automakers from Ford Motor and General Motors to Mercedes-Benz, Volkswagen, Jaguar Land Rover and Aston Martin are scaling back or delaying their electric vehicle plans.

Behind this scale-back is a simple reality – the consumer demand just isn’t there yet. While there are plenty of reasons behind this, a few big ones are: cost, convenience, and politics.

As to cost, Edmunds’ 2024 EV Consumer Sentiment Survey finds that among shoppers who intend to buy an EV, 47% want a price tag less than $40,000. Meanwhile, 22% won’t buy unless the cost is below $30,000.

Those deals are few and far between.

Here’s USA Today:

Zero new EVs have an average manufacturer’s suggested retail price (MSRP) below $30,000, and there are only four below $40,000.

In 2023, the average transaction price of an electric vehicle was $61,702, while all other vehicles stood at $47,450, Edmunds said.

As to convenience, would-be auto buyers are concerned that the national charging infrastructure just isn’t there yet. The fear of running out of electricity is top-of-mind.

On that note, while President Biden’s Inflation Reduction Act of 2022 earmarked a whopping $7.5 billion to build out 500,000 chargers nationwide, as of December, the grand total of new chargers that have been built clocked in at…eight.

Finally, politics have become an unfortunate influence on the sector

The Biden Administration is a major advocate of EV adoption. Today, billions of taxpayer dollars are being directed toward EV rebates offered as incentives.

Here’s Fox Business:

An energy report released last October by the Texas Public Policy Foundation concluded that EVs would cost tens of thousands of dollars more if not for generous taxpayer-funded incentives.

The average model year 2021 EV would cost approximately $48,698 more to own over a 10-year period without the staggering $22 billion in taxpayer-funded handouts that the government provides to electric car manufacturers and owners.

At the same time that Americans see such incentives, they’re aware of the government’s push to phase out fossil fuels, which impacts sales of combustible engine vehicles.

At a state level, here in California where I live, gas-powered cars are on their way out. Recent legislation effectively bans new gas-powered vehicle sales after 2035.

Back to the Federal level, here’s The New York Times from December:

John Kerry, President Biden’s special envoy for climate change, said on Wednesday that the United States supported a phaseout of fossil fuels, his clearest statement yet on America’s position on one of the most intractable issues under debate at the United Nations climate talks in Dubai, United Arab Emirates.

Mr. Kerry said that “largely” ending the burning of coal, gas and oil was required to limit average global warming to 1.5 degrees Celsius above preindustrial levels…

Given heightened emotions around this topic, EV adoption has even been dragged into the “cancel culture” clash.

Back in 2022, Toyota’s president Akio Toyoda expressed growing uneasiness about how quickly the transition from fossil fuels to electricity could happen.

From Toyoda, as reported in The Wall Street Journal:

People involved in the auto industry are largely a silent majority. That silent majority is wondering whether EVs are really OK to have as a single option. But they think it’s the trend so they can’t speak out loudly.

Fast-forward to January of 2023 and this update from Fox Business:

Toyota’s president and chairman was forced to resign after telling the Wall Street Journal that he questioned whether the push for the auto industry to phase out gas-powered vehicles was the right decision.

The unfortunate result of such optics is that EVs have become politicized, which has further impacted consumer demand.

Here’s USA Today:

EVs have become the latest culture war flashpoint between Republicans and Democrats, with Biden pushing heavily for their adoption and Trump promising a “bloodbath” of regulatory restrictions to block imports and protect American auto workers, many of whom are based in the swing state of Michigan.

The impact of all this on EV stocks in recent months has been brutal

Earlier this year, we highlighted EV research from Luke Lango, editor of Innovation Investor:

It’s a bloodbath out there.

And the bad news is that this EV Winter is far from over.

Dozens of EV startups will go bankrupt, which means many EV stocks will go to zero. Poorly positioned investors will likely lose everything.

As we noted at the time, many poorly positioned investors had already lost close to everything.

The data below came from analyst Charlie Bilello on X back in late-January. It shows a basket of EV stocks (or companies related to EVs) and how far below their respective 52-weeks highs they were trading.

Don’t miss Rivian -92%… Lucid -95%… and Fisker -97%. Not to mention Proterra, Arrival, and Faraday all down more than 99%.

You’ve probably seen a Lucid car on the road by now. To illustrate the carnage above, here’s Lucid’s chart since 2/19/2021 – down nearly 95% to date.

I looked at the performance of this basket of stocks since February 1, 2024 (to follow up on Bilello’s research), and Luke was right – the bloodbath has continued.

Nearly across the board, these stocks are in even worse shape now than back in January – some down another 40% – 50%. Even after it’s 15% pop, Tesla is barely above where it traded on February 1st as I write.

Luke points out that the EV sector will have its moment in the sun again. But for now, continued caution is warranted:

It will get rough for the industry in 2024.

[Most] stocks in the EV space are probably best avoided.But here’s the good news: This EV Winter will end. And when it does, the EV stocks that survive will absolutely soar.

We’ll keep you updated on when Luke feels more bullish about the sector.

Meanwhile, recognize that slower EV adoption is a tailwind for oil and gas stocks

To be clear, I’m all for renewable energy, but today, it’s not economically feasible. Green energy at scale is too expensive for the global economy. We still need fossil fuel energy.

The problem is many western governments have been disincentivizing oil production even though green energy can’t fill the energy gap.

Here’s our macro expert Eric Fry, editor of Investment Report with some details:

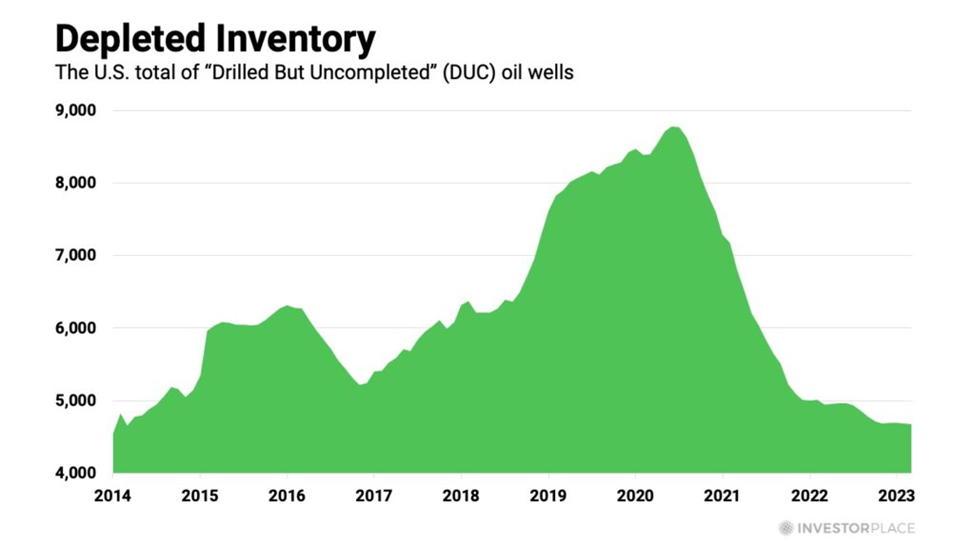

The number of Drilled But Uncompleted (DUC) wells has dropped to the lowest level in more than a decade.

A DUC well is one that has been drilled, but not yet been brought into production. In other words, the well has been drilled to the target depth, but the completion process has not yet been carried out.

Because an oil company can bring DUC wells into production quickly, they provide a great way to capitalize on oil price spikes without having to make sizeable new investments. Oil companies have been doing exactly that during the last four years.

As a result, the remaining inventory of DUC wells has dropped to a 10-year low. These low inventories mean that U.S. oil companies have exhausted most of the “easy money” they could make from oil price spikes.

Going forward, therefore, they would need to boost spending on new drilling activity, but that isn’t happening.

The number of active oil-drilling rigs in the U.S. has been falling for more than a year and currently sits 26% below the 10-year average number.

In other words, there is no significant U.S. supply boost on the horizon.

If drivers are growing less enthusiastic about EVs and refocusing on gas-power vehicles, that’s going to goose oil demand at the same time that oil supply faces headwinds. That’s a great combo for prices to remain plenty high enough to reward oil & gas investors, even if they don’t return to all-time highs.

Back to Eric:

A fresh wave of investment in exploration and production (E&P) could boost output somewhat, but very few oil companies are expressing any intention to do so.

Rising crude demand, coupled with flat supply growth, provides ample reason to take another swing at the oil market.

For more of Eric’s research on the energy markets, as well as how he’s playing it, click here to learn about joining him in Investment Report.

Interested in the political side of all this?

Politics isn’t our focus here in the Digest. But if you’re interested in reading more about the impact of our government on the investment markets, I’ll point you toward our corporate partner, The Freeport Society.

You might recognize the name as the Digest has featured many essays from Charles Sizemore, Chief Investment Strategist at The Freeport Society. He’s one of our most popular guest contributors.

A few weeks ago, Charles sat down with legendary investor Louis Navellier to discuss the presidential election in November, among other topics. In short, Charles doesn’t believe we’re in for four more years of Biden. He also envisions a level of volatility in the stock market that we haven’t seen in years – especially considering Louis’ talks of a shadow candidate.

For more on this, just click here.

Meanwhile, we’ll keep you updated on the EV and energy markets here in the Digest.

Have a good evening,

Jeff Remsburg