The Nasdaq 100 has been on a tear. The tech-heavy index is up 37% over the past 12 months compared to a 26% gain by the S&P 500 and a 17% rise in the Dow Jones Industrial Average. But what goes up must come down. And as any investor who remembers 2022 knows, the reversal can be quick and sharp. The Nasdaq 100 lost 33% of its value that year.

Of course, the bull market ride since then has been phenomenal. Tech stocks have carried the index to a 63% gain, so there’s no reason to fear a market crash. It’s just the next phase before a new run higher that washes away all the pain of the downturn.

But if you want to survive a crash in fine form, the three companies below are Nasdaq 100 crash-resistant stocks that should protect your downside.

Booking Holdings (BKNG)

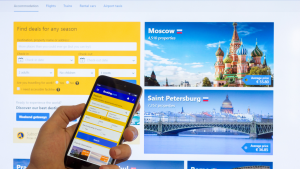

A market crash might impede Booking Holdings’ (NASDAQ:BKNG) growth trajectory as travel demand ebbed, but this global travel giant has geographic diversification that would minimize a full collapse.

In virtually every country around the world, Booking has developed a leading network of hotel properties and services. It has achieved a critical mass that attracts more travelers looking for rooms, rentals, attractions, flights, and a payment platform.

Booking Holdings also possesses a first-mover status in certain regions, such as Asia, which gives it a competitive edge over rivals trying to break into these markets. In China, its partnerships with Trip.com (NASDAQ:TCOM), Meituan-Dianping (OTCMKTS:MPNGF) and ride-sharing app Didi Chuxing give it a leg up as does its own Agoda.com portal. It is difficult and expensive for rivals to build the same sort of network that Booking has established.

With an equally extensive relationship with proprietors in Europe, the online travel agent offers investors downside protection in case of a crash.

Marvell Technology (MRVL)

Chipmaker Marvell Technology (NASDAQ:MRVL) is finding its groove as data center demand for artificial intelligence (AI) creates a burgeoning market. While Marvell’s leadership in electro-optical chips will be its mainstay of growth and profitability, the chipmaker also opened up a new avenue for growth in custom accelerators.

Marvell recently announced its third hyperscale cloud customer for its custom chip business. It proves the chipmaker’s pivot to data center infrastructure positions the company for long-term growth as the market has a runway for significant expansion. Wall Street believes Marvell has won Amazon (NASDAQ:AMZN), Microsoft (NASDAQ:MSFT) and Google as customers. They are impressed with its ability to stand shoulder-to-shoulder with Broadcom (NASDAQ:AVGO), Intel (NASDAQ:INTC) and, of course, Nvidia (NASDAQ:NVDA) in delivering superlative networking chip performance.

The chipmaker forecasts AI revenue will double this year and then double for several years. It expects to generate $2.6 billion in AI sales by 2026. And because it offers a broad catalog of switches, processors and optical chips, Marvell Technology can arguably gain significant market share.

Netflix (NFLX)

In a Nasdaq 100 market crash, having Netflix (NASDAQ:NFLX) in your portfolio would provide sufficient ballast to keep the whole thing afloat. As a cheap form of at-home entertainment, movie streaming can’t be beat. As one of the very few that has proved it can do so profitably, Netflix is quickly becoming one of the last-man-standing providers.

The market is already giving investors a bit of a discount on the stock after it knocked Netflix shares back 10% following earnings.

Although the streamer added even more subscribers to the platform, its forecast for deceleration in the second half of 2024 caused the market to pause its incredible run-up. Over the past year, shares nearly doubled. The platform has over 81 million subscribers in North America, making it a very mature market that is not likely to see much more growth. That’s especially true after converting millions to paying members following a password-sharing crackdown. Still, there is plenty of growth available internationally.

However, what the past four years have shown is that operating a streaming business is not as easy as Netflix made it look. Not even Disney (NYSE:DIS) has found the formula for making money at it, while Paramount Global (NASDAQ:PARA) is desperately seeking a buyer.

Netflix is a solid business that has endured an onslaught of competition. Waiting them out was difficult but has paid off for Netflix and its shareholders.

On the date of publication, Rich Duprey did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.