The huge volatility masked by the S&P’s average yearly gain … how to turn volatility into a tailwind for your portfolio … an important market event tomorrow with master trader Jonathan Rose

What’s the average max intra-year drawdown for the S&P 500?

In other words, from its high of the year to its ensuing low within that year, what’s the average size of the drop?

Ready?

It’s 14.2%.

Are you emotionally prepared for the market to begin a 14% plunge tomorrow?

While the idea is rather nerve-rattling, this 14% average number masks some far more brutal intra-year selloff statistics.

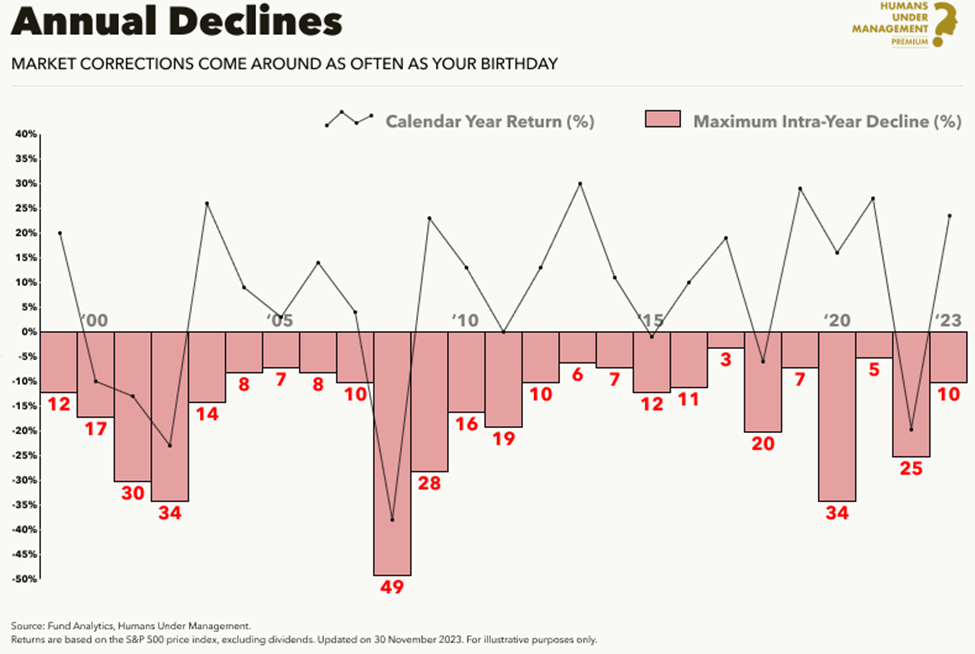

See for yourself. Below, we look at a chart mapping the market’s calendar year return (the thin black line, usually toward the top of the chart) along with the max intra-year decline (the shaded red bars) since 2000. Check out the size of the some of these top-to-bottom drawdowns.

Also, don’t miss how the market can end the year with a respectable gain, yet have suffered a painful, double-digit intra-year decline.

This intra-year drawdown statistic is rarely discussed. Instead, we often hear about the S&P’s long-term average yearly return. That clocks in at roughly 10% over the last 30 years.

Many investors become anchored to “up 10%” and expect a somewhat-pleasant ride in getting there. This leaves them unprepared for the white-knuckle rollercoaster ride that’s often the reality.

So, when that average 14% intra-year drawdown rears its head, it has a way of shaking unprepared investors out of the market, robbing them of those average 10% yearly returns and derailing long-term investment goals.

Now, we could pivot toward the obvious takeaway at this point – “when you’re in top-tier stocks, stay the course despite painful drawdowns.” And for most of us that’s a great plan.

But we’re going to take a different approach to this type of volatility today. Here’s the newest addition to our corporate family, Jonathan Rose, to explain:

You shouldn’t fear volatility. You should embrace it.

Without it, there would be no outsized profits.

How a master trader uses volatility as a profit generator

For newer Digest readers, Jonathan was a professional trader for over 16 years prior to recently joining our corporate family. He traded in the “pits” of some of the biggest exchanges in the world – including the Chicago Mercantile Exchange and the Chicago Board Options Exchange.

He’s made over $10 million during his time in the markets. And he’s profited in both up and down conditions. For example, in 2008, the S&P crashed 38.5%. Meanwhile, Jonathan made over $4 million that year.

Here he is speaking to what it takes to realize this type of outcome in the market:

Becoming a successful trader is not as hard as most people think.

The problem is most people are emotional investors. They let volatility get the best of them.

But I’ve learned that that there are three keys to reining in your emotions:

- A strategy that gives you an edge…

- The right vehicle to boost your returns…

- And a solid trading plan that helps you stay in the game for the long run.

If you’re not using these three keys, you may as well throw your money away.

We couldn’t agree more when it comes to the debilitating effect of emotions on investment returns.

Here’s The Republic with some sobering details on this combination:

From 1992-2022 (30-years, encompassing the dot-com bubble/crash, 9/11, Global Financial Crisis, COVID pandemic and brutal 2022), the S&P 500 still posted an average annual return of 9.65%.

Unfortunately, our human tendency is to get scared and sell at the bottom and get excited and buy at the top, so Dalbar calculated the average U.S. equity mutual fund investor had an actual average annual return of only 6.81% (almost 30% less than the S&P 500).

But let’s say that you’ve armed yourself with the statistics on intra-year volatility, so you’re more emotionally prepared to ride through the inevitable ups-and-downs. What then?

What’s the best way to turn this volatility into a tailwind for your portfolio value?

Leveraging an up-and-down market with options

Let’s returns to Jonathan:

If you want to harness the power of volatility, the best strategy is to trade options.

These are contracts that give the buyer a right – but not the obligation – to buy or sell stocks at an agreed-upon price at a specific time.

And they give you huge leverage over stocks. That means you can pull forward decades’ worth of gains in as little as 12 months.

Now, most folks think options are risky. And your broker may tell you to run away from them.

But options actually limit your downside risk. That’s because with the type of fixed-risk option trades I recommend, you can never lose more than your initial investment.

And if your options trades are winners, they give you leverage – or extra oomph – over the movement in stocks.

Perhaps the simplest and best illustration of how options provide “oomph” comes from Jonathan’s QQQ trade that we profiled here in the Digest last week. QQQ is an ETF that tracks the performance of the Nasdaq Index.

In early-April, Jonathan’s market indicators suggested that QQQ was likely to pull back. So, he recommended that his viewers open an option trade that would profit if QQQ experienced weakness.

The timing was spot on. Later that same day, QQQ began to drop. By the next morning, it had fallen roughly 2%.

Now, let’s assume you had played this move with the ProShares Short QQQ ETF (PSQ). It’s designed to deliver inverse results of the Nasdaq over a single trading session.

If you’d invested in PSQ when Jonathan believed QQQ was going to fall, by the following day, you’d be up roughly 2% – about the inverse of the Nasdaq’s performance.

But Jonathan’s followers, who had played the move with options, found themselves sitting on overnight gains of 279%.

Let’s put a few real numbers on this to highlight the performance differential.

Imagine you sunk $20,000 into the PSQ trade. Well, congrats, you made about $400 overnight ($20,000 x 2% = $400).

On the other hand, say you wanted to limit your risk, so you invested just $500 in Jonathan’s suggested option trade.

In this case you made $1,395 ($500 x 279%).

In other words, you nearly 3x’d your return using only $500 rather than $20,000.

More from less. This is what options have the power to do for you.

Tomorrow morning at 10 AM Eastern, Jonathan is holding his first ever Masters in Trading Live event

He’ll be sharing the details behind the one of the most potentially lucrative money-making strategies in his entire repertoire.

It comes from a quant formula that Jonathan has used to predict market moves. In fact, over the last three years, 90.3% of the calls he made using this strategy went up.

It’s the same market approach that enabled Jonathan to reach complete financial freedom at age 35.

Circling back to the top of today’s Digest, it’s one thing to recognize that volatility is likely on the way, suggesting we should all be ready to ride through that average 14% drawdown.

It’s another thing entirely to make, say, 10 years’ worth of average yearly S&P returns out of such a drawdown. But when you know how to keep a level head and use options to trade what the markets are giving you, such an outcome is more than possible.

Tomorrow morning at 10 AM Eastern, Jonathan will fill in the details on how this all works. To automatically reserve your seat, just click here.

I’ll give him the final word:

If you’re ready to make the leap from Average Joe investor to master trader, I’d like to invite you to my Masters in Trading Summit tomorrow May 8, at 10 a.m. Eastern, with this one-click, instant invitation link.

I’ll reveal my No. 1 indicator to find trades that go up 90.3% of the time.

I’ll share the results of a live experiment that lasted about six weeks, in which I closed seven out of seven trades for an average gain of 125%.

And as a bonus, if you reserve your seat now, you can watch my three-part High Probability Options crash course – free. Just follow this link for immediate access.

Whether you join me or not, please remember… when most people hear the word volatility, they see fear ahead. But for market pros, volatile markets are the best opportunities to make truly life-changing wealth.

And right now, I see an opportunity for you to make returns in 10 months that most people wait 10 years for.

Click here to instantly sign up with just one click for tomorrow’s event to find out how.

Have a good evening,

Jeff Remsburg