Hello, Reader.

In the timeless song “Heart of Gold,” singer Neil Young goes on a quest for authenticity in a world full of noise.

He paints the uphill battle in his lyrics…

I want to live

I want to give

I’ve been a miner

For a heart of gold

Young uses gold as a metaphor for something precious. But not even Young could have known that gold would become 20 times more precious over the ensuing eight years. Its price soared from $42 an ounce when Young’s No. 1 song hit the charts in 1972, to more than $800 an ounce in 1980. The stock market gained just 50% over the same timeframe.

In this way, gold was probably the unlikeliest investment hero of the 1970s…and it may be on the path to an encore performance.

Despite the metal’s lack of alignment with popular tech-focused themes like artificial intelligence, it is outperforming all the major stock market averages.

Even the tech-heavy Nasdaq 100 is trailing behind the ancient monetary metal.

So, in today’s Smart Money, let’s walk through the surge in gold’s buying activity and what it means for the U.S. economy.

Plus, let’s dig into whether there’s any incentive left for us to keep mining this trend…

Fragility Can Bring Opportunity

Now, past performance is no guarantee of future results, of course. But the yellow metal probably has a lot further to run.

You see, even though gold has nothing to do with AI, it has everything to do with the seismic monetary and geopolitical phenomena that are gurgling beneath the surface of the global financial markets.

To put it bluntly, both the Middle East and the U.S. dollar are sitting on a razor’s edge. But even if conditions in the Middle East were as placid as a still pond, the dollar’s precarious strength provides plenty of reason to buy a few ounces of gold. At least that’s what recent central bank activity seems to indicate.

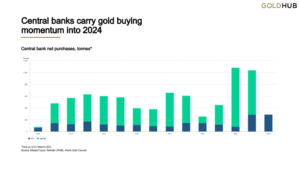

According to the World Gold Council, global central banks “doubled down” on gold demand by setting a new first-quarter buying record.

In total, they purchased 290 tonnes, which was the strongest start to any year on record. The Reserve Bank of India, for example, purchased more gold during the first three months of this year than it did during all of 2023.

This robust central bank 1Q buying activity continues the pattern of 2022 and 2023, when they purchased more than 1,000 tonnes each year. The precise volume of official central bank purchases last year was 1,037 tonnes, which was equivalent to 29% of last year’s total gold-mining production.

Accordingly, the World Gold Council believes the central banks’ ongoing “voracious appetite for gold” is a key driver of the metal’s recent price gains.

So, despite the obstacles, this search for a “heart of gold” is delivering results.

Inflation’s “Gold Lining”

Keep this in mind: Every dollar spent buying gold is a dollar not spent buying some other asset, like a U.S. Treasury bond, for example.

China provides a fascinating and timely case study, which we talked about in a previous Smart Money.

I said…

For most of the last decade, the large Asian nation has been the largest foreign creditor to the United States. However, China’s appetite for U.S. Treasury securities has been waning steadily for years. Today, it holds 40% fewer Treasurys than it did in 2014 and has slipped behind Japan to become our second-largest foreign creditor.

Meanwhile, China has been ramping up its gold purchases. Based on official figures from the People’s Bank of China (PBoC) – which may not be entirely accurate – the country has boosted its gold reserves by 337% during the last 10 years, from $40 billion to $175 billion.

To be sure, the Chinese do not lack for reasons to tiptoe away from the U.S. Treasury market. Our government’s balance sheet is looking a little woozy. America’s annual interest expense is double what it was three years ago and now tops $1 trillion.

That trend is bad news for our national economic health, but good news for gold. Historically, the yellow metal loves runaway government indebtedness.

Economists from Harvard and the International Monetary Fund (IMF) also concluded that today’s real-world inflation is higher than the reported number, and not by a small amount. Interest expenses are, in fact, real expenses. And the U.S. Bureau of Labor Statistics (BLS) eliminated that idea in 1983.

Using the pre-1983 CPI formula, Harvard and the IMF calculated that the peak inflation rate during the current cycle would have been 18%, not 9.1%. Further, they say that the current inflation rate would still be hovering around the 8% level, not 3.5%.

If these findings by the Harvard-IMF team are close to the mark, they provide ample incentive for gold-buying – both by central banks and by individuals.

“Hidden” inflation is still inflation, and it still undermines the value of the dollar.

It seems that Neil Young knew of what he sang in “Heart of Gold.”

In a chaotic world of geopolitical shifts and volatile markets, high inflation makes it easy to appreciate gold’s resilience.

Regards,

Eric Fry

P.S. I’m hosting a special strategy session next Tuesday to tell you about a company that I believe will become The Next $1 Trillion AI Stock.

Most people don’t know about this…

Because this company operates in a niche that’s normally not associated with technology. But I believe this will be the next big AI application.

In fact, Elon Musk, Jeff Bezos, and Bill Gates have collectively invested billions in this new AI trend.

Click here to join me this coming Tuesday, May 21, at 7 p.m. Eastern.