In early May, the Biden Administration announced it would increase tariffs on steel, aluminum, semiconductors, electric vehicles, batteries, critical minerals and solar cells. The announcement creates opportunities for some of the top mining stocks to buy.

With it, tariffs on some steel and aluminum products will jump from a current range of 0% to 7.5% to 25%. According to the Administration, this will help bolster “the U.S. steel industry’s competitiveness as the world’s cleanest major steel producer.”

Tariffs on semiconductors will jump from 25% to 50% by 2025. The tariff rate on electric vehicles will jump from 25% to 100% in 2024. Solar cell tariffs will rise from 25% to 50%.

In addition, “The tariff rate on lithium-ion EV batteries will increase from 7.5%% to 25% in 2024, while the tariff rate on lithium-ion non-EV batteries will increase from 7.5% to 25% in 2026. The tariff rate on battery parts will increase from 7.5% to 25% in 2024.”

They added, “The tariff rate on natural graphite and permanent magnets will increase from zero to 25% in 2026. The tariff rate for certain other critical minerals will increase from zero to 25% in 2024.”

That being said, investors may want to invest in mining stocks to buy, such as the following picks.

MP Materials (MP)

Operating the. Mountain Pass, MP Materials (NYSE:MP) is seeing momentum with the latest tariff news.

In fact, over the last few days, MP ran from about $15.15 to a high of $19.23. From here, despite some overhead resistance, I’d like to see MP closer to $21 a share.

The new tariffs “will help level the playing field for domestic producers, giving U.S. industry the time it needs to scale and develop in a manner that aligns with America’s vital national interests,” MP Materials said, as quoted by Fastmarkets.com.

“In the long term, these measures will foster greater balance and resiliency across the global supply chain, ultimately benefiting producers and consumers worldwide.”

Analysts at D.A. Davidson reiterated a buy rating on the rare earth miner, with a price target of $24 a share. Benchmark analysts also have a buy rating on the MP stock at the moment.

VanEck Vectors Rare Earth-Strategic Metals ETF (REMX)

Another way to trade some of the top mining stocks to buy is with an exchange-traded fund like the VanEck Vectors Rare Earth-Strategic Metals ETF (NYSEARCA:REMX). Over the last few days, the ETF ran from about $49 to $57. But it could push even higher on the recent news.

With an expense ratio of 0.56%, the REMX ETF offers diversification with 33 key rare earth and strategic metal stocks. All holdings must derive at least 50% of total revenues from the rare earth/strategic metals industry.

Some of its top holdings include Albemarle (NYSE:ALB), Pilbara Minerals (OTCMKTS:PILBF), Lynas Rare Earth (OTCMKTS:LYSDY), Arcadium Lithium (NYSE:ALTM), MP Materials, and Sociedad Quimica y Minera (NYSE:SQM) to name a few.

With the new U.S. tariffs and potential retaliation from China, these names and the REMX ETF should benefit significantly moving forward.

Eventually, I’d like to see the REMX ETF retest its prior high of $63.

Freeport-McMoRan (FCX)

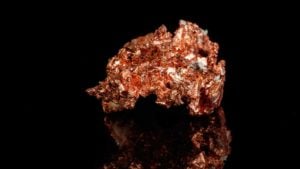

Copper producer Freeport-McMoRan (NYSE:FCX) could see higher highs.

Year to date, it has already run from about $35 to $54.32, but it could push higher with the latest Chinese tariffs. After all, the tariffs on Chinese batteries could lead to an increase in domestic battery production, which will require a stronger supply chain. This development will put North American copper producers in a prime spot to benefit, noted TipRanks.com.

Fueling upside, the world is already dealing with a severe copper supply-demand scenario.

Plus, according to E&E News, the mining industry can’t unearth copper quickly enough to keep up with President Joe Biden’s electric vehicle goals, according to a new study. “A normal Honda Accord needs about 40 pounds of copper. The same battery electric Honda Accord needs almost 200 pounds of copper,” said researcher Adam Simon of the University of Michigan. The “amount of copper needed is essentially impossible for mining companies to produce.”

These dynamics could send copper stocks, like FCX even higher.

On the date of publication, Ian Cooper did not hold (either directly or indirectly) any positions in the securities mentioned. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.