Travel is back in business. Since the latter years of the Covid-19 pandemic, travel stocks to buy have sharply rebounded, boosting earnings and share price of many companies within the sector. The Amplify Travel Tech ETF (NYSEARCA:AWAY) buys shares of travel agencies and travel technology businesses. The ETF has risen around 20.65% over the past twelve months, as travel public companies continue to benefit from travel demand.

While travel stocks to buy enjoy some love from the market, below are three stocks to buy now.

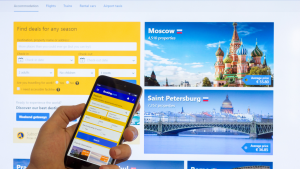

Booking Holdings (BKNG)

Booking Holdings (NASDAQ:BKNG) is a leading global, online travel agency. The holdings company operates household names, including Booking.com, Priceline.com, Kayak.com and Agoda.com. The Covid-19 pandemic hit the company’s revenue and earnings hard in 2020. In fact, revenue contracted nearly 55% on a year-over-year basis while net income came in at a meager $59 million. Since then, Booking’s financial figures have surged well beyond where they were during the pre-pandemic era. In 2023, revenue grew 25% to $21.4 billion.

The firm’s first quarter earnings report for fiscal year 2024 surpassed both revenue and earnings estimates. Quarterly revenue increased 17% YOY to $4.4 billion, while net income increased 192% YOY to $776 million.

BKNG shares have risen over 9% since the start of the year. The company’s recent earnings beat coupled with the fact its stock trades at 21.4x forward earnings, make it a compelling investment.

Airbnb (ABNB)

Airbnb (NASDAQ:ABNB) makes the second entry on this list. The company is a household name for travelers and vacationers across the globe. Airbnb’s online marketplace allows both hosts and guests to connect via their personal computers or via mobile devices to offer and book living spaces. The online platform has grown up in terms of its financial statements. Before and during much of the pandemic years, Airbnb was loss-making company that had been burning significant amounts of cash. However, since 2022, Airbnb has become profitable on a GAAP basis and has continued to improve EPS from year-to-year.

Its recent first quarter earnings report for fiscal year 2024 is a testament to the firm’s ability to grow revenue robustly while keeping margins up. Revenue for the first quarter as well earnings surpassed what Wall Street analysts had been predicting. In particular, revenue increased 18% to $2.1 billion while net income came in around $264 million, making this quarter the company’s most profitable since inception.

ABNB trades at clear premium to a platform like Booking, but robust revenue and earnings growth still makes it a travel stock to buy.

Delta Air Lines (DAL)

Delta Air Lines (NYSE:DAL) is a well-known full-service airline for those living in the United States. The airline has built a robust domestic service that can get anyone to any major city in the country; Delta’s international service includes global hubs across Latin America, Western Europe and East Asia. The airline benefitted immensely from pent-up travel demand after Covid-19 restrictions were done away with. Delta’s revenue growth figures in 2021 and 2022 both encroached upon triple-digit territory.

Fourth quarter results for fiscal year 2023 saw quarterly earnings double on a year-over-year basis, as a result of not just strong domestic travel but, particularly, the rebound international travel routes. First quarter earnings results for fiscal year 2024 also surpassed estimates as “consumers continue[d] to prioritize travel as a discretionary investment in themselves.”

That is to say, despite inflationary pressures, consumers are still willing to spend on travel, which can only help Delta Air Lines and its shares in the near and medium term.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.