Earnings season has gone by in the blink of an eye, with its tail end now upon us.

As we wrap up the season, the best was saved for last. Yesterday, one of the biggest and most influential companies on Wall Street released results. It is a market leader in one of the hottest sectors to emerge in the last few years: artificial intelligence.

I’m talking about NVIDIA Corporation (NVDA).

NVIDIA is the last of the Magnificent Seven companies to report earnings, and expectations were high. I’ve been expecting NVDA’s report to be the cherry on top of what has been a stunning earnings season. And as I’ll explain in a moment, it did not disappoint.

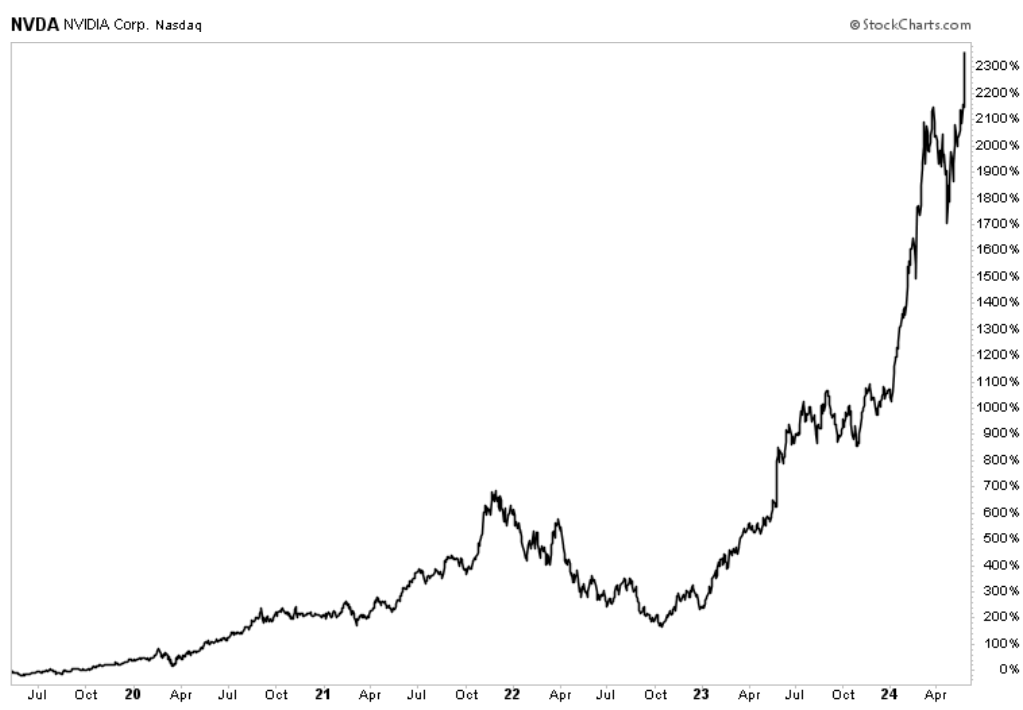

The reality is that NVIDIA is one of the greatest growth stories of this generation. The company has grown by leaps and bounds – particularly over the past five years. And the stock has followed suit – up roughly 2,000% heading into yesterday’s report. It’s truly incredible – and it’s a ride that we’ve been a part of over at Growth Investor since May 2019.

This kind of growth is a testament to the company itself. But we can also look to exactly one year ago. That’s when the company released results for the first quarter of fiscal 2024 – and the chipmaker first stunned Wall Street with the demand for AI chips.

That really marked when the AI Revolution took hold of practically the entire market. For example, according to Bank of America research, the mention of AI during earnings calls since that initial report has increased a whopping 186%.

It’s truly incredible and a big reason why Wall Street was waiting on pins and needles to receive the report. I have to admit, I was, too – because NVIDIA is the market leader that will set the tone for stocks as we emerge from this earnings season.

Now, in Tuesday’s Market 360, I gave a preview of what analysts were expecting. I also predicted that another earnings surprise was likely. But as I noted, even more important would be the company’s guidance.

So, in today’s Market 360, we’ll review NVIDIA’s earnings, and discuss what it means for the AI sector. Then, I’ll share how you can take advantage of AI’s growth, even if you missed out on the first big surge.

The Numbers Are In…

Yesterday, after the market closed, NVIDIA released its results for the first quarter of fiscal 2025. And the company did not disappoint.

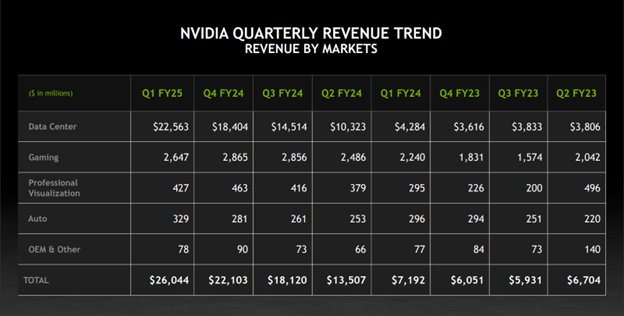

During its first quarter in fiscal year 2025, revenue soared 262% year-over-year to a record $26.0 billion. Analysts only expected revenue of $24.65 billion. NVIDIA noted that data center revenue was also a new record, jumping 427% year-over-year to $22.6 billion.

First-quarter earnings surged 462% year-over-year to $15.24 billion, or $6.12 per share, compared to $2.71 billion, or $1.09 per share, in the first quarter of 2024. Analysts expected earnings of $5.59 per share, so NVIDIA posted a 9.5% earnings surprise.

To give you an idea of the company’s stunning run of success, just look at the table below. This was in NVIDIA’s earnings release, and it shows the company’s staggering increase in total revenue from the second quarter in 2023 to now. We’re talking about a $19.34 billion increase in total revenue – or 288%.

Source: NVIDIA

What’s more, company management guided for revenue of around $28 billion in the current quarter. That’s up 171.8% from $10.3 billion in the second quarter of fiscal year 2024 – and better than analysts were expecting, too.

I should also add that NVIDIA has planned a 10-for-one stock split in June. The stock split is scheduled to occur on June 7, with the new split-adjusted price going into effect on June 10. NVIDIA boosted its quarterly dividend to adjust for the coming split as well.

Key Takeaways

This report is what the folks at Bespoke Investment Group call a classic “triple play.” The company beat sales and revenue estimates and issued guidance that was higher than analysts expected.

All in all, I was pretty pleased by the report. And apparently Wall Street was, too. The stock jumped above $1,000 in after-hours trading and is currently up by about 9% as we head into today’s close. And much of the tech sector has followed suit.

The other thing I want to stress about NVIDIA is that they introduced the new Blackwell chip on March 18. But they aren’t really delivering many of them until later in the year. So, what we are seeing in this latest report is reflecting sales of their old chips.

In other words, just wait until they deliver the new chips.

Also, going into this report, this stock was priced for perfection. But it delivered. In fact, the stock has broken through the $1,000 price target that I set last year, so I’m raising my price target to $1,400 this year (pre-split).

What This Means for AI

In the company’s announcement, founder and CEO Jensen Huang proclaimed that “the next industrial revolution has begun.” He continued on saying:

Companies and countries are partnering with NVIDIA to shift the trillion-dollar traditional data centers to accelerated computing and building a new type of data center – AI factories – to produce a new commodity: artificial intelligence. AI will bring significant productivity gains to nearly every industry and help companies be more cost- and energy-efficient, while expanding revenue opportunities.

Clearly, Huang believes there is a ton of growth ahead for the AI industry. I think he’s right.

Now, I would be remiss if I didn’t talk about the fears that demand will slow down for these powerful chips. And it seems Huang felt the same. In an exclusive interview with Yahoo Finance, he said “People want to deploy these data centers right now. They want to put our [graphics processing units] to work right now and start marking money and start saving money. And so that demand is just so strong.”

The fact is, this is a monopoly, folks. And it’s going to remain a monopoly through the end of the decade. They’re not going to have competition because they spent over $2 billion to build the Blackwell chip. The chip is in a class of its own – in fact, Huang calls it an “AI factory” because it does so much more than what we think of when it comes to chips. And the fact is no one can afford to compete with them.

The Smart Way to Profit from AI’s Growth

The profit potential of AI is no longer a secret.

This year alone, many AI stocks have doubled or more – and NVDA is one of them. In fact, since adding it to one of our Growth Investor Buy Lists in May 2019, we’re up more than 2,300%.

Now, I know everyone wants to find the “next NVIDIA”.

But there are now approximately 70,000 “AI” companies worldwide. And the truth is, companies like NVIDIA just don’t grow on trees. So, investing in individual companies AI plays at this point in the game is a tough task at best.

That’s why I’ve decided to share a unique strategy I have uncovered. It’s a way to pocket a steady stream of income as the entire AI industry grows exponentially. I’m talking about something ordinary investors, industry experts and even billionaires are tapping into with increasing frequency.

I call this opportunity the “AI Retirement Formula.”

Now, this isn’t about hoping for one or two big winners. It’s about putting yourself in a position to benefit from the overarching success of the AI industry.

In short, you now have the chance to earn a series of retirement-boosting payouts from the success of over 10,000 companies.

This is a little-known opportunity that lets you pocket a consistent stream of cash from the AI boom without having to throw darts in the hopes that you’ll hit the next big thing.

Even better, you can start exploiting this unique situation as soon as today without doing anything extra risky.

Click here to learn how to start your own AI income stream today.

(Already a Growth Investor subscriber? Click here to log in to the members-only website now.)

Sincerely,

Louis Navellier

Editor, Market 360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

NVIDIA Corporation (NVDA)