A problem area on Louis Navellier’s radar … the huge growth and huge returns behind private lending … warnings are beginning … is there a silver lining?

Before we begin, a quick note that our offices, including Customer Service, will be closed on Monday, May 27, in honor of Memorial Day. Regular hours will resume on Tuesday, May 28.

We’ll also be taking the day off here in the Digest but will return on Tuesday.

On behalf of all of us here at InvestorPlace, we hope you have a wonderful Memorial Day weekend with friends and family. Welcome to summer!

“I don’t want to scare anybody, but if there’s going to be a problem [this] is where it’s going to be…”

That eyebrow-raising comment came from legendary investor Louis Navellier in yesterday’s Flash Alert podcast in Growth Investor.

Much of the podcast highlighted Nvidia’s blowout earnings, why the company will be the dominant AI chipmaker for years to come, and how investors can position their portfolios for AI growth.

But then came this warning when Louis turned to the just-released minutes of the Federal Reserve’s meeting in May:

[The Fed] did have a little tidbit in the Fed FOMC minutes, talking about the booming private credit industry.

What has happened in America is that we’ve become like China. We have an official bank lending system, then we have an unofficial lending system, controlled by the private credit industry.

Now, private credit is exploding everywhere. This is what you can buy at Morgan Stanley and almost every broker/dealer and financial advisor.

And you can – right now – get an 11% yield, and you’ll get your money back in two years. But the question is “how are they getting an 11% yield?”

What’s happening is it looks like they’re starting to leverage.

Let’s pause here and backfill some details to make sure we’re all on the same page.

The fast-growing private credit industry

“Private credit” is the name for loans made to individuals or businesses from any lender other than a traditional bank. The largest private credit lenders include private equity firms (think “KKR”), alternative asset managers (think “Carlyle Group”), and insurance companies (think “AFLAC”).

For borrowers, these non-bank lenders offer a way to access funds when traditional banks might not provide loans. This can happen because banks face tougher regulatory hurdles and/or lending standards than non-bank lenders.

For the lending institutions, these loans have become big business, providing a reliable stream of high-yield income.

In the wake of the global financial crisis, regulatory bodies clamped down on lending practices from big banks. This created space for non-banks to step into the void. And step in they did.

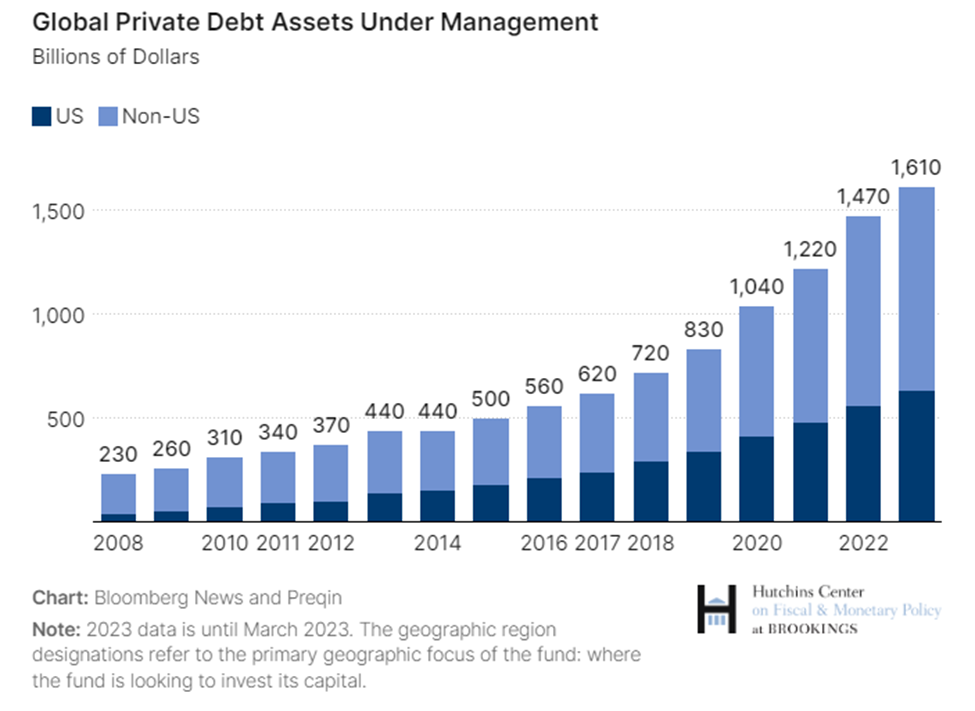

According to Preqin, a London-based financial data and analytics firm, private credit has exploded from approximately $375 billion in 2008 to more than $1.6 trillion by March of last year. That’s more than 4X growth.

Below, you can see how global private debt assets under management have been climbing – and accelerating. Notice the J-curve since roughly 2020.

Behind this growth are big returns for investors

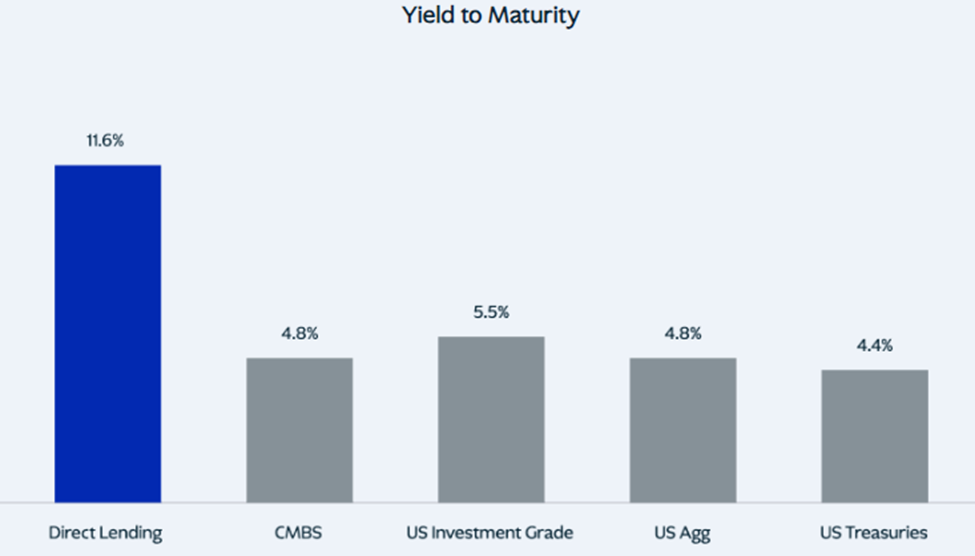

Below, we look at data from private equity firm KKR from last June. We’re seeing various yields to maturity for credit products.

Note how direct lending (private debt) offers an 11.6% yield – more than double the next best yield of U.S. investment grade debt at 5.5%.

So, lenders are enjoying huge returns, and borrowers are accessing funds they might not otherwise receive.

It’s a win/win for everyone, right?

As you might expect, there are growing concerns about the health of the private credit market and its interconnectedness to the traditional banking system

Let’s begin with Reuters from earlier this month:

To some elite financiers who gathered in Los Angeles for the Milken Institute conference, a debt binge in private markets is reminding them of the go-go days of risk-taking before the 2008 financial crisis.

In the halls of the Beverly Hilton and at meetings around town last week, I spoke with more than a dozen investors, bankers and fund managers involved in the booming $1.7 trillion private credit market, where investment funds lend private equity portfolio businesses and other companies money.

Many of the financiers worried about the consequences of debt piling up in that market, which operates mostly out of sight of regulators.

In April, JPMorgan Chase CEO Jamie Dimon noted his growing unease with private credit in his annual letter to shareholders.

He wrote that private credit “isn’t as transparent as public market valuations. In addition, private market loans commonly lack liquidity in the secondary market and are not generally supported by in-depth market research.”

Here’s his broader concern:

New financial products that grow extremely rapidly often become an area of unexpected risk in the markets.

Frequently, the weaknesses of new products, in this case private credit loans, may only be seen and exposed in bad markets, which private credit loans have not yet faced.

Next up expressing concern is Federal Reserve Governor Lisa Cook.

From PYMNTS:

Cook identified private credit — direct loans made to businesses by nonbank entities — as an emerging vulnerability. Private credit funds’ assets under management have grown rapidly in recent years and may involve “weak underwriting or excessive risk appetite,” she said…

[Private credit lending has] increasing ties with traditional financial institutions, and a growing number of banks are originating their own private credit deals.“As a result, I will be monitoring the contribution of private credit to the overall leverage of the business sector and the evolving interconnectedness between private credit and the rest of the financial system,” Cook said

Cook’s comments resemble what we found in the Federal Reserve’s May minutes, which Louis referenced:

Several participants commented on the rapid growth of private credit markets, noting that such developments should be monitored because the sector was becoming more interconnected with other parts of the financial system and that some associated risks may not yet be apparent.

So far, no one is furiously waving a red flag, but as Louis noted, we need to keep an eye on the use of leverage

Let’s return to Reuters:

In many cases, the [new debt lending proceeds are] being raised to pay investors in these funds, such as pensions and endowments, dividends to meet demands for payouts, the financiers said.

That also enables the fund managers to ask investors for new money, generating more fee income.

In some cases, the money is being used to prop up struggling portfolio companies or to invest in them for growth, and to fund new acquisitions.

“Now that we’ve had a real hiatus in their ability to exit a lot of these (portfolio companies), they’ve had cash flow difficulties,” said David Hunt, CEO of Prudential Financial’s $1.3 trillion asset manager PGIM, referring to private equity firms.

“And in order to deal with that, they have now been adding leverage to the fund level. So, they’ve got leverage on leverage.”

“Leverage on leverage” at a time when many Americans are running into problems paying their debts is not a good combination.

If you own the stocks of any private equity companies, alternative asset managers, or insurance companies, it’s worth looking into their exposure to private lending.

You want to make sure they’re not taking on too much, too fast, with too much leverage.

Louis highlights the silver lining in this potential problem area…

Let’s return to his Growth Investor podcast:

The Fed is watching [this]. If there is going to be a problem, this will be it.

But that would actually cause the Fed to cut rates – because they have to save the economy.

So, I’m not trying to scare anybody, but I just want you to know. It was the most interesting thing that came out of the FOMC minutes that came out [on Wednesday].

For now, there’s nothing urgent that demands a frantic rejiggering in your portfolio. But our goal is to put potential red flags on your radar far in advance. And this is one to monitor.

We’ll keep you updated here in the Digest.

Have a good evening,

Jeff Remsburg