The U.S. is considering a ban on TikTok, and has given Bytedance, parent of the popular China-based app. time to either sell it to U.S.-based companies or risk being banned in the U.S. in the coming months. While TikTok is taking a legal approach to fighting that decision, I believe foreign policy issues will likely triumph over any First Amendment concerns by TikTok.

This ban could lead to a huge change in the social media space. There are many companies trying to compete with TikTok, but most have failed to steal much market share away from the company as its algorithm is by far the most efficient right now. The company has said it won’t sell, mainly due to its desire to keep the algorithm a secret. Accordingly, a ban on TikTok could lead to many of its competitors booming in the coming years.

Here are three stocks to buy if you think a TikTok ban is more likely than not.

Snap (SNAP)

Snap (NYSE:SNAP) operates the popular social media app Snapchat. I believe Snap is a compelling buy right now, trading at a bargain valuation, despite showing strong signs of a turnaround. In Q1, Snap’s revenue surged 21% year-over-year to $1.19 billion, a major acceleration from the prior quarter. Even without the ban, the company’s trailing twelve month EBIT is expected to surge going forward.

Regardless, Snapchat’s massive Gen Z user base of over 422 million could explode higher if rival TikTok gets banned in the U.S. With 75% market penetration among 13-34 year olds in over 25 countries, Snap would be a prime beneficiary of TikTok refugees flocking to other social media platforms.

The company’s management team is making smart moves to improve profitability, with a new ad platform driving over 75% growth in purchase-related conversions. Progress with small business advertisers is also encouraging.

While Snap still faces challenges, the stock is too cheap to ignore here. I think the upside is tremendous if Snap can continue executing well and if TikTok’s potential demise funnels more users and ad dollars Snap’s way. This beaten-down social media play could be ready to surge.

Meta Platforms (META)

Meta Platforms (NASDAQ:META) operates a family of social media and communication apps. I believe Meta stock has significant upside potential if TikTok gets fully banned in the US. While Facebook’s younger user base has declined, the app’s overall user base has resumed growth, and Facebook remains the company’s cash cow. However, Instagram would likely be the biggest winner from a TikTok ban.

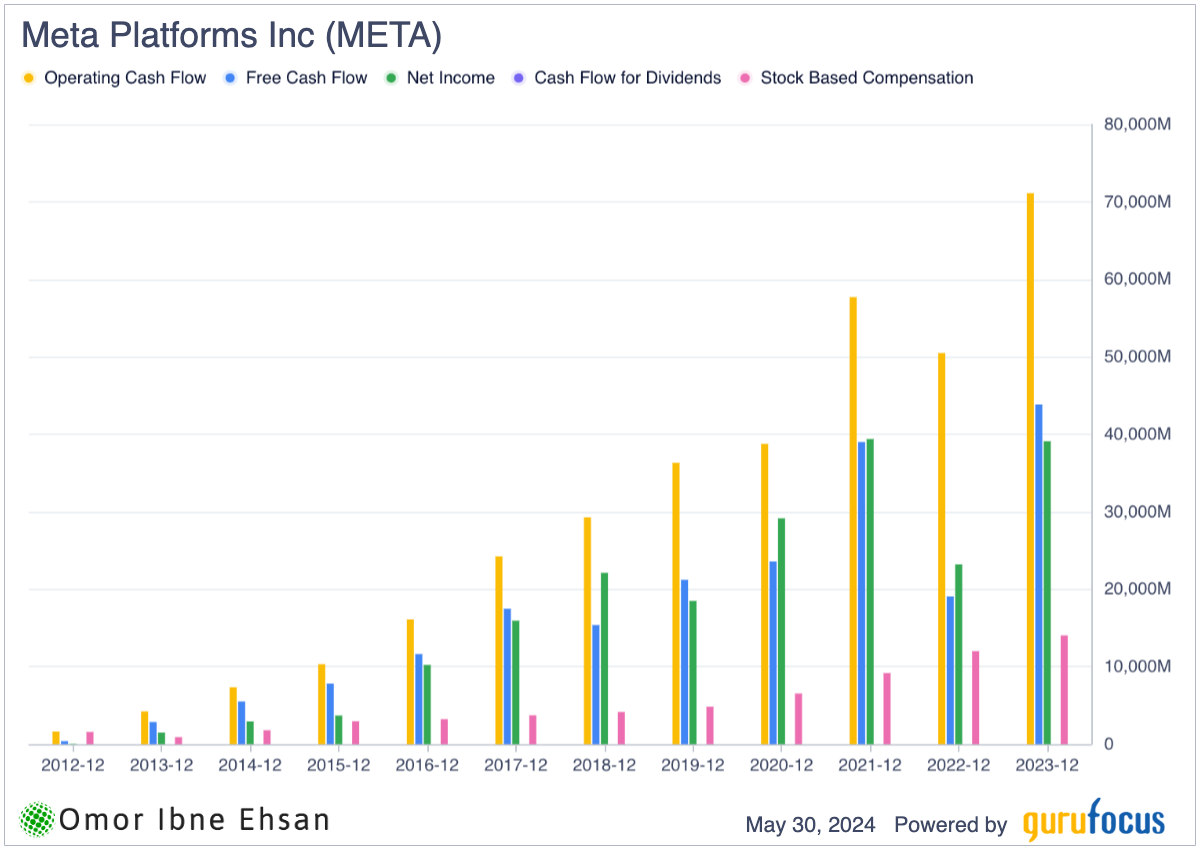

In Q1, Meta reported that over 3.2 billion people use at least one of its apps daily, with “healthy growth” in the U.S. WhatsApp’s U.S. momentum is also gaining steam. Meta’s “Family of Apps” already generates billions in profits, allowing the company to initiate a dividend that seems poised to increase alongside steady cash flow growth.

Meanwhile, Meta is making notable AI strides. Its latest model, Llama 3, powers an enhanced version of its Meta AI assistant. CEO Mark Zuckerberg said tens of millions have tried the new Meta AI, with very positive feedback. As these AI investments bear fruit, Meta’s growth and profitability should benefit. The stock looks attractively-valued based on its sturdy cash flow profile.

Alphabet (GOOG)

Alphabet (NASDAQ:GOOG) owns Google, the world’s dominant search engine, and YouTube, the top global video platform. The company posted 15.4% year-over-year revenue growth in Q1. CEO Sundar Pichai emphasized Google’s rapid progress in AI, a key driver of this impressive performance. Alphabet has been consolidating its leading AI teams under Google DeepMind. With the company’s unrivaled computing infrastructure and the rollout of powerful new AI models like Gemini 1.5 Pro, I believe concerns about Google losing its search crown are overblown.

However, the biggest near-term potential catalyst is the looming TikTok ban. YouTube is already hugely popular, and YouTube Shorts would be the natural alternative for TikTok refugees seeking their short-video fix. Pichai noted that YouTube+Cloud is on track to hit a $100 billion annual run rate. Strategic moves like banning ad-blockers will further boost ad revenue and Premium subscriptions.

If a TikTok ban materializes, I expect an explosion in YouTube revenue and profits. With search stable and YouTube poised to surge, Alphabet stock looks very attractive here for both growth and safety.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.