President Biden vetoes a crypto/banking resolution … why Luke Lango sees bitcoin at $80K this month … muni bond issuance is soaring …

My administration will not support measures that jeopardize the well-being of consumers and investors.

So said President Biden last Friday.

In this case, the apparent “jeopardy to consumers and investors” was a bill that had passed Congress that would have made it easier for traditional banks to work with the crypto sector.

Biden vetoed it, saying:

Appropriate guardrails that protect consumers and investors are necessary to harness the potential benefits and opportunities of crypto-asset innovation.

Here are more details from CoinDesk:

U.S President Joe Biden signed a veto of a House Joint Resolution that would have repealed the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121, he announced Friday afternoon.

SAB 121 is a controversial piece of SEC accounting guidance that directs financial institutions holding crypto for customers to keep the assets on their own balance sheets. Critics of the guidance say it makes it too difficult for financial institutions to work with crypto companies…

The veto came hours after banking groups and members of Congress sent a pair of letters to Biden’s desk, asking him to sign the resolution to overturn SAB 121.

Despite the veto, Bitcoin’s price has held up since Friday, and if our crypto expert Luke Lango is right, the sector is primed for a breakout

As I write Tuesday morning, Bitcoin trades at nearly $70,000. As you can see below, it’s been trading mostly sideways since its fourth halving in April.

This isn’t unexpected. History shows that the granddaddy crypto usually goes nowhere for roughly two months after a halving.

Two months is usually just enough time to frustrate the “me too” investors who hopped aboard Bitcoin’s pre-halving price run-up. Due to frustration or boredom, they often sell, just before the crypto market turns north again – which is exactly where Luke sees the sector heading.

Let’s go to his weekend update in Crypto Investor Network:

We strongly believe the market is primed for a breakout.

The cornerstone of our bullish outlook remains the improving macroeconomic conditions. We believe that weakening economic data, coupled with softening inflation, will compel a significant dovish shift in Fed policy. This shift is expected to occur over the next few months.

Consequently, we anticipate the Fed’s first rate cut to happen much earlier than planned, likely by late summer. Amidst this shift, risk assets should soar. Cryptos should lead the way, given their rate-sensitivity. Altcoins should outperform BTC. And we likely will see a big altcoin rally.

As one illustration of brewing sector bullishness, we’re seeing heavy inflows into bitcoin ETF. Luke notes that these flows have been oscillating between positive and negative ever since the ETFs made their debut at the beginning of the year. But since May 13th through Luke’s update, flows have remained positive – 14 straight days, which is a record high.

This suggests we’re in an accumulation phase in preparation for a new leg higher.

But it’s not just macro conditions and the Fed that have Luke bullish

Less than two weeks ago, the SEC approved a rule change to allow the creation of ETFs that track the price of Ethereum.

The move came less than six months after the SEC approved the first bitcoin ETFs.

Here’s Luke’s take:

We feel the Ethereum ETFs could provide an even bigger upside catalyst for crypto markets [than the bitcoin ETFs] because they represent increased government support for altcoins.

It is one thing for the U.S. government to say they are “OK” with Bitcoin. It is an entirely different—and far more positive—thing for them to say they are “OK” with a crypto not named Bitcoin.

Luke thinks this will lead to approvals for other leading altcoin ETFs such as Solana and BNB over the next several years. That could create a positive snowball effect for the entire crypto market.

Returning to bitcoin and what happens next, here’s Luke’s forecast:

We expect Bitcoin to break out from its recent convergence pattern in a bullish manner to set fresh new highs and potentially explode to $80,000 in June.

Broadly, then, we’re super bullish on the crypto markets right now. We think the technical and fundamental conditions both support a big summer rally in cryptos.

For yet another reason to diversify some of your wealth into crypto, look to the municipal bond market

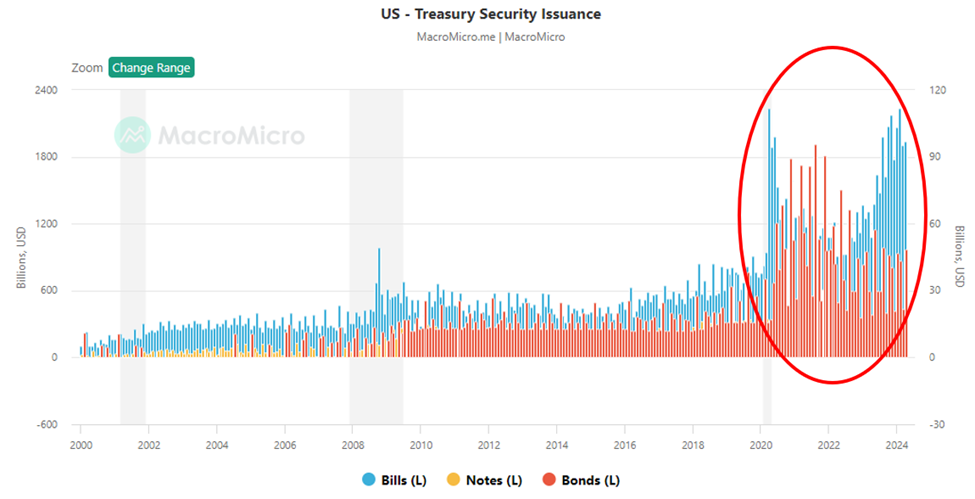

In last Friday’s Digest, in making a bullish case for gold, we highlighted the explosion of U.S. Treasury Security issuance beginning in the year 2000. As you can see below, it was a slow creep higher until 2020, when things exploded.

As a quick refresh, the government has been issuing enormous quantities of debt because it needs money to fund its bottomless pit of spending. Tax revenues alone are woefully insignificant.

The problem is that when the Treasury floods the bond market with new bonds, the oversupply results in lower prices that are needed to entice buyers. And since bond prices and yields are inversely correlated, this means bond yields rise.

That’s not good for stocks or for the federal government’s debt service (and eventually, the value of your savings in dollars).

Well, it’s not just the federal government that’s flooding the market with bonds.

Here’s Bloomberg from yesterday:

The relentless surge in municipal bond sales this year is showing no signs of slowing down as investors brace for the biggest jump in new issuance in two years.

The amount of US state and city debt scheduled to sell in the next 30 days has climbed to almost $19 billion, the most since May 2022, data compiled by Bloomberg show. The measure typically represents a fraction of what actually comes to market as deals are announced with less than a month’s notice.

The bulk of the scheduled wave, $15 billion worth, is slated to price this week, amounting to double the 10-year weekly average.

The slate presents a headwind for a muni market that’s slumped this year, in part because of the increased issuance.

Last month, the swelling sales contributed to the biggest weekly jump in benchmark muni yields in four years.

Here in the Digest, we’ve spilled plenty of ink profiling the deteriorating financial condition of our federal government…

But what’s less discussed are similar problems facing various states.

At the beginning of the year, Pew Research reported that roughly half of Americans live in states that report short-term budget gaps, potential long-term deficits, or both. While some of the shortfalls are relatively small and can likely be overcome with relatively minor policy changes, other states are in worse shape.

Here’s Pew:

Long-term liabilities are a big part of the problem.

In Illinois, deficits stem partially from the state having to spend roughly 20% of general fund dollars on public employee pensions to make up for decades of being one of the worst-funded pension systems in the country…

In California, the Legislative Analyst’s Office reported that the state economy entered a downturn in 2022, with declining real incomes, higher unemployment, fewer home sales, and less investment in technology companies and startups.

Consequently, California faces a revenue decline “similar to those seen during the Great Recession and dot‑com bust,” leading to a $68 billion deficit for the upcoming year and a $155 billion deficit over four.

Translation: Prepare for a tidal wave of new muni bond issuance. I’ll note that the issuance levels so far this year are up 35% compared to this time last year.

Whether it’s our federal government or many of our state governments, financial conditions are souring. This doesn’t bode well for the purchasing power of your dollars.

If you don’t have at least some of your wealth diversified into crypto (and gold), history suggests you could be doing yourself a financial disservice.

One final bit of perspective

Bitcoin hit the scenes in 2009. Now, everyone knows that if you’d invested a few bucks back then, you’d be a gazillionaire at this point. So, let’s not even go down that road.

Instead, let’s look at the U.S. dollar over the same period.

How has the value of the dollar declined since bitcoin launched in 2009? It’s not that long ago.

Well, prices today are nearly 50% higher than in 2009. Specifically, to buy something that cost $100 in 2009, you’d need $146 today.

Bottom line: Make sure your wealth is hitched to an asset that can float atop the rising tide of dollar debasement. A lot more of it is coming.

Have a good evening,

Jeff Remsburg