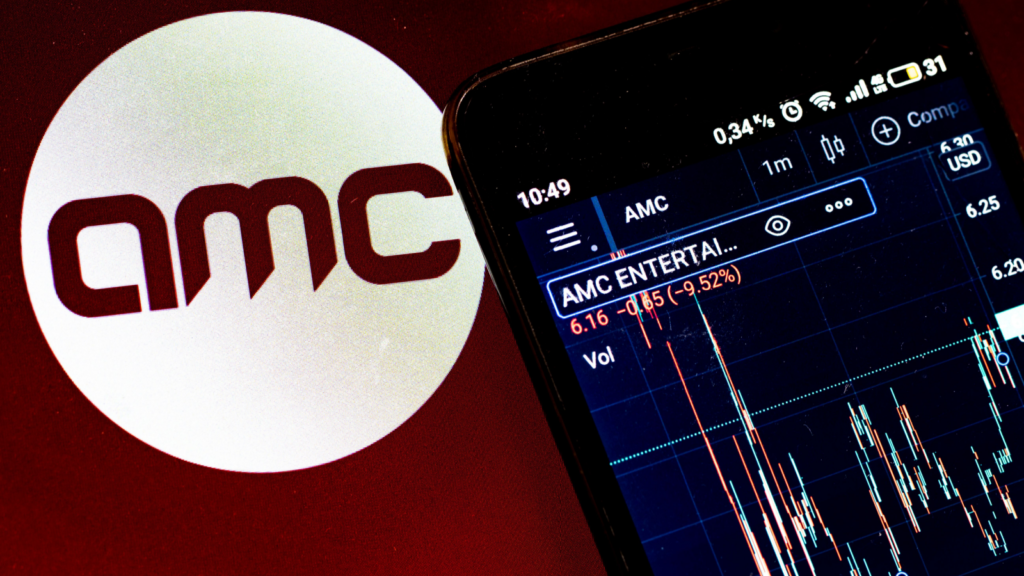

AMC Entertainment (NYSE:AMC) is caught in the crosshairs of meme traders today. AMC stock closed up over 12% yesterday as the shares were boosted by the news that meme stock investor Roaring Kitty was going to appear on YouTube today.

However, disappointing first-quarter results posted by GameStop (NYSE:GME) this morning and the company’s plan to sell additional shares of GME stock are pushing AMC’s shares down this morning.

A Roaring Kitty Rally Gives Way to a Whimpering Decline

AMC stock rose sharply yesterday, along with multiple other meme stocks, including GameStop and headphone maker Koss Corporation (NASDAQ:KOSS). The rally was sparked by news that Roaring Kitty, the well-known meme stock advocate and investor, was slated to appear on a live stream on YouTube at 12 p.m. ET today.

The rally was short-circuited this morning, however, by GameStop’s weaker-than-expected Q1 results. Also weighing on AMC is GameStop’s announcement of its plans to sell as many as 75 million additional shares of GME stock.

What to Know About GameStop’s News

GameStop disclosed that its Q1 top line had come in at $882 million, way down from the $1.24 billion of revenue that the company generated during the same period a year earlier. Moreover, two analysts, on average, had expected the retailer to report Q1 revenue of $995 million. Their mean estimate was significantly above the company’s actual sales.

On a positive note, GameStop’s per-share loss dropped to 11 cents last quarter from 17 cents in Q1 of 2023. However, the two analysts’ average estimate called for an adjusted per-share loss of 9 cents, while the firm lost 12 cents per share on an adjusted basis.

GameStop’s plan to sell up to 75 million more shares of its stock came after it unloaded 45 million shares last month, raising $933 million in the process.

The Price Action of AMC Stock

Heading into today, the shares had climbed 34% in the previous five days, and they had nearly doubled in the previous month.

On the date of publication, Larry Ramer did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.