Why you should be optimistic about the markets … the Age of Chaos isn’t what you think … Luke Lango’s opportunity for huge gains

I believe we may have given you the wrong impression and today I want to clear up any misunderstandings.

My fellow Digest writer, Jeff Remsburg, and I write a lot about different market stories and investing approaches.

We constantly use terms and concepts such as Quantum Scores, and Relative Strength Index and Global Macro investing.

And one of our favorites is “the Age of Chaos.”

The Age of Chaos idea is that faster-than-ever exponential tech progress, insane government policies that create inflation, volatility, and currency debasement, plus the huge changes brought about by the end of globalization has completely turbocharged the rate of change we are seeing in the world.

Industries are sprouting up overnight, while others are being destroyed at rapid rates.

And all that means huge winners and major losers are being created faster than at any time in human history.

This is the heart of the Age of Chaos.

But when I review how we talk about the Age of Chaos, we may have created the wrong impression – and I want everyone to be clear.

We are relentless optimists

Synonyms for chaos are “confusion,” “disorder” and “madness.”

It’s easy to understand why people can view all this change pessimistically.

You understood the world you grew up in. Life felt predictable. The certainty of it made you feel comfortable, and you knew how to react to it.

But all the lessons you learned about the world and investing over the last few decades don’t apply any more.

It can be easy to feel confused and dismayed that the world is falling apart.

But for those of us who are ready for change and know what’s coming…

The Age of Chaos is going to be incredible.

We’re going to see many, many, opportunities to accumulate wealth in the markets.

The global economy is already bigger than $100 TRILLION! The Age of Chaos is going to mean even more opportunities to grow your wealth faster than ever!

AI is the face of this movement

That’s part of the reason Jeff and I write about it so much.

AI is expected to contribute $15.7 trillion to the global economy by 2030 according to PricewaterhouseCoopers.

And, yes, there will be plenty of fakers. Every big movement comes with its share of scammers.

Speaking at the Berkshire Hathaway annual shareholder meeting in May, Warren Buffett said about AI scams, “It’s going to be the growth industry of all time.”

But no one thinks Nvidia (NVDA) is fake.

Here is some perspective from our hypergrowth expert, Luke Lango.

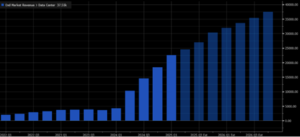

Everyone is buying AI chips in bulk these days. We know as much from Nvidia’s (NVDA) recent quarterly earnings report. The company reported $22.6 billion in Data Center revenue last quarter, which is basically its AI chips business. In the same quarter a year ago, Nvidia reported just $4.3 billion in Data Center revenue.

In other words, Nvidia is basically selling 5X as many AI chips right now as it was just a year ago.

And that number should keep going up. Nvidia’s Data Center revenues are expected to grow to $24.5 billion this quarter, $27 billion next quarter, $30 billion the quarter after that, then $32 billion, and so on and so forth to nearly $40 billion in quarterly revenue by late 2025.

Below is a chart showing Nvidia’s data center quarterly revenues since Q1 2022 and projections going forward through 2026.

Investing in AI development has already created huge winners in Nvidia, Super Micro Computer (SMCI), Meta Platforms (META) and Microsoft (MSFT).

Big companies that have only gotten bigger.

The next on this list, playing catch up, is Apple (AAPL).

Monday starts their annual Worldwide Developers Conference.

In previous WWDC events, Apple has debuted the iPhone, the iPad and major upgrades to their devices and operating system.

This year, the expectation is that Apple will unveil a new iPhone operating system – the biggest in years – that will integrate AI.

Already a company with $1 trillion, an announcement like this will only push Apple higher.

But, according to tech insider Luke Lango, there’s a much bigger opportunity unfolding. The mainstream media are missing it.

Everyone wants to talk about Apple because it’s the name everyone knows.

But in the Age of Chaos, well-positioned investors could make a 10X return in a much smaller company.

Last week, I spoke to Luke about one tiny AI company with more than 20 patents that holds the key to Apple’s AI strategy. Luke expects we’re going to hear big news about its partnership announcement with Apple next week.

And that could launch a 10X price surge starting as early as Monday.

I was lucky enough to host an emergency briefing with Luke last week.

During this briefing, Luke:

- Shows you how the mainstream media is overlooking the significance of Apple’s AI move.

- Explains how Apple’s AI announcement could significantly boost a small-cap tech stock this summer.

- And provides you with a step-by-step financial analysis for why this small-cap stock could yield tenfold returns by 2024 due to AI integration in 1.4 billion iPhones.

Don’t miss this opportunity to uncover potential gains that the broader market may be missing.

Click here to access this briefing today!

There is no better example of how the Age of Chaos is going to create huge opportunities. Small companies can grow huge in what seems like the blink of an eye due to pace of technological progress.

We’re optimists about technology, and how investing in the right companies early can change financial futures.

Enjoy your weekend,

Luis Hernandez

Editor in Chief, InvestorPlace