The U.S. consumer price index (CPI) inflation report for May is scheduled to be released on Wednesday, June 12th. Inflation has been one of the most pressing issues over the past two years, and naturally, this CPI report has also become one of the most important factors for investors to consider in the market.

The report doesn’t just judge inflation right now. It will also provide insight into the dot-plot, or where officials see inflation headed moving forward. Accordingly, many view this CPI reading as the needle-mover for whether or not we’re going to see substantial rate cuts this year or none at all.

This then impacts how the broader economy might perform going forward. If the CPI print is too hot and the Federal Reserve is forced to hold for longer, we could see “stagflation.” Remember, Q1 GDP growth came in at 1.6% versus 2.4% expected. On top of all that, we’re in an election year. Voters won’t be happy if the Biden Administration can’t bring inflation down and growth stalls out.

With these enormous impacts in mind, here are three stocks to watch that could swing either way, depending on how hot/cool the inflation report comes in.

Tesla (TSLA)

Tesla (NASDAQ:TSLA) reported disappointing Q1 2024 results that missed expectations on both the top and bottom lines. I believe this highlights the growing risks surrounding TSLA stock in the current macro environment. CEO Elon Musk acknowledged that EV adoption is under pressure globally, with many automakers pivoting back to plug-in hybrids. Despite this reality, Tesla remains committed to the EV transition, which I think is the right long-term strategy.

However, in the near-term, Tesla faces significant headwinds from high interest rates that could dampen demand for its premium-priced vehicles. I would exercise caution with TSLA stock ahead of the upcoming CPI report in May.

On a positive note, Tesla’s energy storage business reached record profitability in Q1. However, until the interest rate picture stabilizes, I believe Tesla’s stock will remain volatile.

Don’t get me wrong, I’m very bullish on Tesla over the long-run, since there aren’t any pure-EV competitors in the West right now. However, hybrids are increasingly the focus of investors, so you should buckle up for a potentially bumpy ride.

Boeing (BA)

Boeing (NYSE:BA) has also not been short of controversy and debate lately. The firm has faced significant criticism after a series of maintenance-related problems tied to its 737 max aircraft. Two whistleblowers also passed away in a short timeframe, which was quite suspicious to many. However, looking beyond these challenges, I believe BA stock offers a compelling long-term entry point at current levels.

In Q1 2024, Boeing reported a loss per share of $1.13, beating estimates by 39 cents, although revenue of $16.57 billion missed expectations. Management also took dramatic actions following the Alaska Airlines accident in January to prevent future incidents.

I think potential rate cuts could provide a major boost to Boeing given its substantial debt load.

However, if the upcoming inflation report comes in hot, BA stock may face increased near-term pressure. As such, Boeing remains one of the stocks to watch closely ahead of the May data release.

Coinbase (COIN)

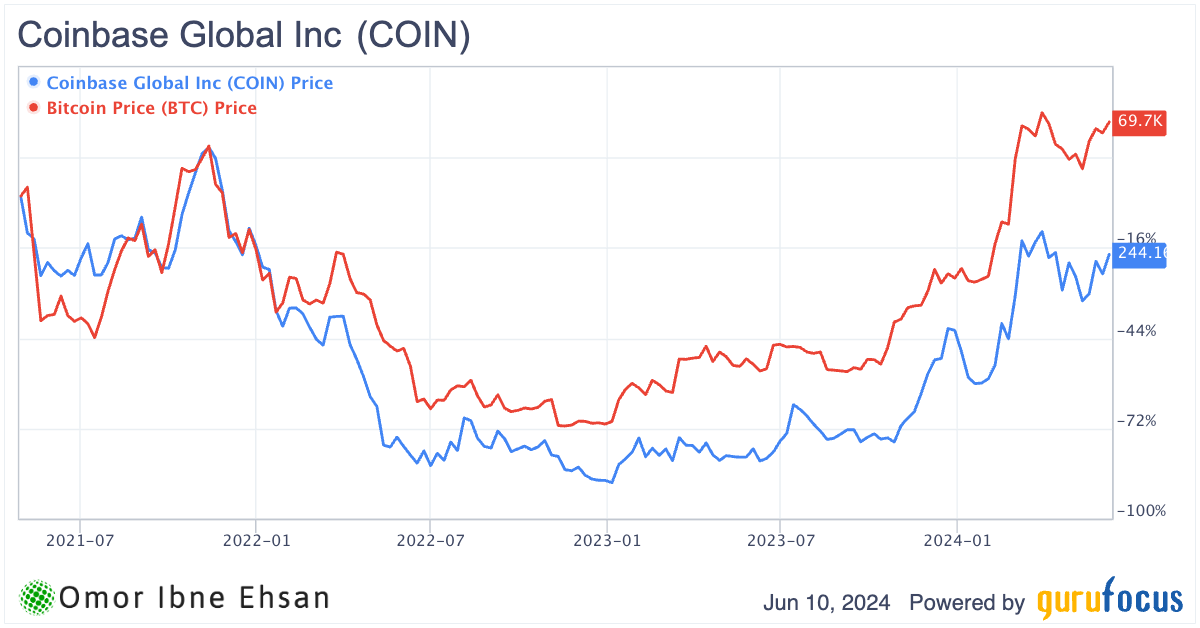

Coinbase (NASDAQ:COIN) operates a leading cryptocurrency exchange platform. In my view, this is one of the most volatile stocks you can invest in, since the company’s revenue and profits are directly tied to the performance of the crypto market. That said, there are still some ways to guesstimate where this stock could go next based on the upcoming CPI print.

Coinbase reported very strong Q1 results, generating more adjusted EBITDA than all of last year. Revenue surged 115.6% year-over-year to $1.6 billion, beating estimates. The company also reported $4.40 of earnings per share, which trounced expectations. The company saw promising early growth in its derivatives products and a 30% increase in the USDC stablecoin market cap.

If the inflation report shows cooling price pressures, it could be very positive for crypto, as lower interest rates would likely drive greater capital into this sector. You’re essentially betting on the market movements in the crypto space by investing in this stock – that’s a high-risk proposition on its own.

Given Coinbase’s high sensitivity to crypto market conditions, I believe it’s one of the key stocks to watch closely before the CPI data on Wednesday. This CPI report could make or break the stock’s recent momentum.

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.