Market contrarianism tends to be one of the riskiest pathways available, yet it can also, on occasion, lead to massive gains. That might be the situation with high-risk, high-reward idea Telesat (NASDAQ:TSAT). Financially, the company presents a rather poor profile. Nevertheless, TSAT stock has attracted interest from retail investors.

Falling under the communication equipment industry, Telesat specializes as a satellite operator. The company provides many services, one of which is providing direct-to-home (DTH) solutions, encompassing television programming, audio and information channels. This puts Telesat potentially at risk of suffering from the cord-cutting phenomenon.

But Telesat also offers satellite capacity to enterprises and agencies in the maritime and aeronautical markets. Therefore, TSAT stock represents one of the cogs within the burgeoning space economy. As McKinsey & Company pointed out, the aforementioned ecosystem could become a $1.8 trillion market by 2035.

Considering that TSAT stock carries a market capitalization of just $400 million as of this writing, the total addressable market is theoretically massive.

High Short Interest Provides Temptation

So, with so much potential, why isn’t everyone clamoring for TSAT stock?

Well, potential is one concept, probability is another. Based on Telesat’s financials, the trend is simply not moving in the right direction.

According to data from Gurufocus, the telecom specialist generated revenue of roughly $690 million in the fiscal year ended December 2019. Last year, the company posted a top-line print closer to $520 million. The years in between each represented a consecutive revenue decline.

Let me remind you that the underlying global satellite communication market is expected to expand at a CAGR of 9.4% from 2022 to 2030, per Straits Research. TSAT stock is almost going in the exact opposite direction.

Of course, in this meme-centric environment, disappointing financial trends aren’t the end of the world. In some cases, they might be the beginning of something special. For TSAT stock, it’s the No. 1 most-shorted security – according to Fintel’s Short Squeeze Leaderboard – in terms of short interest as a percentage of float.

Presently, Telesat’s short interest stands at a staggering 216.03%. Further, its short interest ratio – the time needed to unwind all bearish positions based on average trading volume – comes out to 6.05 days to cover. A little upside pressure could have the bears panicking, leading to a positive feedback loop.

Trade of the Day: Bet on TSAT Stock

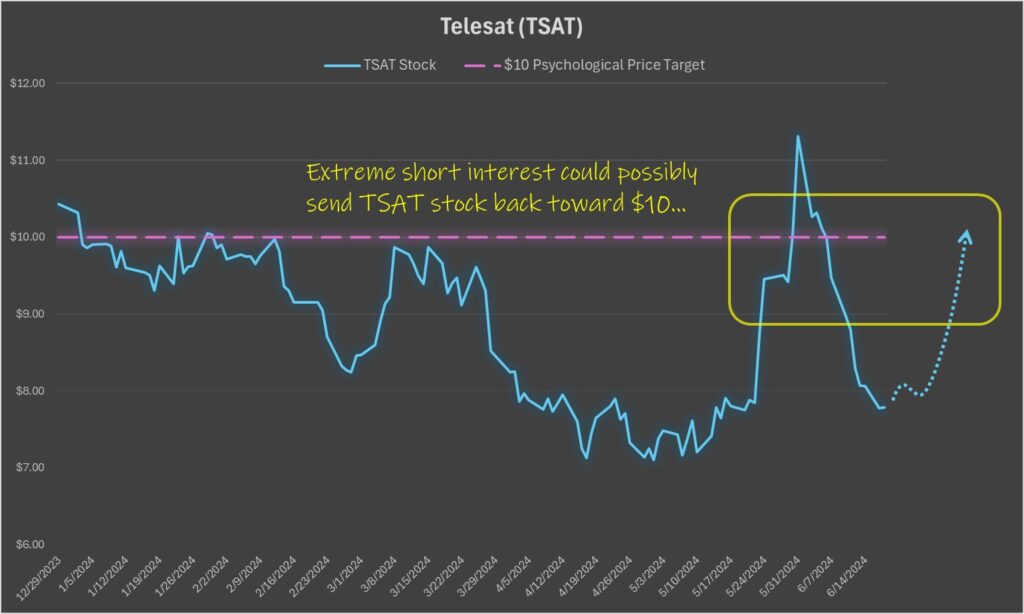

Thursday’s trade of the day is incredibly risky but straightforward: Buy TSAT stock in the open market. Aside from a gargantuan spike in late May, Telesat shares have stabilized under the $8 price since April. The idea here is to bank on another big upswing.

It’s not out of the question that it could happen… and soon. Just a few weeks ago, TSAT stock closed at $11.31 before tumbling down. But as Fintel reports, the short interest remains sky high. That could give bulls an incentive to try again.

Moreover, it’s important to note that $10 is one of the most important psychological milestones. It’s the delineation point between single digit and double digits. Almost surely, the rest of the market has the same idea: Push TSAT stock above this benchmark.

It’s no guarantee that upside profits will materialize. However, the remarkable short interest means that if another spike occurs, the bears will be extra motivated to protect themselves against severe portfolio damage.

After all, we’ve already seen what ridiculously high short interest can do for other stocks.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of publication, Josh Enomoto did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.