Despite hard challenges in the form of noise, error rates, qubit coherence, and scaling, quantum computing stocks to buy now remain enticing enough to continue attracting capital. Unlike traditional computers, quantum computers can simultaneously hold 0 and 1 states.

In certain scenarios involving complex problems with multiple variables, quantum computing can be significantly faster and energy-efficient.

According to analysts, the global quantum computing market size is estimated at $1.3 billion in 2024. But it is poised for a CAGR of 32.7%, bringing it to $5.3 billion by 2029. Of course, major technological breakthroughs are not predictable, which makes quantum computing exposure so exciting.

But given the complexity of quantum development, which companies have demonstrated their competency? And is that enough for investors to look into quantum computing stocks to buy now?

Rigetti Computing (RGTI)

Rigetti Computing (NASDAQ:RGTI) has been thoroughly price-corrected, having flatlined returns year-to-date (YTD) at -0.47%. It’s not surprising, given both the nature of quantum computing and inherent penny stock volatility.

Nonetheless, the Berkeley-headquartered company has shown consistent progress in full-stack quantum computing. After the fourth-gen Ankaa-class architecture, RGTI commercialized quantum computing with Novera QPU at the end of 2023 with 9-qubit and 5-qubit chips. Although mainly geared toward professionals and students, the launch provides a baseline for further research and growth.

However, on the financial front, Rigetti Computing continues racking up losses. Despite the net loss of $20.7 million in Q1 of 2024 earnings (which was less than the $23.3 million net loss in the year-ago quarter), Rigetti’s cost of revenue tripled.

Against total liabilities worth $46.5 million, the company holds $35 million in cash and cash equivalents. Yet, with Rigetti’s Berkeley and DARPA connection, the company is likely to find backers. During Q4, multiple funds raised their stakes in Rigetti Computing. Those included CIBC Private Wealth Group to Procyon Advisors and Brighton Jones.

At the present price of 95 cents, RGTI is in line with its 52-week low of 90 cents per share. Therefore, it is one of the cheapest entries for investors seeking quantum computing stocks to buy now.

Accenture (ACN)

For a safer quantum exposure, the global consulting firm Accenture (NYSE:ACN) is a wider, indirect approach. The company has collaborated with Intel (NASDAQ:INTC), IBM (NYSE:IBM), MarketsAndMarkets, D-Wave (NYSE:QBTS), Microsoft (NASDAQ:MSFT) and IonQ (NYSE:IONQ) to push the quantum computing envelope.

Accenture sees it as a disruptive tech that could jumpstart smart crop growth companies. Moreover, it could improve supply chain optimization and integrate within radiotherapy. So, across healthcare, finance and logistics, the company is pushing for wider quantum adoption through research investments and education.

Through IBM’s Quantum Experience and Q Network, Accenture has access to cloud apps and tools to harness quantum computing potential. Indeed, Accenture is a solid substitute for a number of quantum computing stocks, given the company’s consistent revenue and profitability due to consulting projects for large enterprises and government agencies.

Accenture announced its fiscal Q3 of 2024 financial results, displaying a mixed performance. The company reported revenues of $16.5 billion, down 1% in U.S. dollars but up 1.4% in local currency compared to the same quarter last year.

At the present price of $308.98, ACN stock is close to its 52-week low of $278.69, well under the high of $387.51 in the same period. Given Accenture’s strong fundamentals, this point in time is well-suited for a quantum computing exposure entry.

Honeywell International (HON)

Honeywell International (NASDAQ:HON) is an international conglomerate focused on aerospace technologies. However, it is diversified across industrial and building automation and energy and sustainability solutions.

Further, HON formed its subsidiary Quantinuum. It was born of the merger between Honeywell Quantum Solutions and Cambridge Quantum Computing in 2021. The subsidiary is yet to be considered for an IPO launch.

Courtesy of HON’s deep capital ($32 billion backlog as of April 2024) and diversification, the company has a proven track record to scale new tech. In September 2023, this was demonstrated by Quantinuum’s Quantum Origin tech integrated into smart meters for gas, water and electric utilities.

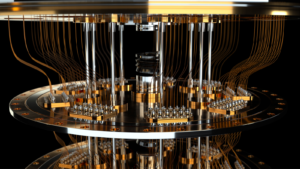

Also, Honeywell International partnered with JPMorgan Chase (NYSE:JPM) to raise $625 million worth of capital for Quantinuum in January. And, Quantinuum’s System Model H2 appears to be the most advanced commercially available quantum computer. It has 99.87% two-qubit gate fidelity, holding 56 fully-connected qubits.

At the present price of $215.09, HON stock is aligned with the 52-week high of $213.22 per share. According to Nasdaq forecasting data, the price could go even higher to $229.21 as the average price target, with a pessimistic outlook of $205. The high HON ceiling is $250 per share.

On the date of publication, Shane Neagle did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.