Is it time to buy retail stocks to buy on the dip? Amid high uncertainty surrounding the near-term prospects of both consumer discretionary retailers, as well as historically recession-resistant retailers like discount stores and grocery stores, this may be a question on your mind.

With consumer discretionary retailers, headlines discussing a slowdown in U.S. consumer spending call into question the merits in buying such names at this point in the economic cycle. That’s not all. Many consumer discretionary retail stocks have also been hammered by mixed quarterly results and downbeat guidance this earnings season.

Regarding consumer staple retail stocks, factors like inflation continue to affect their fiscal and stock price performance. Yet while all of this may suggest at first to stay away from the sector, keep in mind that the market has been waiting for the other shoe to drop for quite some time.

The emergence of further uncertainty has pushed many already beaten-down names to oversold prices. Thus, it may indeed be an opportune time to scoop up some retail stocks to buy on the dip, before they cease to trade at bargain basement prices. The following seven are a prime example of such opportunities.

Academy Sports and Outdoors (ASO)

Shares in Academy Sports and Outdoors (NASDAQ:ASO) have pulled back in recent months, with the latest pullback occurring after the release of the sporting goods retailer’s latest quarterly results earlier this month. During the quarter ending in April, both revenue and earnings fell short of forecasts.

These results indicated that the company continues to be affected by high inflation, and its impact on consumer spending and hence its impact on demand among Academy Sports’ customer base. However, with this uncertainty comes a low valuation for ASO stock. At current prices, Academy Sports and Outdoors trades for only 8.5 times estimated 2024 earnings of $6.53 per share. It should also be noted that, despite the current challenges, Academy continues to expand its footprint, through the opening of new locations across the U.S.

While it may take some time for demand trends to normalize, the payoff could be substantial, as both existing and newly-opened locations reported stronger results down the road. Given ASO’s strong upside potential, from both an earnings rebound as well as a possible market re-rating to a higher valuation, consider it a buy on the dip.

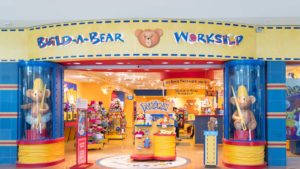

Build-A-Bear Workshop (BBW)

Build-A-Bear Workshop (NYSE:BBW) is one of the retail stocks to buy on the dip that I have included in other recent coverage of top oversold stocks to buy this month. As mentioned in my prior article discussing BBW, investors have again turned bearish on the specialty retailer, as its latest quarterly results and updates to outlook indicate that similar results lie ahead in the coming quarters.

Again though, weak investor sentiment may work in your favor, given the extent in which this has affected valuation of BBW stock. Today, you can buy Build-A-Bear Workshop for just 7 times forward earnings. Similar to the aforementioned sitaution with Academy Sports and Outdoors, low expectations could give way to positive surprises when BBW next reports results. In fact, positive surprises in the next quarterly earnings release could produce a much stronger near-term rebound for BBW.

Why? Although BBW is no longer one of the most shorted stocks out there, short interest still remains somewhat elevated, at around 12% of float. A moderate short-squeeze coupled with more promising numbers/guidance could result in a strong post-earnings rally for shares.

Bath & Body Works (BBWI)

Bath & Body Works (NYSE:BBWI) is another retail stock that has tanked this earnings season, upon the release of its latest quarterly results. Shares in this purveyor of home fragrance and soap products fell immediately after the release of its latest numbers pre-market on June 4, but not due to the results themselves.

BBWI’s revenue and earnings for the preceding quarter came in ahead of forecasts. Still, guidance fell short of what Wall Street was expecting. Also, as BMO analyst Simeon Siegel pointed out, investors aggressively cycled back into BBWI stock ahead of earnings. While not certain, they may have looked to any negative aspect of the release as reason to exit positions. After the post-earnings pullback, BBWI now trades for 12.8 times forward earnings.

Sure, this forward multiple is in line with BBWI’s historic valuation. Over the past ten years, valuation has ranged from low-teens to high teens. Still, with results beating expectations last quarter, management’s latest updates to outlook could prove too conservative in hindsight. Rising expectations about results later this year, and into 2025, may help to drive a rebound, even as shares have more limited re-rating potential.

Five Below (FIVE)

If growth-at-a-reasonable-price (GARP) is more your style than deep value investing, then Five Below (NASDAQ:FIVE) is one of the top retail stocks to buy on the dip. Shares in this specialty discount retailer have sank in recent months, most recently due to the company’s second big earnings miss in a row.

As InvestorPlace Earnings reported on June 5, for the fiscal quarter ending April 2024, both revenue and earnings came in slightly below Wall Street consensus. The macro factors affecting retailer demand are clearly at play here, but keep the following in mind. For starters, these post-earnings sell-offs have knocked FIVE stock down to a forward multiple of just 22.1 times estimated earnings for the current fiscal year.

Not only that, consider that Five Below has yet to give up on its plans to double its store count by 2030. Coupled with a normalization in demand, the company remains poised to experience further strong growth over a multi-year time frame. While it may take some time to take shape, a comeback for FIVE could be substantial. Ultimately, this $115 per share stock could soar to prices above that of its past high-water mark of $236.21 per share.

Guess? (GES)

Recently, I argued that Guess? (NYSE:GES), out of favor and heavily-shorted, has substantial upside potential, if the apparel company can prove to the market that they have “guessed” wrongly about its future prospects. On a short time frame, an earnings beat could produce a post-earnings “short squeeze” rally for the stock.

Guess? is expected to next report earnings by the end of August. Longer-term, moves such as its recent acquisition of retailer Rag and Bone may enable the company to overcome its persistent growth challenges. In turn, giving investors reason to bid up the stock a much higher forward multiple. Right now, GES stock trades for only 7.3 times forward earnings.

If combined with earnings growth, even a re-rating to 10 times forward earnings could result in a strong move move for shares. Sell-side forecasts call for results during fiscal year ending January 2026 to come in as high as $3.27 per share. This in turn could take GES, trading for just over $20 per share today, back to price levels in the low-$30s.

Haverty Furniture Companies (HVT)

Haverty Furniture Companies (NYSE:HVT) operates in a highly-cyclical industry. The housing market slowdown has resulted in a considerable decline in Haverty’s revenue and earnings since 2022. However, if you’re bullish that possible interest rate cuts by the Federal Reserve will lead to a busier housing market in 2025, HVT may be worth buying.

Per sell-side forecasts, if this bullish scenario plays out, Haverty’s earnings could more than double in 2025, from $1.36 to $2.84 per share. Earlier this year, such a rebound was arguably priced into HVT stock, but following its pullback from $35 to $25 per share, this is no longer the case. Besides being one of the top retail stocks to buy on the dip, HVT may be attractive for another reason.

That would be the stock’s 5.12% forward dividend yield. Even with the earnings weakness in recent years, HVT has not just maintained its quarterly payout. The company managed to raise it as well. Back in May 2023, Haverty implemented a 2 cent per share dividend hike, raising it from 28 cents to 30 cents per share.

Sally Beauty Holdings (SBH)

Sally Beauty Holdings (NYSE:SBH) is a “buy the dip” opportunity, but at first you may not think that’s the case. Shares in this beauty supply retailer and wholesaler at super cheap. At current prices, SBH has a forward price-to-earnings ratio of just 6.1.

That said, given the maturity of this business, not to mention the company’s recent lackluster quarterly earnings release, it’s understandable if SBH stock looks like a “value trap” on the surface. However, as Seeking Alpha commentator Hawkinvest pointed on in April, there is a possible needle-moving catalyst in motion for Sally Beauty Holdings. SBH is currently implementing an aggressive cost reduction program.

Said program could lead to annualized cost savings of as much as $120 million by 2026. Sally has already for years used its free cash flow to pay down debt and repurchase shares. However, profit enhancement efforts to this degree may turbo-charge these deleveraging and return-of-capital efforts. If all goes right, in a few years, Sally Beauty Holdings could report materially higher earnings per share (EPS). SBH could also experience some much-deserved multiple expansion.

On the date of publication, Thomas Niel did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.