Hello, Reader.

The United States spends more money defending its credit worthiness than it does defending its borders. This financial curiosity may be the newest reason to own precious metals.

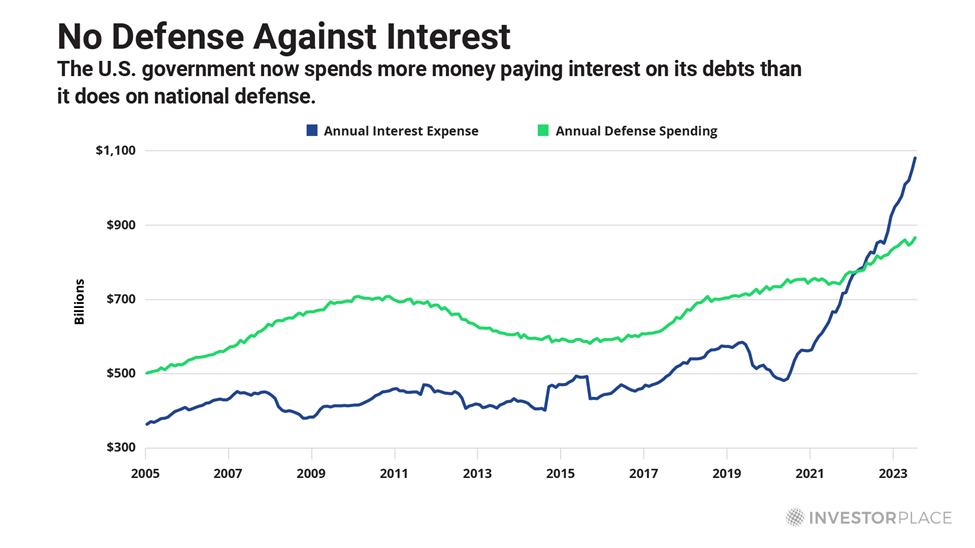

As the chart above shows, the U.S. now spends nearly $1.1 trillion per year to make interest payments on its outstanding debt. That titanic number is roughly 25% more than what it allocated to the Department of Defense during the last 12 months.

That is an ominous sign, according to historian Professor Niall Ferguson. A long line of empires throughout history, he said, have spent themselves into a position of weakness… and eventually oblivion. “Any great power that spends more on debt service than on defense will not stay great for very long,” he asserted recently.

From the Roman Empire to the Ottoman to the British, and many lesser empires in between, success bred a fatal combination of hubris and complacency that led to economic doom.

Ferguson warns that that U.S. may be flirting with a similar fate. He is not the only prognosticator to raise warning flags. Michael Peterson, CEO of the Peter G. Peterson Foundation, warns, “The harmful effects of higher interest rates fueling higher interest costs on a huge existing debt load are continuing. It’s the definition of unsustainable.”

But neither Ferguson nor Peterson possess perfect clairvoyance. For decades, many “Cassandras” have been predicting the “End of America”… but America is still here, and it remains the world’s leading super power.

It remains a strong and prosperous nation, albeit an increasingly indebted one. As investors, therefore, I recommend continuing to focus on the facets of the U.S. economy that produce prosperity – the great companies that have the power to enrich their shareholders.

That said, the U.S. financial condition is not optimal, and neither political party seems particularly concerned about it. The national debt increased by a whopping $7.8 trillion during the Trump administration and it has jumped by another $7 trillion under the Biden administration… so far.

Of course, neither Trump nor Biden could have racked up monster deficits without the aid and abetment of Congress. Both sides of the aisle seem to agree that deficit-spending is no big deal, provided that the spending goes to “good” programs and not “bad” ones.

As a result, the deficit over the next 12 months could flirt with a record-high $2 trillion. Numbers like these are sufficiently concerning that they could undermine the global appetite for Treasury bonds, along with the global appetite for U.S. dollars.

Because of that risk, adding precious metals to your portfolio seems like a prudent hedge, at least with a portion of your capital.

To be clear, that’s not a doom-and-gloom recommendation; it is simply a hedge. And best of all, it is a hedge that could flourish, even if the U.S. economy continues its world-beating ways.

After all, that’s exactly what happened during the early 2000s. The gold price soared 500% even as the U.S. economy flourished. A repeat performance could be underway.

For more insights on navigating precious metal investments, join us at Fry’s Investment Report.

There, you’ll find my latest recommendation… one that I believe could rival gold’s potential gains.

In fact, I talked about this unsung metal here at Smart Money last week. You can check it out – and last week’s other Smart Money highlights – below…

Smart Money Roundup

Put Gold on “Mute” for a Minute Because This Unsung Metal Is Making Some Noise

In the orchestra of precious metals, platinum isn’t exactly taking the spotlight as maestro these days – or even as first chair. However, two industries are breathing new life into this oft-overlooked metal… and setting the stage for its potential comeback. So, we’ll examine platinum’s current price and where demand could take it next. Plus, we’ll consider whether it’s worth the investment, and if so, where to make it. Keep reading here.

Why I Expect NVIDIA to Be a $5 Trillion Company

Following the announcement of the company’s successor to its Blackwell chips, Louis Navellier expects NVIDIA’s market cap to jump from $4 trillion this year to $5 trillion in 2025. NVIDIA develops generative AI chips, which the company calls the “defining technology of our time.” So, the company expects its Blackwell chips will “power this new industrial revolution,” by providing AI capabilities across all industries. Click here to learn more.

Looking Forward

Stay tuned for your next Smart Money update, where we will continue to unpack some broad market trends that I’ve been eyeing.

Plus, I’ll share one of the most valuable traits for an investor to have… and how it can deliver the kinds of spectacular gains no other investment trait can produce.

Stay tuned.

Regards,

Eric Fry